First results of the 2013 collection

Tax revenues: Rising trend continues

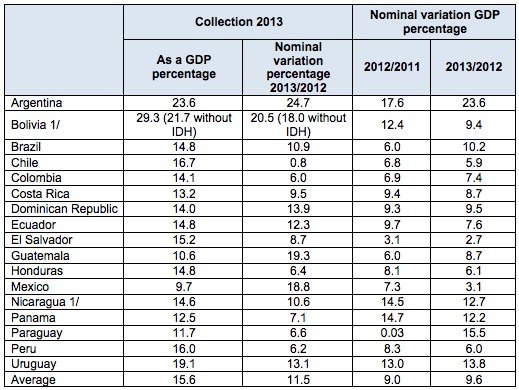

The tax revenues from the Central, Federal or National Governments from the CIAT member countries of Latin America have reached in 2013, on average, 15.6% of the GDP, which represents a growth of 11.5%, in nominal terms, in respect to the same period of the previous year.

The tax revenues from the Central, Federal or National Governments from the CIAT member countries of Latin America have reached in 2013, on average, 15.6% of the GDP, which represents a growth of 11.5%, in nominal terms, in respect to the same period of the previous year.

The countries which show the highest increase in this last year collection are Argentina, Bolivia (even without considering the Direct Tax on Hydrocarbons), Dominican Republic, Ecuador, Guatemala, Mexico and Uruguay.

It is to note that the considered collection does not include the social security contributions. Similarly, in the case of Bolivia and Nicaragua, data do not deduce the tax refunds.

Most countries maintain the growth that has taken place in the years following the financial crisis of 2008-09, due to the expansion of the tax bases for certain taxes (especially VAT) and to the tax reforms implemented and, in some cases as in Colombia, the implementation of new taxes such as the Income Tax for Equity and the Consumption Tax, both created in 2012.

Finally, in most countries the collection reflect the economic activity results. In the cases of Argentina, Bolivia, Ecuador, El Salvador, Guatemala, Mexico and Dominican Republic, they are even better; this infers a significant positive impact from the management of tax administrations. In a small group of countries, despite the good performance of the economy, the elasticity of the tax collection is less than one.

Source: CIAT

1/ Gross collection.

1,415 total views, 1 views today