Income tax: “Minimum Tax”

The Income Tax is the tax with the highest rate of evasion in LAC. Although, in theory it is the most equitable, in practice, the multiple ways of evading it or using tax benefits, have turned it in actual taxation as a tax with serious issues of inequality.

It is possible to differentiate the “theoretical taxation “from the” real taxation” because the economic consequences proclaimed in the first, not only sometimes do not have the same effect in the second, but sometimes have the economic effect totally contrary to the goal sought, and tax equity is the first victim of this reality[1]. Obviously, in the” real taxation”, the tax administration has a leading role.

So, Schome (2000)[2] argues that, when a tax structure becomes a law, it is the administrator who decides what is implemented and what is not, which part is modified in the interests of simplifying its practical application, or to achieve better collection goals, or which parts do not apply for not being effective. To this would correspond to add the total or partial inapplicability of that tax law when the tax administration lacks the minimum capacity for its proper management. Here, we should add the level of fiscal discipline that the taxpayers of the respective country have.

Therefore, the cited author clarified that “…the signal of an advanced tax system is seen, on the one hand, in the degree to which there is the maximum correspondence between the administration of the tax, and the original objective of the policy and, on the other hand, in the measure in which when conceiving a tax, the feasibility of its implementation is also taken into account.”

In LAC, this scenario is aggravated in individual taxpayers in the “self-employed ” segment and at the enterprise level in large companies by the significant potential for income tax that is lost.

Obviously, this is a subject of constant concern for both tax policy makers and Tax Administration directors. This situation currently demands greater attention, considering the revenue needs motivated by the increase in public spending to meet the harmful economic effects that the coronavirus pandemic is causing.

‘Minimum tax”

To avoid this problem and achieve greater fairness in the tax system, many countries have proceeded from the application of a minimum tax to that of an autonomous presumptive income tax[3].

In the “minimum tax”, the tax created is a payment on account and vice versa of income tax, while autonomous taxes are exclusive, that is, they replace the classic income tax, and therefore their tax burden is definitive.

In the minimum tax, there are various modalities, depending on the taxable persons (individual taxpayers or companies) or the tax technique used to configure the tax event and the tax base.

Background

In our region, the most notorious antecedent was the tax on Business assets (IA), which Mexico began to apply from 1989 to 2007, by which it taxed business assets, to avoid the fall in income tax collection[4], constituting a “minimum tax” to be a payment on account and vice versa of this tax. It should be noted that not in all countries it was applied under the modality “minimum tax”, because in some it was done as an autonomous tax.

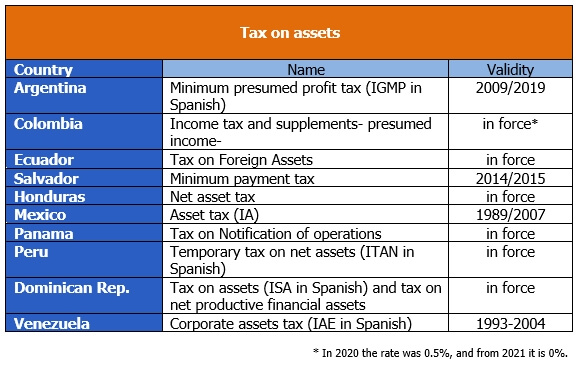

In Latin America it was applied by several countries, namely:

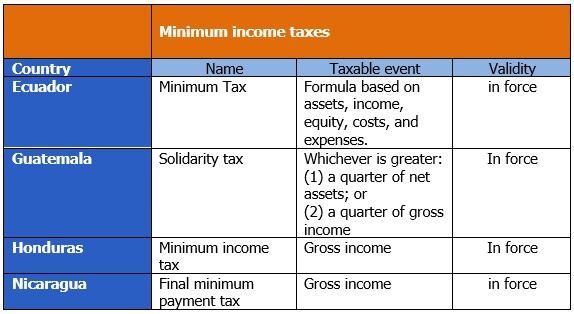

Other countries established presumptive minimum income taxes, considering other taxable facts, namely:

Other experiences:

US: Alternative Minimum Tax (AMT)

In 1969, the U.S. Congress found out that 155 high-income taxpayers were legally using tax deductions and exemptions, so they did not pay any income tax. In the face of this scandal, the Alternative Minimum Tax was instituted with the aim of making the US tax system fairer.

In this country, they realized that by applying the tax, certain tax benefits can significantly reduce the regular amount of the taxpayer’s tax burden. The AMT applies to individual taxpayers who have income from a threshold. Specifically for self-employed workers, it constitutes a simplified and schedular regime of determination of the taxable base, which has specific rates and deductions, aimed at ensuring that taxpayers of economic significance pay at least a minimum amount of tax.

India: Alternative Minimum Tax

In this country, the above-mentioned tax applies exclusively to companies with a 15% rate (plus surcharges and fees) on adjusted accounting profits, when the tax liabilities resulting from the Income Tax were lower. In India’s tax system, this presumption of profitability is applied, to ensure a minimum business payment on income.

Conclusion

[1] Theoretical paradox, because equity is precisely the flag that rises to defend the pure income tax, but which in real taxation has serious shortcomings.

[2] “Taxation in Latin America: structural trends and impact on administration, fiscal policy in Latin America: a selection of topics and experiences at the end and beginning of the century”, Schome, P. (2000): seminar and Conference Series, No. 3, LC/L. 1456-P, Santiago de Chile, Economic Commission for Latin America and the Caribbean (ECLAC). “Taxation in Latin America: Structural Trends and Impact of Administration”, 1999, IMF, Washington.

[3] Either as a schedular tax within the IT or as an independent tax.

[4] It originated in the option that established the tax system to deduct investments in new fixed assets as expenditure rather than depreciating them, due to high rates of inflation, and the manipulation of transfer prices by multinational companies.

5,009 total views, 1 views today