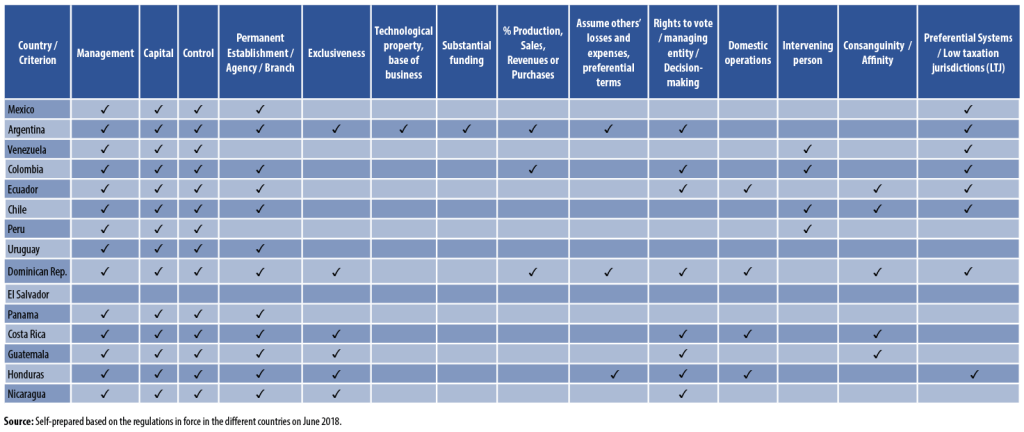

Scope of application of transfer pricing based on the definition of related parties in the regulations in Latin America

The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD Guidelines) provide orientations and recommendations that have been adopted and, at times, expanded in the domestic legislation of each jurisdiction. One of the aspects subjected to greater expansion has been the definition of related parties. In this sense, the definition of the arm’s length principle in the OECD’s model tax convention on income and capital (OECD Model), as well as that of the United Nations (UN Model) in the first paragraph of article 9 reads as follows:

“1. Where:

a) An enterprise of a contracting State participates directly or indirectly in the management, control or capital of an Enterprise of a contracting State; or

b) The same person participates directly or indirectly in the management, control or capital of an Enterprise of a contracting State and an Enterprise of the other contracting State.

And in both cases conditions are imposed between the two enterprises in their commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which would, but for those conditions, have accrued to one of the enterprises, but, by reason of those conditions, have not so accrued, may be included in the profits of that enterprise and taxed accordingly.”

What has happened in practice is that the different jurisdictions, based on that provided in the model as well as in the OECD Guidelines, have determined in their local regulatory framework, the scope of application of the arm’s length principle. They have considered as a starting point the criterion of direct or indirect participation in management, capital or control, when determining the taxpayer’s related parties. Nevertheless, they have not stopped there. They have rather tried to ensure that their regulations will consider different circumstances wherein those elements (especially those dealing with control) may be applicable. The intention is not to leave any doubt of which particular situations, such as: exclusive relations, production volumes, permanent establishments and even operations between taxpayers who are residents in the same jurisdiction, are subject to the transfer pricing obligations.

These particular situations will be of greater or less relevance for various jurisdictions, depending on economic and social aspects, which directly influence their definition of risk. From the foregoing one may infer that the jurisdictions will be encouraged to provide additional details of those situations that may have been observed in taxpayer groups of greater importance, in terms of tax contribution and their compliance behavior. Likewise, local regulations usually determine the percentage of direct or indirect stock participation for considering two entities as related parties.

The comparative table shown below summarizes the scope of application of transfer pricing obligations in some Latin American countries:

Each of the jurisdictions may adjust their scope of application based on their own reality and experience to ensure that the transfer pricing compliance obligation may be headed in the right direction.

3,514 total views, 2 views today