Risks in Brazilian tax policy and tax management: Reflections and parallels in Latin America

The Federal Court of Accounts (TCU) is the external control agency of the Brazilian federal government that operates as an auxiliary of the National Congress with the mission of monitoring the country’s budgetary and financial execution and contributes to the improvement of public administration for the benefit of society.

The quality of TCU’s analyses and technical staff is widely recognized both in Brazil and internationally for the high level of specialization of its employees and the methodological rigor applied in its audits and inspections.

This institution published the document “High Risk List of the Federal Public Administration 2024” [1], which consolidates the assessment on 29 critical areas of the Brazilian public administration that present significant risks capable of compromising the quality of services provided to citizens and the effectiveness of public policies.

In the area of “fiscal management”, three major risks are associated with tax policies and management:

- Transparency and effectiveness of tax expenditures

- Efficiency of collection and tax litigation

- Credibility of the accounting information of the tax collection

The first risk refers to the set of governance weaknesses, mainly in the formulation and monitoring of public policies financed with government subsidies.

The second risk concerns the efficiency of credit collection and tax litigation (administrative and judicial). There are chronic risks such as the long duration of the processes, the high volume of cancelled assessments and the low collection of amounts from assessments maintained in the administrative tax process (PAF), in addition to legal discussions on procedural issues of the administrative litigation.

The third risk relates to relevant distortions in the accounting information disclosed on tax collection, in particular: discounts granted on Federal debt assets not amortized from the assets, lack of appropriate accounting classifications, revenues recognized in an incorrect accounting period, etc.

Based on the risks identified in Brazil, the following hypothesis is proposed: tax administrations in Latin America and the Caribbean (LAC) face similar risks.

This article aims to take a first step in the process of validation or refutation of this hypothesis through a preliminary bibliographic research, supported by the use of artificial intelligence tools to perform automated searches and identify relevant sources.

ㅤ

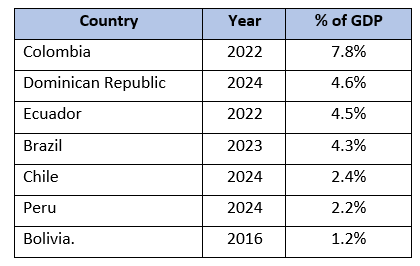

1. Transparency and effectiveness of tax expenditures

Regional situation:

Tax exemptions, also referred to as tax expenditures, include a variety of tools such as incentives, exemptions, deductions, deferrals, tax credits, reduced rates and special regimes. These measures are widely used in Latin America to encourage investments, promote economic development and support strategic sectors. However, in many cases, they lack adequate monitoring to assess their true impact on the economy.

The design and implementation of these tax benefits are not always transparent, which can lead to abuses and generate significant losses of tax revenue. In addition, the coverage and level of detail of tax expense reports vary considerably between countries in the region. For example, Brazil and Bolivia have more comprehensive reports, while countries such as Colombia and Costa Rica face significant challenges in improving the quality and depth of their reports [2].

Economic impact of tax benefits

Source: [1]

CIAT manages the Latin American and Caribbean Tax Expenditure Database (TEDLAC)[1], source for many research papers.

ㅤ

Possible mitigations:

The issue of tax exemptions or tax expenditures has been extensively studied by specialists in tax administrations, academia and international organizations, and ways for their effective management have already been outlined, such as: the creation of a digital public registry of tax exemptions, accessible to the public, with details of the tax exemptions granted, the sectors benefited and the amounts involved (example: the Brazilian portal that allows citizens to consult tax benefits (https://portaldatransparencia.gov.br/renuncias); periodic impact assessments, with cost-benefit analysis of tax exemptions using analytical models to verify if they meet their objectives (example: the National Planning Department (DNP) of Colombia periodically evaluates the effectiveness of tax incentives) [2]; establishment of limits with clear and transparent criteria for granting exemptions, with time limits and conditions for their renewal; elimination of ineffective exemptions, which do not generate the expected economic or social impact.

These solution/mitigation proposals are not novel, the biggest problem is to align them to not always rational political decisions.

Reference [S4] summarizes a set of good practices and recommendations from international organizations and civil society entities on tax benefits.

Conclusion:

We conclude that the transparency and effectiveness of tax expenditures is a common problem to several LAC countries, where the lack of clear mechanisms to measure and justify tax exemptions affects the transparency, confidence and effectiveness of the tax system in most countries of the region.

ㅤ

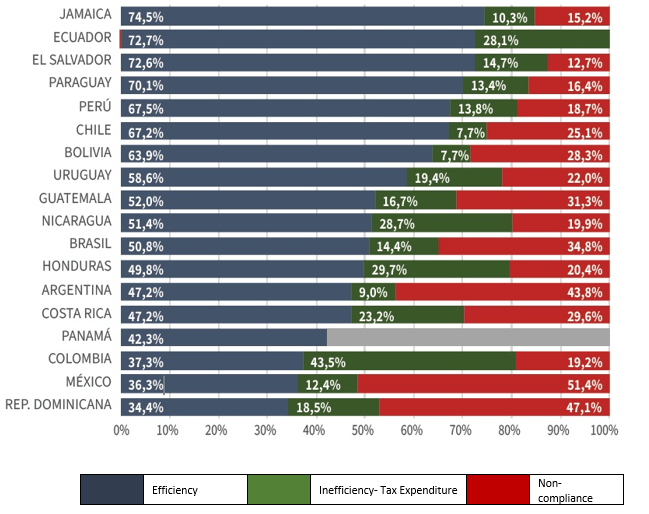

2. Efficiency of collection and tax litigation

Regional situation:

The problems in tax collection affect both the collection efficiency and the tax sustainability of many countries in the region. Tax administrations face significant challenges to maximize revenue collection due to factors such as tax evasion, high economic informality and the complexity of tax systems.

On the other hand, tax litigation is often lengthy and expensive, which makes it difficult to effectively recover the taxes owed. For example, in Argentina, according to CIAT, the average time to resolve a tax dispute exceeds five years, which significantly delays tax revenues. In Mexico, the complexity of the tax control systems generates high levels of litigation, complicating tax management.

In Brazil, the cost of tax compliance is one of the highest in the world. In 2023, the revenues managed by the Special Secretariat of the Receita Federal of Brazil (RFB) reached R$ 2.2 trillion (approximately USD 400 billion), which represented 90% of the current revenues collected during that period. However, the receivables derived from taxes and social security contributions, as well as those registered in the active debt, amounted to R$ 1.52 trillion (USD 276 billion). Of these, the active debt under the responsibility of the Attorney General’s Office of the National Treasury (PGFN) exceeded R$ 1.10 trillion (USD 200 billion), representing more than 72% of the outstanding loans [1].

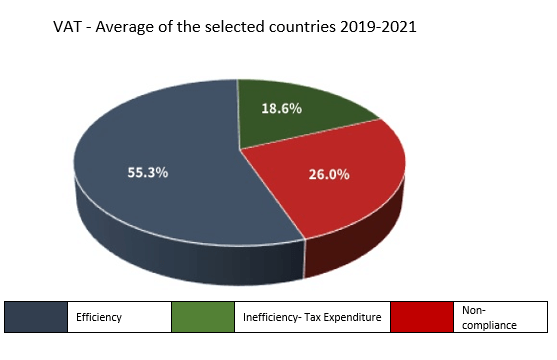

Components of the potential VAT collection

Average of selected countries 2019-2021

Source: [5]

In the 2019-2021 triennium, the estimated collection efficiency for VAT in the analyzed countries was 55.3% (similar to the average of the 2016-2018 period, 55.1%), while the tax gap was divided into 18.6% attributable to the gap generated by tax expenses and 26% of non-compliance.

ㅤ

VAT – Average of the selected countries 2019-2021

Source: [5]

Tax specialist Everardo Maciel, former secretary of the Receita Federal of Brazil, summarizes the problems of tax litigation in the country as follows:

“The main tax problem in Brazil is the permanent litigation that undermines legal security, even for the tax authorities themselves. Disputes, including active debts and administrative and judicial disputes of the federal entities, reach values greater than half of the Brazilian GDP. These disputes are rarely related to the nature of taxes; mostly, they originate from procedural issues. There are three main sources of controversy: the no-fault valuation, the questioning of tax arguments through the diffuse control of constitutionality and the ambiguity of certain concepts. Insubstantial infringement notices do not generate costs for the State, but they seriously harm taxpayers, causing reputational damages, significant legal costs and the need to present enormous guarantees in the judicial field.” [6].

In addition, the work published by the Inter-American Development Bank (IDB) in its blog “Collecting Welfare” highlights the challenges of tax litigation in Brazil and proposes solutions aimed at mitigating this problem [8].

Possible mitigations:

The agility in the identification and communication of possible tax offenses, as well as the agile response to administrative claims help to mitigate the amount of resources to the litigation.

Currently, alternative dispute resolution systems are proposed, through tax mediation or arbitration mechanisms, to resolve tax disputes more quickly and efficiently. In Spain, specialized courts have been implemented to resolve tax disputes in an agile way; in Brazil, orientation and self-regulation operations are conducted, in order to achieve taxpayer compliance, avoid litigation and resolve doubts and pending issues, in addition to the opening of communication channels with representative confederations of economic categories, unions and class entities at the national level.

These measures are part of a global movement initially promoted by the OECD, known as “cooperative compliance” or, in some cases, as “reinforced relationship” or “horizontal monitoring”. This approach focuses on the establishment of a bilateral relationship between taxpayers and the tax administration, based on mutual trust and cooperation. The main objective is to promote the highest level of voluntary tax compliance and offer greater certainty for both tax authorities and taxpayers [9].

Conclusion:

Efficiency in tax collection and the resolution of tax disputes are common challenges in several Latin American and Caribbean (LAC) countries, arising from the complexity of tax systems and aggravated by the slowness of legal and administrative systems in many countries of the region. However, these problems are particularly critical in Brazil, where they reach an even greater magnitude.

ㅤ

ㅤ3. Credibility of the accounting information in the tax collection

Regional situation:

Tax information is not always reliable due to the lack of uniform standards, adequate technological tools and an over-reliance on manual processes. In some countries, although tax revenue data are available, they are not always rigorously audited or validated, which generates distrust in their accuracy.

In Brazil, for example, the audit of the Accounting Statement of the Balance Sheet of the Union 2023 conducted by the Court of Auditors of the Union (TCU) identified significant errors in tax revenues, including:

- • Discounts granted on active debt transactions of the Union that were not de-recognized from assets.

- • Lack of proper accounting classification for certain accounting entries.

- • Recognition of income in incorrect accounting periods.

- • Methodological deficiencies in the accounting estimates of adjustment for losses on tax credits.

These errors pose significant risks to the State, such as the reduction in collection due to errors or fraud and the presentation of materially incorrect financial information [1].

On the other hand, in countries such as Venezuela and Cuba, the availability of fiscal data is limited, while in Ecuador there are problems related to the quality of certain data, which has led to its exclusion from several statistics of Latin America and the Caribbean promoted by the OECD [10]. Likewise, the same statistical report points out the lack of subnational tax statistics in some countries of the region and the differences in the treatment of social security contributions.

Despite efforts to standardize data collection, challenges persist, linked to disparities in countries’ institutional capacities, which can compromise the accuracy of tax statistics. The absence of uniform and sufficiently disaggregated accounting criteria in the presentation of fiscal data hinders internal management, affects transparency and limits comparability between countries.

Finally, inaccuracies and discrepancies in accounting records can undermine confidence in the information presented by tax authorities, underscoring the need to strengthen auditing standards and mechanisms in the region.

Possible mitigations:

Generally, the implementation of standards such as the International Public Sector Accounting Standards (IPSAS) is recommended to harmonize the presentation of tax data. As proposed in [1], three key improvements are related to:

Accounting estimates: It is suggested to adopt more robust calculation methodologies, especially in the adjustment for losses of tax credits, which would favor the coherence and transparency of the information presented.

Classification of tax credits and active debt: Institutions should re-evaluate the classification criteria, with the aim of better aligning with current regulations and reducing the volume of credits classified as irrecoverable.

Strengthening of internal controls: It is essential to strengthen internal controls to minimize errors in the accounting of liabilities and income.

In addition, the strengthening of independent audits [3] it is essential to ensure the accuracy and veracity of tax data.

Conclusion:

The credibility of income information is also relevant for the social control by citizens, users of public services and providers of these resources.

It is noted that the transparency of tax collection in LAC, related to the disclosure of tax data, has grown significantly. Also, some questions remain: is the published information sufficient for all sectors of society? Is the published information enough to reflect the reality of taxes (audited)?

The credibility of the accounting information of the tax collection doesn’t seem to be a widespread problem in many LAC countries, although a more in-depth analysis is lacking.

ㅤ

ㅤ4. Final comments

As established at the beginning, this work represents a first step in the verification of the proposed hypothesis. To advance in this analysis, it will be necessary to carry out a more exhaustive evaluation that incorporates a greater number of countries in the region.

Despite the aforementioned limitations, the data obtained allow us to infer that the three problems analyzed could be recurrent in the tax administrations of many Latin American countries, although with different levels of incidence.

The following is a summary of the conclusions reached:

In addition, although it is possible to identify similarities in the situation of several countries in the region and propose general solutions, the implementation of specific solutions requires detailed evaluations that consider the structural, economic and institutional factors specific to each country.

ㅤ

Bibliographic References

[1] TCU, 2024. Lista de Alto Risco da Administração Pública Federal 2024. Available at: https://sites.tcu.gov.br/listadealtorisco/index.html [2] ECLAC-PTLAC, 2024. Managing Tax Benefits in Latin America: Experiences, Diagnoses and Policy Alternatives. Available at: https://www.cepal.org/sites/default/files/static/files/informe_beneficios_tributarios_pltac.pdf [3] Renzio, P., 2019. Accounted For, But Not Accountable: Transparency in Tax Expenditures in Latin America. International Budget Partnership. Available at: https://internationalbudget.org/wp-content/uploads/tax-expenditure-transparency-in-latin-america-spanish-ibp-2019.pdf [4] Gerbase, L., 2021. Tax Benefits and Tax Justice in Latin America: Recommendations of International Financial Institutions and Civil Society Organizations. Available at: https://derechosypoliticafiscal.org/images/BackgroundPaper-N7-ES-VFok_compressed.pdf [5] Longinotti, F.P., 2024. Collection Efficiency and the Tax Gap in Latin America and the Caribbean: Value Added Tax and Corporate Income Tax. CIAT – Working Document. Available at: https://biblioteca.ciat.org/opac/book/5866 [6] Maciel, E. 2020. Litígio tributário, or problem. Brazilian Institute of Concurrent Ethics. Available at: https://www.etco.org.br/noticias/litigio-tributario-o-problema/ [7] Peduzzi, p. 2024. Receita announces measures to solve tax litigios. The Brazilian Agency. Available at: https://agenciabrasil.ebc.com.br/economia/noticia/2024-10/receita-anuncia-medidas-para-solucionar-litigios-tributarios [8] Calijuri, M., Mac Dowell, M., Cartaxo, M. 2022. Estudo: Oito desafios relacionados ao contencioso tributário brasileiro e possíveis soluções. Available at: https://blogs.iadb.org/gestion-fiscal/pt-br/estudo-oito-desafios-relacionados-ao-contencioso-tributario-brasileiro/ [9] OECD. 2016. Co-operative Tax Compliance: Building Better Tax Control Frameworks, OECD Publishing, Paris. Available at: http://dx.doi.org/10.1787/9789264253384-en [10] OECD et al. 2023. Tax statistics in Latin America and the Caribbean 2023, OECD Publishing, Paris, https://doi.org/10.1787/5a7667d6-es[1] https://ciatorg.sharepoint.com/:x:/s/cds/EdXDni-Sk_NEtwl5F0UnVvIBDprC98xE3zOoypdEqBQKlg?e=NF7Nvv

[2] It is also ideal to conduct this evaluation prior to approval.

[3] In general, independent audits are carried out by specialized independent entities of the State. Private entities suffer from suspected information security breaches.

11,187 total views, 16 views today