- Featured

- Publications

The Inter-American Center of Tax Administrations (CIAT), with the support of GIZ and COSEFIN, publishes the Taxation and Gender Study, the first regional analysis based on official records disaggregated by…

- Featured

- The Executive Secretary in the Press

From September 25 to 28, 2025, in Punta Cana, Dominican Republic, the Inter-American Center of Tax Administrations (CIAT) participated in the 2nd International Congress of Tax Consultants (CICI 2025), organized…

1,516 total views, 2 views today

- Featured

- Other News

The Inter-American Center of Tax Administrations (CIAT) has expanded its digital production with the launch of its official podcast, “Al día con el CIAT”, now available on Spotify. This new…

1,389 total views, 2 views today

- Featured

- Working Missions

In Guadalajara, Mexico, from September 1 to 5, 2025, two academic and professional meetings on international taxation were held: the XVIII Meeting of the Ibero-American Observatory on International Taxation and…

1,083 total views, 1 views today

- Featured

- Working Missions

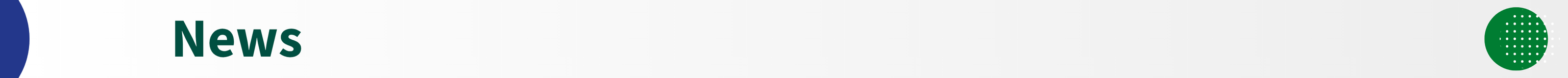

Within the framework of the cooperation that CIAT maintains with its peers in the Network of Tax Organizations (NTO), the CIAT Executive Secretariat attended the 7th WATAF High Level Policy…

1,131 total views, 1 views today

- Featured

- Working Missions

On September 15–16, 2025, the International Preparatory Cycle of the National Meeting on Planning and Institutional Management “SUNAT 4.0: Professionalism, Technology and Predictability at the Service of the Common Good” was…

1,357 total views, 1 views today