Today’s fashion will be fleeting, let it not be distressing

Chapter 15. New Disruptive Digital Technologies and Services – Opportunities and Challenges

ICT as a Strategic Tool to Leapfrog the Efficiency of Tax Administrations

Making predictions about what the future will look like will always be a risky business. The possibility of being wrong is very great. But it is essential to think about how the application of technologies will be, their impacts, their potential and their risks in order to travel a path with a more defined idea of how we want that destination to be.

It is always possible that a series of unfortunate events will change the course of things. Teleworking, for example, was explored by some tax administrations a couple of years ago, but not by all of them, or for all their agents. The adoption of new ways of working, solidly supported by technology, was perhaps abrupt and without prior planning. It would be the exception rather than the rule if, by early 2019, an administration had a business continuity plan that considered the vast majority of its staff working from home. And yet, many public administrations, and tax administrations in particular, have adapted, with surprising agility, to a way of working that was unthinkable but made possible only because of the massive availability of personal computer equipment and widespread access to the Internet.

It is unlikely that this scenario would have been imagined in the early 1980s. When the young people of that time listened to “Whip it”, “Soy un macarra” or the album “Looking for America” on the radio, depending on their musical preferences and geographical location, the personal computer equipment appeared and was there to stay. The administrations incorporated, very slowly, the first personal computers, which, together with the office productivity tools, changed the work environment from what was seen to what was painted. These tools, which already had the potential to end up with typewriters, with adding machines, and at the same time, to help retire secretaries and calculators, reached the administrations thanks to investments made by the administrations. Access to computers, which had been reserved for a few privileged “nerds”, became more democratic.

Let us remind the impact of the Internet and the increase in connectivity, which made it possible in various administrations, sometimes for some years already, to have electronic declarations for all taxpayers or to implement national electronic invoicing systems.

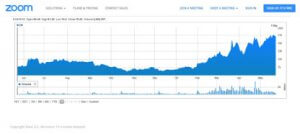

Today, the use of personal computers and their connectivity seems normal, but it was not necessarily evident when the first bet was made on these technologies. Those visionary pioneers took risks, and they bet well. They did not always succeed, of course, often their effort and initiative resulted in very little, either because their capacity was overestimated, or because they walked into obsolescence, due to the immediate arrival of something better or more efficient. The fate of new technologies, moreover, may be conditioned by other factors not controllable by users, errors in the vision of the companies that created them, the acquisition of a company by another larger one, which decides, for its own strategic development, to “kill” a specific development, and with that decision also shorten the life of the projects in which they invested in that development; by the preferences of consumers who choose a competing technology, perhaps inferior, but better marketed; or, as we have seen in these strange times we are going through, by the valuation of certain technologies thanks to their positioning in unexpected situations, which end up raising the value of their companies in the stock markets while punishing other companies to the point of threatening their own existence and consequently the products and developments that they promote. The graph below shows the evolution of the share value of a company whose service many of us use on a regular basis today, and which many had not heard of at the beginning of this year.

When we wrote with Antonio Seco the chapter 15 of our reference publication “ICT as a strategic tool to leapfrog of efficiency of tax administrations” [1]we knew that trying to visualize the future use of technologies is taking a risk. Relying on instinct alone was not enough, we could fail enormously by focusing on very new technologies, certainly promising, but not sufficiently tested. That is why we seek to identify technologies that are already available, with very recent developments, proofs of concept or pilot projects, in the field of tax administration.

The chapter visits topics such as advanced analytics, the use of big data tools, such as Hadoop, for example, to prepare pre-filled VAT returns in Chile. The analysis of data for the management of default risk, which goes from stages in which these are simply identified, to others in which the data is used to explain the things that happened, and even to diagnostic scenarios, when it is possible to identify why things happen and arrive, using techniques such as clustering, regressions and certainly artificial intelligence to predict default situations in order to explain them. Passing, of course, through the use of artificial intelligence tools to facilitate services for taxpayers.

Of course, the potential of blockchain technology and distributed records is analyzed in complex processes in which the tax administration, being part of larger ecosystems, interacts with other actors in the chains of private blocks that ensure, thanks to the immutability of records, unprecedented levels of trust to the different actors.

The possibilities of increasing the use of mobile applications to extend service platforms and the possibilities of developing, through application interfaces, interoperability mechanisms with taxpayers for compliance processes are also explored.

The chapter, although brief, explores the possibilities of using sensors and connected devices, to bring control mechanisms closer to taxable events. Its use will go beyond the obvious, such as the control of specific taxes in the production of fuels or liquors, the use of devices, sensors, equipment, and certainly software, will allow, for example, to closely follow the work done by robots and artificial intelligence systems. Information flows to the tax administration could have a qualitative leap in frequency and quantity of the order you already saw when electronic invoicing systems were consolidated.

I hope this mouth opener invites you to explore, or better yet, read this entire chapter 15. And why not, give free rein to your imagination and visualize your tax administration in 5, 10 or 20 years.

Greetings and good luck.

[1] The publication in Spanish will be available in a few weeks

2,561 total views, 5 views today

1 comment

Great blog. It makes one think, what is the best business model for at least the next 10 years. For most tax administrations, the acquisition of technology is a substantial capital investment. For sure, one takes a best guess or a scientifically-based guess that the purchase of a particular product will have a very positive return on investment. But not everything is a sure bet. The Pony Express was a great idea and I’m certain that the founders laid out a chunk of cash to create the company. But it only operated from April 3, 1860, to October 24, 1861. A disruptive technology called the telegraph sunk that Pony Express good idea. And you have situations like the one we’re living today with CVD-19. Six months ago one would have said, “Who? What?” But thanks to CVD-19 a plethora of entities are rethinking their business model or completely getting out of a particular business. One example is two of my favorite buffet restaurants. Both were doing well. Unfortunately, with the current “normal” we live in, gone forever. Bottom line, I agree, things can go wrong. However, there is no limit to how much research one can do to try and get it right. I wonder how long cash registers will be around?