International tax cooperation: Main advances and opportunities for Latin America and the Caribbean

The increasing globalization of the last 40 years has increased the importance of greater international tax cooperation (ITC) to combat tax evasion and prevent the erosion of the income tax base through the shifting of profits between jurisdictions.

In this blog, we will discuss the main advances in this international tax cooperation, the participation of Latin America and the Caribbean in this process and future opportunities for the region.

A brief history of international tax cooperation

In the 1920s, international corporate income tax agreements were established, the result of negotiations in the League of Nations. These agreements defined three fundamental concepts:

The need for international cooperation to combat evasion figured prominently as evidenced by the title of the 1927 report “Report on Double Taxation and Tax Evasion presented by the Committee of Technical Experts on Double Taxation and Tax Evasion”.

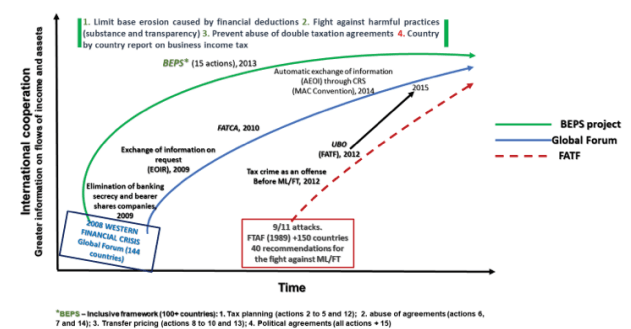

Globalization accelerated in the last 40 years with the commercial exchange, accompanied by the liberation of financial flows and the emergence of global firms, complex value chains that concentrated the exchange of goods, services, financing and intangibles. This process intensified, even more at the end of the century, with the extraordinary development of the logistics, information technology and telecommunications industries. From the beginning of the 2000s, it became clear that the greater the commercial and financial liberalization, and consequently the economic integration, the greater the tax competition to attract business investment and high wealth (saving). This led the international community to develop instruments to try to retain the tax bases within national borders, such as the OECD transfer pricing or the EU Savings Directive, agreements that had limited results. In this way, the project Harmful Tax Competition failed. It was conceived in 1998 to put an end to the problem of tax havens and mobile investment attraction regimes, the first serious attempt at coordinated action on this issue.

A new impetus to cooperation: the September 11 attacks and the international financial crisis

At the beginning of the XXI century, the international cooperation processes for tax transparency and the fight against evasion, promoted by the G20 and led by the OECD, became a priority after two critical events:

Global Forum Transparency and Exchange of Tax Information

Although the operation of the Global Forum mainly affects the management of tax administrations, it has consequences in tax policy, such as reinforcing the principle of global income in the taxation of individuals. Additionally, starting in 2014, the Global Forum developed the standards for the automatic exchange of financial information, a purely international tax administration function that is having a great influence on fiscal control in the countries that have been carrying out the exchanges since 2018.

Based on these advances in ICT and in view of the high levels of debt and deficit, governments focused on combating evasion and avoidance, the product of aggressive tax planning by large multinational companies that transfer their profits to countries with little or no taxation, with the connivance of these especially the “tax havens”. This is how the project came about.“Base erosion and profit shifting” (BEPS for its acronym in English). This cooperation, initially limited to OECD members, was gradually expanded to reach more of 140 countries in the so-called Inclusive Framework (IF).

Although BEPS is primarily about tax policy, many of its measures require to strengthen the administrative cooperation. This is the case of the exchange of rulings of Action 5, the prevention of abuses of tax treaties of Action 6, the exchange of country-by-country reports of Action 13 or peer reviews for the resolution of disputes of Action 14. More recently, the need for ITC is being reinforced in the implementation of the proposal of the 2 Pillars, which will transform the taxation of international corporate income.

Source: Own

Main advances in international tax cooperation in Latin America and the Caribbean

Since 2010, the countries of Latin America and the Caribbean (LAC) have made an effort to comply with their international commitments and have improved their domestic capacities to fight tax evasion:

International collaboration has resulted in:

Thanks to this control infrastructure, seven countries estimate to have raised an additional €3.6 billion as an exclusive result of Information exchange on request actions since 2009 and it is estimated that an additional €21.5 billion has been collected in LAC due to voluntary regularization programs prior to automatic exchanges (CRS-AEIO) since 2009, according to the Global Forum Transparency Report in 2021. Finally, it should be remembered that in said document the offshore assets of LAC are estimated at US$ 900 billion, of which 27% are financial, , which highlights the arduous road ahead.

Obviously, this effort of the countries was supported by the IDB and other multilaterals agencies operating in the region through technical assistance by various means, including seminars, manuals, training, etc. and mutual collaboration that were developed to train about 1,500 officials.

Challenges and possible lines of action for Latin America and the Caribbean to deepen international tax cooperation

The first and most important is to strengthen the effort to seek the “completeness” of the application of tax transparency instruments in the fight against tax evasion and tax policy agreements that prevent aggressive planning from eroding the tax bases.

The main actions to achieve this are:

It is also important to strengthen the institutional framework, mandates and procedures to overcome asymmetries between countries in the formulation of tax policies in international forums. That means strengthening the regional dialogue so that Latin America speaks with its own voice and its role is not limited to adherence to regulations defined mainly by developed and large emerging countries in consultation with large multinationals. This will require the modernization of the international areas of the tax administrations, for which mutual help is needed, in addition to multilateral support.

Another opportunity for the region is to strengthen cooperation to improve the control of compliance with VAT on digital services, such as international corporate income or wealth taxes. In this regard, the region should:

Finally, and not least, these advances will lead to to the integration of all jurisdictions at a global level, and to the exclusion of those that do not collaborate, to the transparency process due to the fact that a single country with tax opacity generates inefficiency in integrated markets and inequities among trading partners. In addition, it is crucial that ITC mechanisms to combat evasion also include management improvements to be effective without omitting the protection of taxpayers’ rights, data security and that compliance and control costs are as low as possible.

At the IDB, we are aware of the magnitude of these challenges and the difficulties involved in being a full participant in ITC. Our mission is to make our technical and financial resources available, so that the tax administrations of the region can improve in the mobilization of domestic resources and thus achieve the Sustainable Development Goals.

Learn more about the IDB’s work with tax administrations out here.

This work is linked to the document: New International Taxation on Companies. Challenges, Alternatives and Recommendations for Latin America and the Caribbean.

Other related articles

Featured Post:

Digital VAT Toolkit

[1] In all countries where bank secrecy has been abolished, the account holder maintains the right to privacy with respect to third parties, but supervisory authorities, including tax authorities, are not considered third parties in this regard.

6,121 total views, 2 views today