- Featured

- Working Missions

On December 9, 2025, the Receita Federal do Brasil (RFB) celebrated in Brasilia the completion of the Cooperative Compliance Program, known as CONFIA, which began in 2021, and its official…

2,885 total views, 1 views today

- Featured

- Working Missions

On December 4 and 5, 2025, the annual meeting of the VITARA program was held at the headquarters of the International Monetary Fund in Washington, D.C., a key forum for…

2,476 total views, 1 views today

- Featured

- Training

We are pleased to announce that registration is now open for the virtual training programs we will be offering throughout the first semester of 2026. This academic program has been designed…

3,095 total views, 4 views today

- Featured

- The Executive Secretary in the Press

On December 9, 2025, the 11th Methodological Meeting with Major Taxpayers of the AGT of Angola was held, dedicated to the implementation of electronic invoicing. The Executive Secretary of CIAT,…

2,452 total views, 2 views today

- Featured

- Working Missions

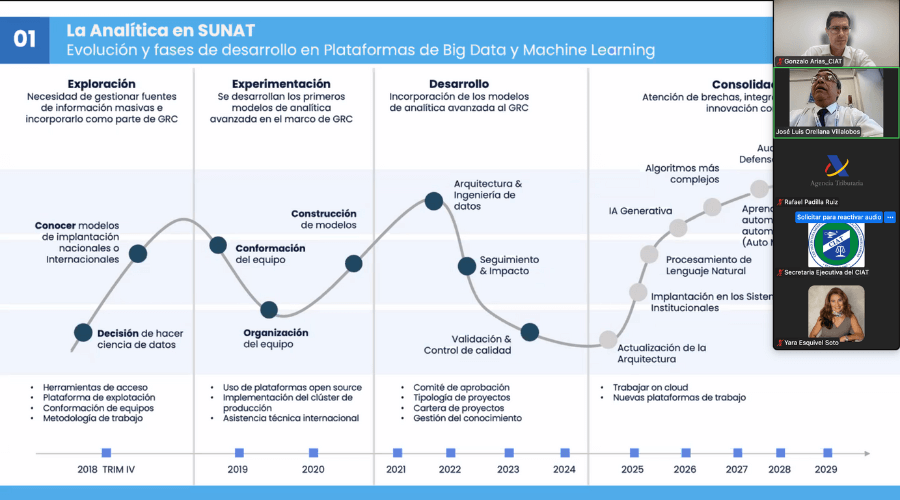

As part of the Cooperation Program currently maintained by the CIAT Executive Secretariat with the Spanish Cooperation (AECID), an activity was conducted to address issues related to innovation and international…

1,417 total views, 1 views today

- Featured

- Working Missions

On November 18 and 19, 2025, the II International Taxation Congress was held in Panama City, sponsored by the IFA Panama Group.The Congress was attended by renowned experts from different…

1,755 total views, 1 views today