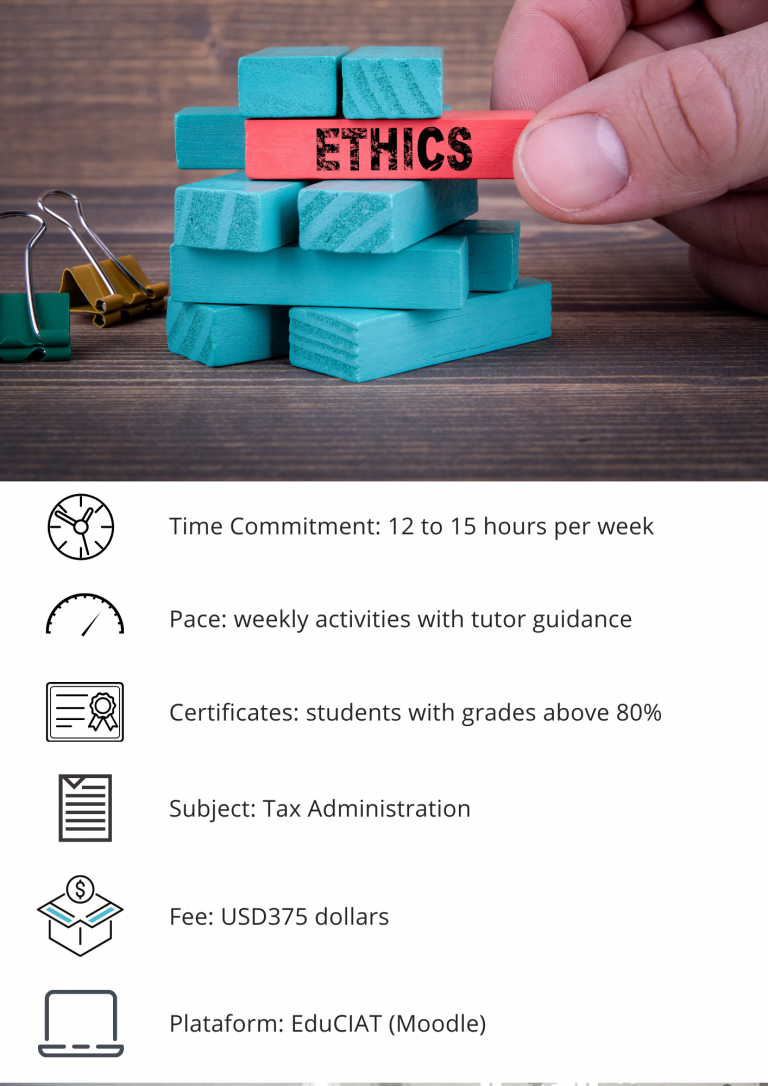

Course on Tax Ethics 8ed.

This course seeks to develop the capabilities, for elaborating proposals, tools and standards that may facilitate the promotion of public ethics, which initially requires understanding the basic criteria and principles that regulate it.

General Information

When: June 27, to September 18, 2022.

Modality: virtual.

Duration: 13 weeks and 150 academic’s hours.

Target audience: officials of the tax administrations of the CIAT member countries, as well as the public in general.

Language: Spanish.

Registration Deadline: May 13, 2022.

Requirements

-

Updated browser (Google Chrome, Mozilla Firefox or Safari).

-

Permission to receive external emails.

-

Adobe Reader.

-

Adobe Flash Player.

-

Java.

-

Zoom, is the tool to perform synchronous sessions.

Content

The course will develop the following topics:

Lesson 1. Ethics and Corruption

Lesson 2. Ethics in Public Administration

Lesson 3. Ethics or Tax Morality

Lesson 4. The CIAT Works in the Promotion of Ethics in the Tax Administration

Lesson 5. The Construction of Tax Ethics: Tax Citizenship