Getting a degree in illegality and disappear in style…

The profession

The abundant and growing signs of illegality affecting economies, enriching crime and degrading the human condition, lead me to think about the “experts” who feed their selfish ambitions by shielding illegality in an environment of inequality and poverty of the communities, trying to save a competence surpassed today by the technology, without a role to replace it.

Some Professionals see their services robotized by technology and lacking essential values, they degrade community trust in their personal management by jumping on the fastest bandwagon to satisfy their ambitions.

Thus, socioeconomic crises are born in an illegality shielded by “experts” who, protected by the weakness of the prevailing order, the inability or disinterest to improve it and the limitations of the professional role to deserve the trust in which it was formed, turn it into a culture.

With full respect for those who base their profession on values that prioritize the human social condition over personal selfishness, here are some reflections…

Expert training

An essential role in the management of economic reality information is that of the professional who, with reliable financial information, must guarantee the credit of the companies, assist the trust of their investors and serve the faithful fulfillment of the contributions to the social pact.

It is proper to the training of professionals, the guardianship of financial integrity with regulatory agencies in the fight against illicit activities. Its key role is to assist in their competence with technological tools to operate in the economy.

It is the responsibility of universities and professional training associations to ensure professional compliance with ethical standards and codes of conduct, prevent crime, fight corruption and raise awareness on the consequences of engaging in illegal activities.

The state supervision of economic activity, the training of experts by universities and professional associations, and the intervention of law enforcement authorities in illegal or suspicious activities are of major significance.

Attributes

When the State requires certification or professional opinions in tax returns or accounting expertise, it resorts to professionals to build the economic reality or affect it when they are distorting it.

The relationship between professionals and the State contributes to the integrity of the tax system in the management of auditing processes, identification, overcoming gaps in legislation and promoting best practices in financial reporting.

Independence of judgment and public faith are attributes of the professionals that imply reliability, integrity and responsibility for financial information.

Independence of judgment

Independence of judgment is a principle that implies objectivity and impartiality in the ability to form one’s own unbiased opinion on the financial situation and results of the organization.

Such independence is challenged by conflicts of interest with the entity being audited or certified, self-pressure or pressure from other interested parties, regulations in ethical codes or opacity in the audit and certification processes.

Public trust

Public trust is an attribute that entails ethical and professional responsibility, confers presumption of accuracy and credibility and implies reliability of professional work unless proven otherwise.

Professionals vested with public trust are obliged to act with integrity, impartiality and respect for the law in the exercise of their functions. In the event that they engage in illegal activities that violate their public faith, they face administrative sanctions, suspension or revocation of their professional license and the likelihood of criminal charges.

Professional regulations

The balance between the responsibility and protection of professionals and the ethical duty to report illicit or fraudulent activities is fundamental challenge of the regulatory order to strengthen confidence in the veracity of economic information and the tax system.

About the activity

Professionals involved in illegal or unethical practices raise doubts about the integrity of their professions and that of the institutes that train and regulate them.

To guide professional conduct, regulations are required that at a minimum should consider ethical standards, review and auditing techniques, competence to understand and abort improper practices, cooperation between jurisdictions to address tax evasion and other illegalities, and transparency of tax operations.

Registration associations

Professional registration and regulatory associations have their origin in the need to establish standards and promote practices in oversight and enforcement techniques, advocacy, training and professional development, and representation of professional interests.

Associations must provide standards and protocols to determine the veracity and accuracy of financial information and identify irregularities and also help promote the integrity and transparency of the process. They are usually subject to government regulations that guarantee their operation and compliance with ethical and legal standards.

The State may include the review and approval of the codes of ethics and conduct of professional associations, the investigation of training programs that violate these standards or their monitoring and the criminal conditions of their sanction.

There must be a balance between state supervision and professional independence in order to preserve the autonomy and self-regulatory capacity of the professional.

Illicit activities

The perception of the existence of illicit activities or of those who benefit from fraudulent or elusive practices affects the social pact, generating distrust in the State and affecting the community’s contribution.

The relationship between illicit activities and corruption influenced by criminal power factors and bribery weakens the State’s coercive capacity.

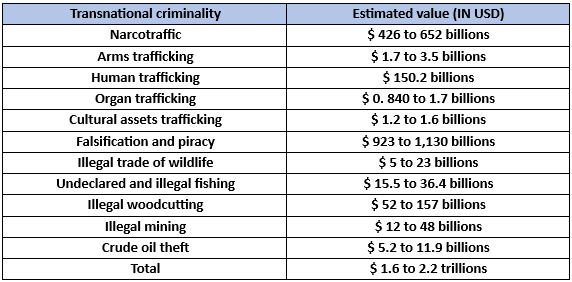

Table No. 1

“Market value of transnational crime”

Source: Transnational Crime and the Developing World. Global Financia Integrity. Channing May. March 2017.

The figures are alarming, the reality reveals the insane significance of the financial benefits and social damages that erode public confidence, feed inequality and exclusion and weaken the economy, increasing insecurity and violence and causing human suffering.

Illegality requires more than a repressive strategy; understanding it implies feeding back the elements that facilitate it, the search for the causes that stimulate it and their adjustment.

Expertise in illicit activities

This is knowledge and experience in illicit or criminal activities, in the development of elusive strategies and their legal consequences.

The professions that may be involved in the expertise to shield illicit financial benefit transfers often have specialized knowledge in finance, law and international corporate structures.

These professions, through their training and skills, can be used to design complex structures to hide or legitimize funds from illicit activities, such as money laundering, tax evasion or corruption.

Expertise may include specialization in regulatory aspects of illicit assets in accounting and finance, assisting in the administration of accounting records, the creation of financial structures and the use of instruments to shield illicit assets that make possible the outflow of the resulting financial flows thanks to the existence of a market of services, outside the country, that provides architecture and organization to the creation of legal structures and the required tax and financial planning.

The opacity of the international financial and tax system conceals the tax havens, social structures and instruments that hide the beneficiaries of illegality, their activities and the advice and confidentiality of the experts they use.

Illicit activities expertise and the professional training and regulatory bodies

The complicity of professionals in illicit activities and the financial flow deriving thereof affects the institutional reputation of the universities and professional associations that have trained and registered them, regarding the integrity and quality of the education and training they provide, in the review of responsibilities for compliance with standards, and in the cooperation with investigations and authorities.

Imputability

Expert assistance to the shielding of illicit activities points to the urgent need to review the commitment of inclusive associations and universities to the full service of the social pact.

Universities are meant to provide education, knowledge and skills to students, but they cannot fully control the actions of graduates once they leave the institution where they have been trained.

The State is more effective in the supervision and regulation of economic activity to prevent and detect illicit activities, sanction them and provide feedback to the entities that give life and oversight to the professions, than to impute responsibilities to the training institutions.

The future of the profession

The penetration of illicit power in State decisions leads to excessive ambition in society, which, encouraged by the interests of unregulated activities and stimulated by illegal expertise, is increasingly driven by violent decisions.

If professionals are associated with tax evasion, money laundering and concealment of assets, public trust based on independence of judgment and public faith is eroded.

Many of the traditional professional functions can be performed today by AI, software, data analytics skills, cybersecurity, and emerging technologies such as blockchain that expose professions to the choice of accepting new roles and rules of the game presented to them by the current reality.

One option is specializing in areas such as forensic auditing, compliance, fraud prevention and business ethics, helping to combat illicit activities.

“Yet, advances in forensic accounting and financial analysis are being exploited by unscrupulous individuals in facilitating financial flight and tax evasion.”

The threat that “expertise in illegality” becomes a significant component of the professions should trigger ethical and regulatory reforms with stricter standards, more rigorous audits and harsher penalties for those involved.

The response of the state and society will influence their future. Extreme transparency and accountability are demanded by governments and civil society. This may deter experts from engaging in illicit activities. A lax response could allow the “expertise in illegality” to gain traction..

Technological expectations, the advance of the illegal economy, the growing non-compliance with contributions to the social pact, the coercive incapacity of the State to contain it and the deterioration of the conditions of coexistence warn that the professions of reference are facing a crossroads.

The idea that the professions might choose to specialize in illicit activity as a livelihood is an extremely worrying concern and reflects a pessimistic scenario. However, if the professions do not take strong initiatives to reinforce their principles, more than a few would be tempted to follow this path.