The Cost of Collection in Latin America

Carefully comparing

While working at the SUNAT, one of the hardest comparisons to carry out was the cost of collection in Latin America. This concern arose whenever we had to go to defend the institution‘s budget at the Congress of the Republic. In times in which access to public information was limited, there was little I could do from my desktop. Today the scenario is different because many countries have adopted Public Information Transparency Laws enabling citizens (and anyone in the world), to analyze various aspects regarding the use of public funds in their country.

While working at the SUNAT, one of the hardest comparisons to carry out was the cost of collection in Latin America. This concern arose whenever we had to go to defend the institution‘s budget at the Congress of the Republic. In times in which access to public information was limited, there was little I could do from my desktop. Today the scenario is different because many countries have adopted Public Information Transparency Laws enabling citizens (and anyone in the world), to analyze various aspects regarding the use of public funds in their country.

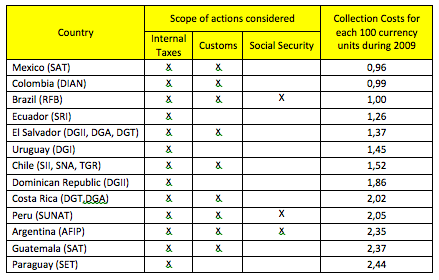

The cost of collection results from comparing the total expenses incurred by a tax administration against the collection obtained in a period of time. It is an overall indicator of efficiency. A quick look at the budgets and the collection of a representative sample of tax administrations(1) of Latin America countries members of CIAT, shows that in the year 2009 of every 100 currency units (Pesos, Reales, Quetzales, etc.) that these collected, on average, 1,66 were aimed at maintaining their operations, where Mexico’s SAT, Colombia’s DIAN and RFB of Brazil were the less expensive institutions.

Table N° 1

Cost of Collection in Latin American countries members of CIAT

Source: CIAT

Some considerations on the construction of the ratios must be taken into account before deeming this international comparison as conclusive. To begin with, the scope of action of the tax administrations analyzed is not the same. Most only collect internal taxes (Ecuador’s SRI, El Salvador’s DGII, the DGI in Uruguay, Chile’s SII, Costa Rica’s DGT, the SET of Paraguay and the DGII of the Dominican Republic). Some additionally collect customs taxes (Mexico’s SAT, Colombia’s DIAN, Guatemala’s SAT). Others are fully integrated (Brazil’s RFB, Peru’s SUNAT and Argentina’s AFIP)(2).

In this regard, the expenditure of the institutions compared is not necessarily attributable to the same functions. Some tax administrations, for example, are not competent for the collection of tax debts such as the RFB of Brazil, the DGII of El Salvador, Chile’s SII and Paraguay’s SET. Therefore, when building ratios, the expenditures of the customs, the treasuries and any other body involved the management of taxes in the country must also be included. I have done this for El Salvador including the DGA and DGT, for Chile including the SNA and the TGR and for Costa Rica including the DGA.

Ratios are made relative discounting the collection that is not attributable to the management of the administrations analyzed. For example, in the case of Ecuador, Uruguay, Paraguay and Dominican Republic it has being discounted the collection of customs duties and specific or general taxes applied on imports, since this is handled by their respective Customs Authorities. While this discount makes ratios more comparables, other distortions remain as the one associated with the low productivity of certain functions that integrated tax administrations face. For example, tax administrations that collect taxes that are by nature part of Customs sometimes perform additionally functions such as drug control and health controls that do not have a direct collection impact, although they do entail relevant staff and technology expenses. Similarly, tax administrations collecting social security payments also gradually begin to engage in the payment of benefits that have little or no collection impact.

When using collection as a comparison factor of the expenses of the tax administrations, ratios can be very volatile if simultaneously their budgets do not adjust to collection. For example, it is clear that the collection in 2009 was fairly bad for most Latin American countries. If budgets were not adjusted downwards in the same magnitude during this period, ratios must be showing growth when compared with the previous year. The tax administrations that have a budget linked to collection this should not be so relevant, but for those whose budget is set at the beginning of the year, it should be.

Finally, when considering total expenditure instead of only the operating expenditure, ratios are higher for countries that have carried out major investments during the period analyzed, while they are lower for those who are benefiting from the reduction of costs from investments in technology and other initiatives initiated several years ago. A finer analysis of the uses of fixed capital in the period analyzed would be necessary for ratios to better reflect the costs associated with the operations of tax administrations.

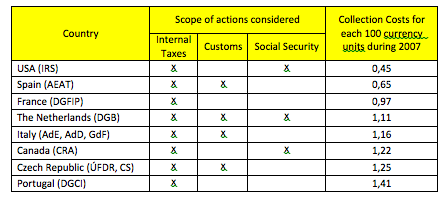

In sum, while this ratio must be calculated and analyzed by governments in their desire to get the fat out of the public sector, international comparison of the cost of collection should be analyzed carefully taking into account the particularities of each tax administration. However, looking that in OECD countries members of CIAT, the ratio in 2007 was 1,03 on average, it would seem that there is room for further optimizing spending in some tax administrations in Latin America.

Table N° 2

Cost of Collection in OECD countries members of CIAT

Source: Tax Administration in OECD and Selected Non-OECD Countries (2008)

2,696 total views, 6 views today

1 comment

Some real good points made here. The only thing one can’t conclude is whether being very efficient also means one is also very effective.