Regional cooperation and Tax Information Exchange between tax administrations

The Asia-Pacific and the Latin American cases

The accelerated growth in the economic activity of countries brings as a result increased international tax risks including cross- border tax evasion and tax avoidance. It is therefore now more necessary than ever that tax administrations work together to fight tax evasion. In a global context, the Organization for Cooperation and Economic Development (OECD), international organization based in Paris, has been taking the initiative to promote transparency and exchange of information.

On the other hand, despite the increased demand that exists globally to achieve closer cooperation between tax administrations, frames or forums for regional cooperation between tax administrations in Asia-Pacific are so far incipient in comparison with those of Latin America and other regions. There will also be space for further strengthening the capacity of Tax Information Exchange, especially in developing countries.

1. Economic growth and risk of cross-border tax evasion

As the region increase its share in the global economy, so does the risk of cross-border tax evasion and tax avoidance. In that sense, Cecilia Licona Vite, in the document “Study on Tax Evasion and Tax Avoidance in Mexico”(1)

, shows that tax evasion and avoidance were a main cause of the drop in income as a percentage of gross domestic product (GDP) in Mexico. The exchange of information between the different countries under international treaties and agreements was one of the means to combat tax evasion. This trend receives now greater emphasis in the Asian region that guides the growth of the world economy.

|

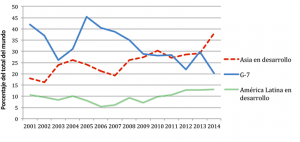

Figure 1: Foreign direct investment (incoming) as a percentage of the total of G-7, Asia and Latin America, in 2001-2014 |

|

| Source: Conference on trade and development United Nations, Geneva. |

Graph 1 presents the flow of incoming Foreign Direct Investment (FDI) as a percentage of the total of the world in the G-7 and developing countries of Asia and Latin America, for the years 2001-2014. It shows that FDI in developing Asian countries has surpassed the advanced countries of the G-7 in 2010. On the other hand, Latin America has also doubled its percentage since 2007. In the case of multinational companies that perform cross-border investment, they deal with their tax affairs on a global scale (2)

The Global Financial Integrity (GFI), non-profit organization based in Washington, D.C. and dedicated to research and consulting, United States, has warned of the possible increase in the risk of tax evasion in the regions. That organization has also released information about the illicit financial flow in the developing countries for the years 2004-2013, such as Asia and the Western Hemisphere; they reached 38.8 percent and 20.0 per cent of the world, respectively.(3)

2. OECD project on the Tax Information Exchange

In a global context, the OECD promotes international standards on the exchange of information between tax administrations, in particular via its framework of the Global Forum on Transparency and Exchange of Information for Tax Purposes

(4) Under the Framework of the Global Forum, the project covers not only the 34 OECD States members, mostly advanced and historically gravitate around Europe, but other countries and territories including offshore financial centers and emerging countries. By January 2016, the Global Forum had 130 members.

The origin of the OECD project on Tax Information Exchange goes back to May 1996 when an OECD press release at Ministerial Council level, urged the OECD to analyze and develop measures to address the effects of harmful tax competition. Two months later, the economic communiqué of the G-7 Summit held in Lyon in July of 1996 underscored the risks of harmful tax competition between States, and supported the work of the OECD in this field.

Since the beginning of the years 2000, the project has focused on two main elements; i.e., transparency, which would be in other words availability and access to information by tax authorities, and the exchange of information. In recent years, the G-20 has consistently supported the work of the OECD on the Tax Information Exchange; and in particular, it emphasizes the importance of the participation by developing countries.

3. OECD Project, Asia-Pacific and Latin America

To what extent do Asia-Pacific and Latin America participate in the project of the OECD on transparency and exchange of information? It cannot be said that the two regions are well represented among the 34 ordinary members of the OECD, which include four members from Asia-Pacific (Australia, Korea, Japan and New Zealand), and two from Latin America (Chile and Mexico).

On the other hand, in the first stage of the project, the OECD focused on Caribbean and the Pacific territories. When a progress report of the OECD was published in 2000, Towards Global Tax co-operation: Progress in Identifying and Eliminating Harmful Tax Practices, it identified 35 countries and territories as tax havens. These 35 countries included 15 jurisdictions in the Caribbean: Anguilla, Antigua and Barbuda, Aruba, the Bahamas, Barbados, British Virgin Islands, Dominica, Grenada, Montserrat, Netherlands Antilles,(5) St. Lucia, St. Kitts and Nevis, St. Vincent and Grenadines, Turks and Caicos, the Virgin Islands of the United States. There were also two Central American countries: Belize and Panama, and seven jurisdictions in the Pacific: Cook Islands, the Marshall Islands, Nauru, Niue, Samoa, Tonga and Vanuatu.

Under the current framework of the Global Forum on transparency and exchange of information, the scope of the project has been extended considerably. It includes financial centers such as the Special Administrative Region of Hong Kong and Singapore, and emerging countries.

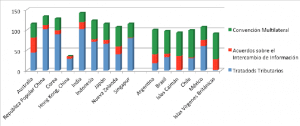

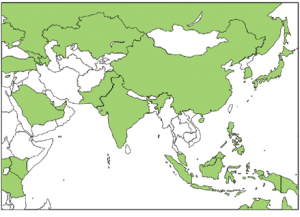

| Figure 2: Members of the Global Forum of the OECD in Asia |

|

|

| Source: Organization for cooperation and economic development, Paris |

|

Figure 3: Members of the OECD Global Forum OECD in South America |

|

| Source: Organization for cooperation and economic development, Paris |

Of the 130 members of the Global Forum, until January 2016, 22 were from the Asia-Pacific region and were 31 Latin American jurisdictions.(6) In addition to the OECD member countries, member countries of the G-20 in the regions joined the Global Forum; i.e., Argentina, Brazil, the People’s Republic of China, India and Indonesia (see charts 2 and 3).

On the other hand, as the map of chart 2 indicates, emerging countries in Southeast Asia such as Myanmar, Thailand and Viet Nam are still absent. In the light of the project of the ASEAN economic community(7) (CEA) conducted in December of 2015, it is important to adjust the cooperation between tax administrations to the progress of economic integration. In this regard, the OECD strengthens activities in the Asian region, often in collaboration with fellow organizations such as the Asian Development Bank.(8)

In a new move, the European Commission published in June 2015 a list of countries and territories that the European Union Member countries evaluate with respect to the application of the rules of good tax governance (transparency, exchange of information and fair tax competition). It included a number of countries and territories listed in Asia-Pacific and Latin America, particularly Oceania and the Caribbean.(9) This indicates the importance of the two regions for the issue of tax transparency.

4. Regional cooperation frameworks for the tax administrations

Daniel Drezner introduces as a category of international governmental organizations, organizations of neighboring’ countries whose membership are based on geography.(10) Tax administrations that tend also to form structures or forums in each region. These regional frameworks are intended to foster cooperation between tax administrations more directly. Effective exchange of information to fight against cross-border tax evasion is definitively among the main topic in their regional activities.

|

Table 1 : Regional cooperation Frameworks for Major Tax Administrations |

||||||

|

Name |

Number of members |

Year of creation |

Permanent Secretariat |

|||

|

Inter-American Center of Tax Administrations (CIAT) |

38 |

1967 |

Panama City |

|||

|

Study Group on Asian Tax Administration and Research (SGATAR) |

17 |

1970 |

None |

|||

|

Commonwealth Association of Tax Administrators (CATA) |

47 |

1978 |

London |

|||

|

Centre de rencontres et d’études des dirigeants des administrations fiscales (CREDAF) |

30 |

1982 |

Paris |

|||

|

Inter-European Organization of Tax Administration (IOTA) |

46 |

1996 |

Budapest |

|||

|

Pacific Islands Tax Administrators Association (PITAA) |

16 |

2003 |

Suva, Fiyi (interina) |

|||

|

Association of Tax Authorities of Islamic Countries (ATAIC) |

28 |

2003 |

Jartum, Sudán |

|||

|

African Tax Administration Forum (AFTF) |

36 |

2009 |

Pretoria |

|||

Table 1 is a list of major regional frameworks specialized in cooperation between tax administrations in the world. The Inter-American Center of tax administrations (CIAT) was inaugurated in the year 1967 in Panama and is the oldest regional tax administrations forum on the list. CIAT’s main activities include the promotion of cooperation between tax administrations, technical assistance, and studies and research on tax issues. To perform these activities, the CIAT Executive Secretariat is located in the city of Panama. Member organizations pay annual contributions based on the economic scale of the countries. It is worth mentioning that the 38 member countries of CIAT include not only American countries, but also five Europeans, among them Spain, France and Portugal. The participation of European Member States reflects an economic union between Latin America and Europe, and their interest in technical assistance activities.

On the other hand, in the Asia-Pacific region we have the Study Group on Asian Tax Administration and Research (SGATAR) with 17 member authorities in East and South-East Asia, and Oceania, including tax administrations in four member countries of the OECD. While the SGATAR has a relatively long history, and its first meeting was held in Metropolitan Manila in 1971, its functions and results remain modest compared to those of the CIAT. The report “Supporting the Development of More Effective Tax Systems”, presented by international organizations at the G-20 Summit of Cannes in November of 201 stated that knowledge of the capacity of tax administration in Asia were limited in comparison with other regions such as Latin America.(11)

SGATAR itself felt the need to strengthen its functions. The press release of its annual meeting held in Sydney, Australia, in November of 2014 made clear that the Group would continuously execute its activities under a new platform. Meanwhile, the Pacific Islands Tax Administrators Association (PITÄÄ), another framework for regional cooperation in Oceania, was planning to set up its permanent secretariat in Fiji as the host country.(12)

5. Current situation of the Tax Information Exchange

What is the current situation of the Tax Information Exchange between tax administrations in the regions? Reflecting economic growth in emerging countries and the strengthening of transparency in financial centers, the demand for exchange of information tends to increase in the regions.

Table 2: Tax obligations collected by exchange of information in Australia

|

2012-2013 |

2013-2014 |

|||||||

|

Ranking |

Partner Jurisdiction |

Tax obligations |

Partner Jurisdiction |

Tax obligations |

||||

|

1 |

Singapore |

159 million |

Great Britain |

39 million |

||||

|

2 |

Great Britain |

147 million |

South Africa |

38 million |

||||

|

3 |

Cayman Island |

38 million |

Jersey |

38 million |

||||

|

4 |

Netherlands |

25 million |

Cook Islands |

28 million |

||||

|

5 |

United States |

24 million |

Italy |

28 million |

||||

|

6 |

Ireland |

22 million |

Bahamas |

21 million |

||||

|

7 |

New Zealand |

14 million |

Singapore |

18 million |

||||

|

8 |

Italy |

11 million |

Japón |

13 million |

||||

|

9 |

People’s Republic of China |

10 million |

Bermuda |

9 million |

||||

|

10 |

British Virgin Islands |

10 million |

Malaysia |

9 million |

||||

Sources: Commissioner of Taxation Annual report 2012-2013 and 2013-2014. Australian Taxation Office, Canberra.

Table 2 shows the first ten partner jurisdictions for the Australian Taxation Office in the field of tax duties collected by the Tax Information Exchange in the years 2012-2013 and 2013-2014. The table also indicates that, while the partners for the exchange of information tend to change every year, the proportion of trade partners in Asia and Oceania, and financial centers in the Caribbean is considerable.

Table 3: Exchange of information in Latin America in the year 2010

|

Number of requests sent |

Number of requests received |

|||

|

Argentina |

47 |

8 |

||

|

Brazil |

2 |

29 |

||

|

Chile |

8 |

22 |

||

|

Ecuador |

4 |

1 |

||

|

Mexico |

112 |

25 |

||

|

Peru |

2 |

1 |

Source: Inter-American Development Bank. March 2013. State of the tax administration in Latin America: 2006-2010. Washington, D.C.

Table 3 reflects the numbers of cases of information exchange in selected countries in Latin America in the year 2010. Taking into account the scale and economic growth in Latin America, a more active employment of the exchange of information system in the region could be expected.

6. Key factors of the information exchange system

In general, while advanced countries actively exchange tax information with partner jurisdictions, the level of information exchange system is different according to the jurisdictions, and specifically, developing countries need to promote further the capacity of the system. The exchange of fiscal information system is composed of several factors that include legal foundations and practice in tax administration.

First, the tax administration implements the international Tax Information Exchange via international agreements such as tax treaties through a clause on the exchange of information,(13) and special agreements on Tax Information Exchange.

|

Figure 4: Networks of international Agreements in Asia-Pacific and Latin America |

|

| N.B.: The graph shows all the signed agreements. Not all agreements considered here include a clause on the exchange of information that meets internationally agreed standards.

Source: Organization for Cooperation and Economic Development, Paris. |

Graphic 4 shows the development of international tax agreements networks in major jurisdictions in Asia-Pacific and Latin America. We could say that these jurisdictions in general have a sufficient international network. Above all, a multilateral instrument, the Multilateral Convention on Mutual Administrative Assistance in Tax Matters, which contributes to the expansion of the network for the exchange of information in addition to the bilateral agreements.(14)

Secondly, an effective information exchange system requires a set of law and regulation with which the tax administration can get foreseeably relevant information, in order to carry out the exchange of information, and then provide information to foreign authorities. The concept of foreseeably relevant information also contains banking information.(15)

In addition to legal foundations, the third point at issue is the tax administration organization itself. The organization must include a team dedicated to the information exchange, often called Information Exchange Unit, as well as the internal instructions manuals, and Information and Communication Technology (ICT) systems.

Finally, what matters is that the process of information exchange is part of the General activities to strengthen compliance with tax obligations, especially tax inspection and investigation. Even if the information exchange unit at the Central Offices meets international standards, if the inspectors and investigators on the field cannot sufficiently use the system of exchange of information, such a system would be something like a treasure without value.

7. How to strengthen regional cooperation and exchange of information

How can we promote regional cooperation and the smooth exchange of tax information in the regions? The means to promote them could be classified in three categories: (1) those that each tax administration must address, (2) those that regional cooperation frameworks must address and (3) those that require support from international organizations.

First, considering that each jurisdiction include the function of tax administration, each government must have responsibility and ownership on the process of Tax Information Exchange. The aspects that each jurisdiction must address have many facets, and consist broadly of legal foundations and an administrative system.

On the other hand, there are limits to this approach at jurisdiction level, particularly in developing countries, and therefore different frameworks and international organizations have specific roles to play.

As seen in section 4, it seems that the regional cooperation frameworks for the tax administrations in Asia-Pacific have room for strengthening, and these same administrations could learn from the experience of the Inter-American Center of tax administrations (CIAT), as well as from other regional cooperation frameworks. In addition, strengthening regional cooperation frameworks tends to improve the exchange of Tax Information between jurisdictions that have strong economic ties, result of dialogue and exchange of knowledge and experiences.

Finally, it is important to take as a reference not only the initiative of the OECD and its Global Forum on Transparency and Exchange of Information for tax purposes as a regulator and promoter of international standards, but also those of other financial institutions for international development and bilateral development agencies. They can play roles that are more active in benefit of the tax administrations in developing countries of developing Asia-Pacific and Latin America.(16) Administrations in resource-constrained developing countries need technical assistance from the international community. On the other hand, regional cooperation frameworks and the OECD do not have sufficient resources to provide technical assistance activities “custom-made” for each country with low income, and from this point of view, financial institutions and development agencies who have experience in the development of capacity can fill the gap that may occur between supply and demand.(17)

4,434 total views, 12 views today

1 comment

Great page! Thank you for the information.