The Internet of things and tax administrations: concepts, challenges and opportunities (i)

The Internet of things- concepts and current situation

Internet of Things (known for its acronym, IoT[1]) is the network of physical devices such as vehicles, appliances and other objects, which incorporate electronic components, software, sensors, actuators and network connectivity, which allow these devices to connect and exchange data. Each “thing” is uniquely identifiable through its integrated computer system, but can be interoperable within the existing Internet infrastructure[2]. These devices generate data for real-time monitoring and measurement, and the trend is that the analysis of these data becomes part of standard mode of business management. IoT technology, associated with business processes, allows to: track and count, observe and identify, evaluate and act, in circumstances so far invisible and out of reach. [3]

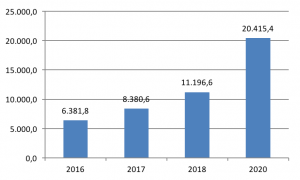

It is estimated that by the year 2020 more than 20 billion of the device will be connected in network, 60% of which in consumer goods. Figure 1 then presents a vision of this growth.

Figure 1: Number of devices connected to IoT (in millions)

Source: create by author, with data from the Gartner Group (January 2017)[4]

In terms of investment values, for example, the cost of an image sensor has decreased from $22 to 40 cents in the last 20 years. Active RFID devices[5] have also lowered their costs, with dollar-cents values.

Similar tendencies have resulted in miniaturized, inexpensive and robust enough sensors to gather information in everything from heartbeats of a fetal heart through a conductive fabric on the mother’s clothes up to jet engines roaring at 35,000 Feet[6].

These devices generate enormous amounts of data that must be stored, classified, grouped and treated by techniques of Big Data/Data Analytics. In addition to monitoring data, they can also attach information of tax interest. For this, it would be important to create international standards of information to be initially assembled in the devices presenting fiscal interest, such as vehicles, special equipment and consumer goods. Other attractive applications are the connection of cash registers to the tax administrations, sensors in the gas stations to combat the fraud in the distribution chain and to control the carbon tax[7]. Some of these applications are already present in some countries, still in limited contexts.

Opportunities

Tax administrations could use these capabilities to track the movement of goods, both to alleviate the burden of corporate taxpayers in VAT compliance or sales tax, as well as for excise duties on consumption and customs. Policies regarding IoT data have not yet been established in many cases and it is not clear that those responsible for the tax policy are representing their interests[8].

Below are three tax projects in which IoT exerts or can exert an important role.

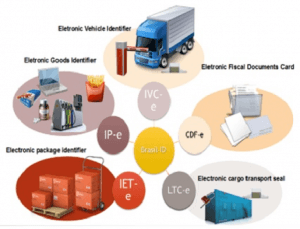

It is a system based on the use of radiofrequency identification Technology (RFID) and other wireless communications, which establish a standard of identification to be used in products and tax documents circulating in the country, with additional services tracking and verifying the authenticity.

The Brazil-ID system was originated by the tax administrations of the Brazilian states and the Federal Tax Administration, with the participation of transport companies and national technological research centers.

The control of the transit of goods for the management of the ICMS (Tax on the circulation of goods and services), under the responsibility of the States, faced important challenges, with compulsory stops of transport vehicles and manual verification of their cargoes in each crossing of inter-state boundaries, generating additional costs to taxpayers and to the government. This system responds to these challenges, eliminating or reducing the time of the stops for the control of the trucks, improving the certainty in the control and lowering the cost for the transport companies. Additionally, the expansion of the use of the system by other private and state actors improves road safety and fight the theft or diversion of shipments.

Figure 2: General scheme of Brazil-ID system

Source: Proyecto Brazil-ID

The electronic devices of the project – sealing, antennas, sensors, chips – were developed in the country, with the participation of the private initiative, establishing national standards. Several private and government companies adhered to the project to obtain byproducts of non-fiscal interest.

It is currently deployed in 13 states (of 27) with reading antennas on the country’s main roads.

The extension of the Association of IoT to products in general will be of great practicality for the customs, even within the current processes of customs management. Imagine products and containers that are automatically identified when they arrive, repassing their characteristics directly to the information systems, without any human intervention.

Meanwhile, allied with other technologies and the modernization of the processes, the new approach can be disruptive.

Singapore Customs is developing a pilot project with IBM to modernize the entire customs flow, from source to destination, using blockchain technology. The flow will provide security, authenticity and trust between the parties, using the typical mechanisms of blockchain – intelligent contracts, consensus determination, cryptography, file distribution, etc. The main goal is reduction of times and costs for all parties.

Although limited to IBM exports from the United States to Singapore, this pilot project involves all stakeholders – agents, banks, transporters, and customs administrations. The World Customs Organization participates in the project, for evaluation of its possible enlargement on a larger scale. Other similar pilot projects, in progress, deal with the entire supply chain.

To improve this pilot project, we can reflect on the availability of standardized electronic identifiers in the products and containers, as mentioned above. These identifiers would come from the factory (better choice and current trend) or would be added to the customs of origin for the case of container description. Automation and streamlining would be extended, including improved security and fraud reduction.

Ainsworth & Shact, in a recent work, proposed a mechanism to improve VAT management in the European Union, based on the use of blockchain technology[12].

In short, the proposal pretends that the DICE initiative (Digital Invoice Customs Exchange), currently underway, will be implemented with the blockchain technology. For this initiative, digitally signed invoices will be exchanged in an automated way.

Likewise, the DICE initiative in its original version would be based on the exchange of information between independent centralized databases from each of the 28 member countries, extremely complex task in terms of security, opportunity, quality and Information reliability. According to the authors, with the implementation in blockchain, each product or shipment would have its own chain, where the tax events would be recorded step-by-step, from origin to delivery. The mechanism of consensus between the tax administrations origin-destination would be more easily implemented and the whole process would be faster and more reliable, essential condition to minimize the MTIC fraud (Missing trader Intra-Community) [13], responsible for annual losses that vary between 50 and 60 billion euros.

The above-mentioned document proposes a step-by-step example of the sale of a vehicle between two EU countries, showing the effectiveness of the model.

In addition, considering that vehicles have original factory identification sensors, it would be guaranteed that at every stage of the process cycle the product identification, including technical details, would be automatically obtained and Inserted in the information system, without human intervention. In an automated manner, it would also confirm that the vehicle that came out of the factory would be the same delivered to the buyer. Such improvement to the process provided by IoT device is similar to the one described in the example of the previous item.

[1] Internet of Things

[2] Https://en.wikipedia.org/wiki/Internet_of_things

[3] Raynor, M., Cotteleer, M., “The More things Change”, Deloitte Review, Issue 17, 2015, Sec 2:55

[4] http://www.gartner.com/newsroom/id/3598917

[5] Radiofrequency or RFID identification is an automatic identification method through radio signals, which retrieves and stores data remotely through devices called RFID tags (Wikipedia).

[6] Raynor, M., Cotteleer, M., “The More things Change”, Deloitte Review, Issue 17, 2015, Sec 2:55

[7] A carbon tax is an imposed rate on burning coal-based fuels (coal, oil, gas).

[8] IBM, “Tax Administration 2025”, White Paper, 2016, pp. 13

[9] http://www.Brasil-ID.org.br/ Portal of the project

[10] A file system distributed with permanent and rape-proof records. More details at https://www.ciat.org/blockchain-conceptos-y-aplicaciones-potenciales-en-el-area-tributaria-13/

[11] HTTPS://WWW.YOUTUBE.COM/WATCH?V=LEKAPQAQIMK description of the process

[12] Ainsworth & Shact, “Blockchain technology may solve VAT fraud”, Tax Notes, vol. 83 #13, Sept 26, 2016

[13] https://en.wikipedia.org/wiki/Missing_trader_fraud

7,396 total views, 12 views today