How could fiscal policy help fighting the climate change?

Man and nature

One of the major structural challenges of the modern world is the rupture of the balance between man and nature. Economic models that encourage the unrestrained exploitation of natural resources without any concern for their consequences have caused grave phenomena of environmental transformation, especially in relation to climate change and the loss of biodiversity.

Changing this self-destructive framework is critical to the survival of humans on earth and has been the subject of numerous global debates. Taking into account the seriousness of the problem and the complexity of possible solutions to the issue, the success of this effort will undoubtedly depend on the use of all public policies in favor of restoring the ecological balance and a sustainable development.

In this sense, the fiscal policy with its main components – taxes, public expenditures and fiscal incentives – can fully join the effort to contribute to the preservation of the environment by using the potential of extra fiscal objectives. According to Hugo de Brito Machado:

“The objective of taxation was always to provide financial resources for the State. In the modern world, however, taxes are widely used in order to interfere with the private economy, stimulating economic activities, sectors or regions, discouraging the consumption of certain goods and, finally, producing the most diverse effects on the economy. This modern tax function is called the extra fiscal function.

Taxes are very important mechanisms of economic transformation; they can have a strong impact on social behavior and the fiscal system plays a key role in any process of change of this magnitude.

How could fiscal policy help to save the planet?

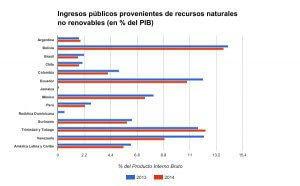

First, to implement an ecological fiscal policy giving priority to the economic activities that have a positive impact on the environment, and affect those that damage the ecosystem with a greater tax burden or any other form of compensation. This is the green taxation, called “green tax” in the original terms or similar expressions. It is therefore imperative to modify the tax structures that have never considered ecological assets as a key factor, and preserving and building a pro-nature tax system. In Latin America and the Caribbean, 13 countries already obtain revenues from taxes on non-renewable natural resource, which represented an average of 6.1% and 5.5% of their GDPs in 2013 and 2014.

Source: Tax statistics in Latin America and the Caribbean, OECD

Second, public expenditure and tax incentives policies must be coordinated and operate in a complementary way to preserve the environment. These must use public spending policies and tax incentives in harmony and not risk conflicting with each other, to be environmentally effective. Predatory economic activities that can damage the ecosystem cannot be developed with tax discounts and without providing to the society a fair compensation for the exploitation of these natural resources.

Mistaken or misleading tax incentives can help to stimulate activities detrimental to the ecological balance and to allow the extraction of natural resources without adequate compensation. In addition to damage the environment, they will result in a looting of public property and endangering the survival of future generations.

In Brazil, some states have adopted tax policy measures with regulatory objectives and complementary to their environmental policies. Environmental criteria have been established to define part of the percentage distribution to municipalities of their tax shares on operations related to the movement of goods and on the interstate, inter-municipal and communication services – ICMS.

This scheme, called Ecological-ICMS, considers for determining the participation rates that will be assigned to each municipality, the existence of an environmental policy that aims at the preservation of forests, the conservation of each protected area and its surroundings, as well as the participation and improvement in the quality of life of traditional populations, and the support provided by the municipality for its sustainable development.

However, it is a mistake to imagine that only state action can bring about a change in the destructive model of polluting economic development that has characterized the economic systems for at least two centuries.

In a complementary way, it will require broad support and the direct participation of the society in the application of these profound regulatory changes and also the transformations of their irrational and ecologically incorrect behavior that, unfortunately, characterize their habits. The benefits are immense and the whole humanity would be grateful.

This article by Jose Tostes was originally published on the blog of IDB; it is reproduced here with the author’s authorization.

2,106 total views, 2 views today