PROFISCO improves the procedures related to Brazilian tax litigation by driving the digital transformation – Part II

IDB experience in PAT-e implementation

The PROFISCO program is helping several Brazilian states drive digital transformation related to tax litigation.

São Paulo: pioneering the implementation of PAT-e

The state of São Paulo was the first Brazilian tax administration to develop, still in 2009, the electronic tax Administrative Procedure and was called e-PAT. Its implementation was supported by law 13.457 / 2009 and decree 54.486 / 2009, which regulate tax administrative procedures, derived from the ex officio settlement, for the resolution of disputes related to state taxes and their respective sanctions, in the electronic modality. The legislation also provided that all acts of the electronic procedure would be signed by means of a digital certificate, issued by an Accredited Certification Authority, for the unequivocal identification of the signatory.

The automatization of tax litigation was developed by the Ministry of Finance of the state of São Paulo (SEFAZ/SP), which involves, in addition to the area of Information Technology, all sectors responsible for tax litigation. The strategy adopted was to take advantage of the administration system that already allowed for the electronic filing of infractions and their evidence and integrate it with a new system focused on tax litigation procedures and its interface with taxpayers. This new system was called e-PAT.

To allow the exclusively electronic existence of the communication of the TA with a certain taxpayer about their notifications of irregularities, the use of the electronic address of the taxpayer (DT-e) was regulated, which is a messaging email box-type tool that, in a secure environment, allows rapid communication. This communication is considered personal for all legal purposes and, by provision of the law, implies the tacit knowledge of the taxpayer. In addition, the electronic report of SEFAZ/SP was created, available on the Internet, for the electronic communication of procedural acts of interest to the company.

The e-PAT, which covers the stages of tax litigation, has been developed in modules and presents functionalities such as:

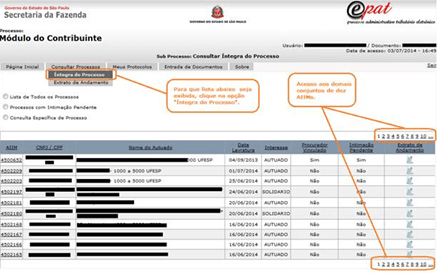

E-PAT Portal: procedure display screen

E-PAT Portal: procedure display screen

To facilitate access to the e-PAT Portal, several dissemination events were held with taxpayers and the e-PAT Manual portal that describes all the functionalities and how to use them is available on the internet.

Paraná: a comprehensive solution for administrative litigation

Presented in a different perspective, the implementation of the e-PAF in the state of Paraná began in 2015 and the strategy adopted was the development of a comprehensive solution from the issuance of the service order to the auditor, through the issuance of the infraction notification, to the final decision of the administrative litigation. This solution would be integrated into the systems of complementary procedures, such as Registries, Collection, electronic tax documents, as well as installment payment, registration in active debt, filing deadline, compliance with court order, among others.

The option for an integral solution, with all the stages of the tax credit cycle, and native integration with other Tax Administration Systems, was due to the absence of a state system of infractions that allowed generating previously elaborated and automated models with parameterization of information, such as occurrence, legislation, sanction, etc.

The implemented solution incorporates components of Business Process Management (BPM), Enterprise Content Management – ECM, business services Bus (IBM Integration BUS – IIB), as well as features, resources, and functionalities to support digital certification, user management, and administration.

The implementation of e-PAF began with a pilot project that contemplated the main functionalities linked to the origin of the tax credit – the issuance of the infringement notice. The extension has expanded gradually to the entire flow of the tax administrative procedure. At the end of the implementation, all the new evaluation procedures regarding the main state taxes[1] and their respective tax litigation are included. The integration with the system of the State Attorney General’s Office – PGE, responsible for the management of tax executions with the Judiciary, is also in planning.

For the interaction with the taxpayer, an Internet portal – E-PAF manual External Portal was developed for the visualization of information and documents of the entire content of the procedures, in addition to the functionality of the submission of petitions, resources and documents.

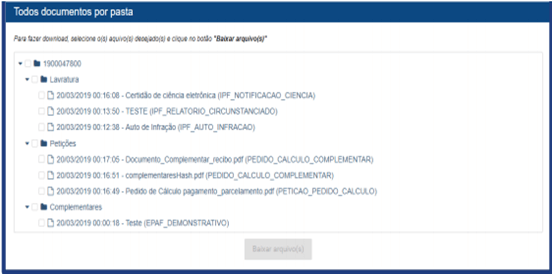

E-PAF External Portal: consultation of the documents of the act of infringement by folder

E-PAF External Portal: consultation of the documents of the act of infringement by folder

Benefits of the automatization of tax litigation

Research shows that the efficiency promoted by digital technologies in the public sector can save up to 97% of the costs of government services.[2]

The e-PAT is a solution that has proven to be very efficient for both government and taxpayers. The main benefits are:

In summary, the results obtained so far with the implementation of the e-PAT show that digitalization is an essential ally of the state to increase tax collection and improve the provision of services to Brazilian taxpayers. It is also proof of the transformative power of the PROFISCO Program, a partnership between the IDB and the Brazilian government that promises to continue driving innovation in Brazilian fiscal management.

Other posts about PROFISCO program that may interest you:

- Brazil reaps the benefits of the digitalization of invoices

- Digital innovation for more efficient public procurement in Health: e-invoicing as a price parameter

- The virtual attention to the taxpayer allows the continuity of the tax business and is strategic in times of the coronavirus

[1] Tax on operations relating to the movement of goods and the provision of interstate and intercity transport and Communication Services (ICMS) and the tax on the transmission of death and donations, of any goods or rights (ITCMD).

[2] K. Kernaghan-Brock University (2012), Transforming local public services using technology and digital tools and approaches – Local Government Association (2014), Digital government transformation – Deloitte Commissioned by Adobe (2015).

1,977 total views, 3 views today