Flavored drinks and non-basic foods – Special Tax on Production and Services (IEPS).

Summary.

In the tax system, all the taxes are not established to collect revenue, aimed at satisfying the needs of the population. Others have an extra-fiscal nature. Their essential objective is away from collection and seeks other purposes, and such is the case of the Tax on Production and Services. It is a control tax and inhibitor of consumption; its implementation aims at discouraging the consumption of certain products that can cause health problems or affect the environment and the economy of people and the State.

Mexico is in elevated levels of obesity and overweight, which in part is related to a poor diet, as well as the consumption of non-basic foods with high caloric density and sugary drinks, which has motivated the legislator to establish, in 2014, a tax on these products in order to inhibit consumption and reduce the health problems that cause both obesity and overweight.

Seven years after its implementation, it is important to review if this tax has achieved its mission to combat the consumption of these products and the decrease in the high percentages of the population with obesity and overweight problems.

Key words: non-staple foods with high caloric density, sugary drinks, overweight and obesity, IEPS.

Within the theory of consumption taxation modalities, there is the personal consumption tax, general consumption taxes and taxes on certain goods. Likewise, the selective tax on consumption does not necessarily imply a tax aimed at proportionality or progressiveness, on the contrary, it breaks with the scheme of neutrality and focus on certain sectors and products that require State intervention to correct situations that distort, alter or in a certain period have negative repercussions for the State, the population, the environment and the economy.

Selective consumption taxation may aim at attracting resources and improving the allocation of resources, which implies establishing a contribution that is discriminatory in principle, but whose purpose goes beyond the tax system and seeks extra-fiscal purposes, that is, the purpose it pursues may be social, economic or of another non-tax nature.

In the case of Mexico, in 2013, the Federal Executive presented a proposal to create two novel items in the Law of Special Tax on Production and Services (LIEPS by its acronym in Spanish), which are sugary beverages and non-basic foods with high caloric density (acronym in Spanish: ANBADC).

The IEPS in general taxes gasoline and diesel; alcoholic drinks; beers and soft drinks; tobaccos; games and raffles; pesticides, carbon and Telecommunications. And for the purposes of this work, flavored drinks and ANBADC are added.

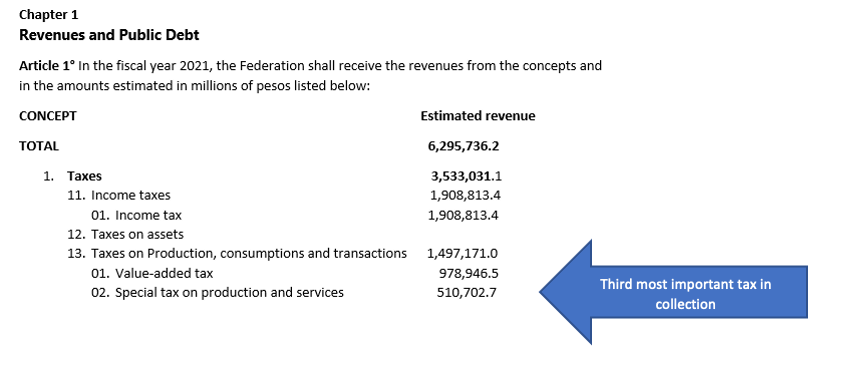

This tax is control and inhibitor of consumption, but over time it has become a collection tax, as shown in table 1, which is the estimated income to collect in accordance with the 2021 Federal Income Law.

Table 1. Estimated Revenue

Source: 2021 Income Law of the Federation.

Source: 2021 Income Law of the Federation.

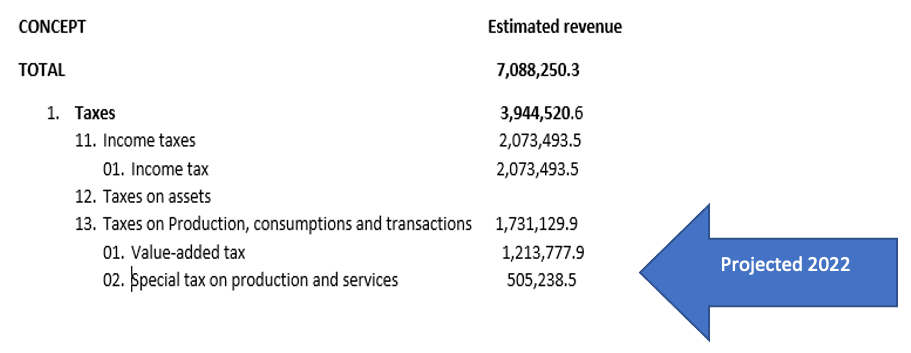

Table 2, according to the Federal Revenue Law for 2022, once again contemplates an important collection in IEPS, with a decrease associated with the fiscal incentives applied to automotive fuels.

Table 2. Estimated Revenue

Source: Income Law of the Federation for the Fiscal Year 2022.

Source: Income Law of the Federation for the Fiscal Year 2022.

According to the explanatory memorandum in 2013, for the implementation of the new assumptions for the IEPS charge we have:

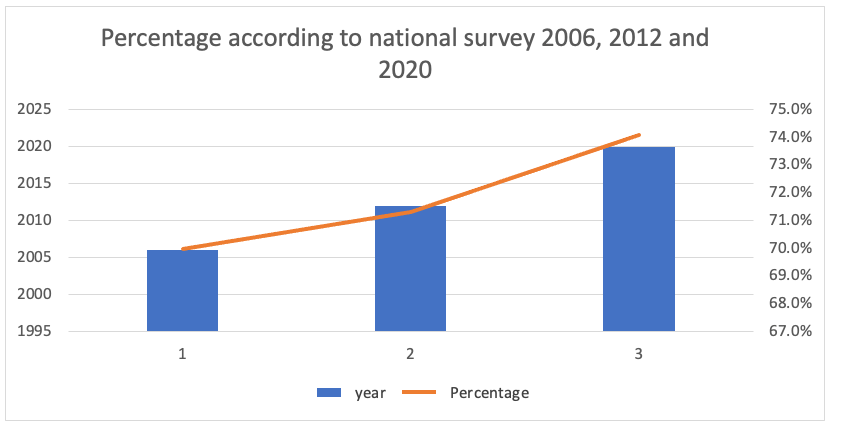

“According to the results of the National Health Survey (ENSANUT) 2012, the prevalence of overweight and obesity in adults in Mexico was 71.3%, which represents 48.6 million people. The prevalence of obesity in this group was 32.4% and that of overweight 38.8%.”

These health problems identified in Mexico have as a consequence: premature death, reduction in labor productivity associated with overweight and obesity, economic problems in families when allocating resources in the treatment of chronic diseases, a high cost and, where appropriate, making it impossible to State that can guarantee the right to health protection, therefore it is clearly noted that the purpose of implementing a tax has totally extra-fiscal purposes directly related to the health issue.

A crucial point to consider is what has happened to those indexes after 6 years of implementation? Was it possible to reduce these percentages? According to the ENSANUT 2020, the following data appears on the website of the Center for Research in Evaluation and Surveys:

“… Nationally, 74.1% of adults were overweight (38.1%) or obese (36%). … The findings found in this survey confirm the need to act immediately with public health strategies that contribute to reducing the prevalence of overweight and obesity in adults aged 20 years and over. ”

The following graph shows the variation in the percentage of the population suffering from obesity and overweight from 2006 to 2020, which has been growing steadily:

Graph made with information from ENSANUT.

Graph made with information from ENSANUT.

Now, in terms of tax collection, how are we doing?

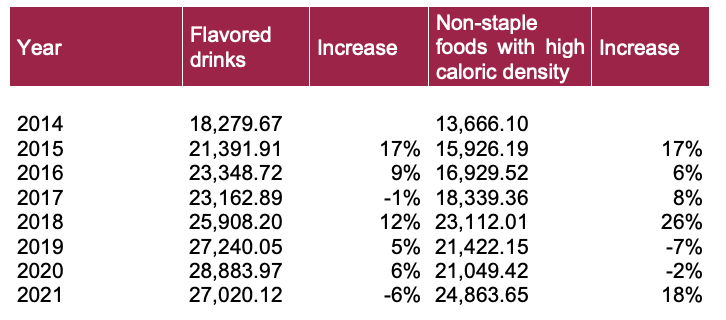

The IEPS rate for flavored beverages started in 2014 at a peso per liter, currently it is $ 1.3036 per liter. And an 8% rate for ANBADC of 275 kilocalories or higher per one hundred grams.

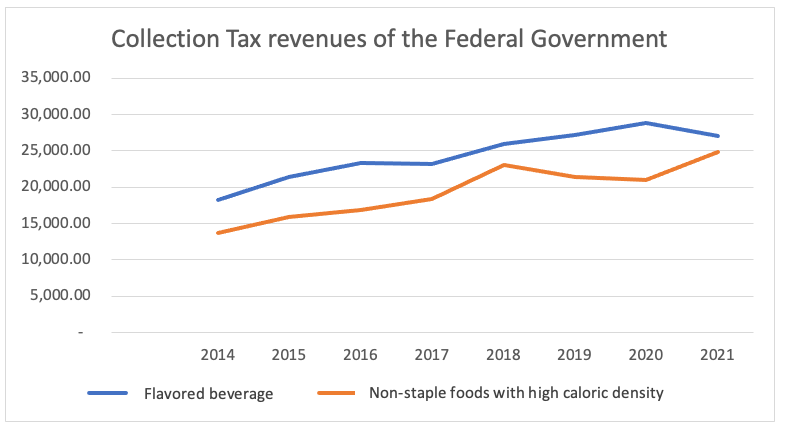

According to the report of tax income by segment in the specific case of IEPS, provided by the Tax Administration Service (SAT) we have:

Tax income (Millions of pesos)

Table and graphs prepared by author, with information provided on the web page datos.gob.mx, as well as SAT figures.

Table and graphs prepared by author, with information provided on the web page datos.gob.mx, as well as SAT figures.

Note: Closing 2021 is projected by the author.

Jurisdictional issue.

It is important to mention that the Supreme Court of Justice of the Nation has already analyzed these issues, conforming jurisprudence (Thesis of jurisprudence 71/2017 10a.). Approved by the Second Chamber, in a private session on May thirty-first, two thousand seventeen), and in the analysis conducted, they indicate that the purpose of the IEPS as a tax measure is proportional and reasonable with the extra-fiscal purpose.

Labelling.

November 8, 2019, the modification to the General Health Law was published in the Official Gazette of the Federation, in order to publish the warning regarding the excess of the maximum limits of energy content, sugars added, saturated fats, sodium and other critical nutrients and ingredients established by the competent regulatory provisions. Data that have not achieved the desired impact in reducing the consumption of these products.

Conclusions.

The foregoing concludes that the main extra-fiscal objective for this tax in terms of the inclusion of sugary drinks and ANBADC, which was the decrease in the population percentage regarding obesity and overweight problems, has not been achieved, and that on the contrary it has increased from 71.3% to 74.1%, that is, 2.8% of the total population, so it seems that this way of contributing to the product to make it more expensive and that the population does not consume it because it is more expensive, has not been effective; On the other hand, for collection issues it has been effective and has impacted on the increase as seen in the collection tables, since by 2020 a collection in flavored drinks and ANBADC of 28,883.97 and 21,049.42 million pesos, respectively, was achieved.

Therefore, this public health problem in Mexico continues to be a challenge that must be resolved as soon as possible since the implications affect Mexicans in terms of their quality of life and the State itself as an obligated subject to provide protection to health.

Mesografía.

- Ley de Ingresos de la Federación para el Ejercicio Fiscal de 2021

- Ley de Ingresos de la Federación para el Ejercicio Fiscal de 2022

- Ley del Impuesto Especial sobre Producción y Servicios. 2021

- https://ensanut.insp.mx/encuestas/ensanutcontinua2020/informes.php

- htts://ensanut.insp.mx/encuestas/ensanut2006/doctos/informes/ensanut2006.pdf

- https://www.finanzaspublicas.hacienda.gob.mx/work/models/Finanzas_Publicas/docs/paquete_economico/ilif/ilif_2022.pdf

- http://omawww.sat.gob.mx/cifras_sat/Paginas/datos/IngresosTributarios.html

- Thesis [J.]: I2a./J. 71/2017, Segunda Sala de la Suprema Corte de Justicia de la Nación, Semanario judicial de la Federación y su Gaceta, Decima Época, Tomo II, junio 2017, p. 705. Reg. digital 2014503

12,395 total views, 16 views today

1 comment

Hola, la comparación de los montos obtenidos por los IEPS a bebidas saborizadas y alimentos no básicos está mal porque los montos de 2014 no están inflados a precios de 2020.

Si se ajustan los precios por inflación, los aumentos son de 21% en ambos IEPS entre 2014 y 2020.