The OECD and CIAT Co-Sponsor Part II of the Virtual Course on Transfer Pricing in Spanish

From June 23 to 25,2020, the OECD and CIAT organized Part II of the Course on Transfer Pricing, Part I of which took place last May. The objective of the course was to study in depth the issues raised in Part I, while integrating outstanding experiences from Latin America. In this sense, the advanced topics discussed were related to the application of the methods proposed by the OECD Guidelines for Transfer Pricing, which most of the countries in Latin America and the Caribbean have adopted, emphasizing complex aspects of the Profit Split Method and comparability analysis.

During the three sessions, mor e than 450 people participated, most of whom were officials from the tax administrations of the region.

During the three sessions, mor e than 450 people participated, most of whom were officials from the tax administrations of the region.

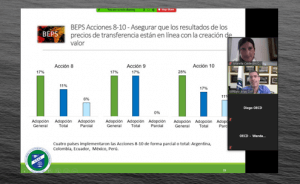

Mr. Isaác Gonzalo Arias Esteban, Director of Cooperation and International Taxation at CIAT, and Anarella Calderoni Specialist in the aforementioned Directorate, presented an overview of the regulatory and administrative aspects of transfer pricing control in Latin America and the Caribbean. Highlighting similarities, differences, controversial aspects, good practices, and opportunities for improvement.

The CIAT Executive Secretariat thanks the OECD for its cooperation, and all of the participants who have attended this activity with great motivation.

We invite you to consult the following CIAT products related to the course topic:

- BEPS Monitoring Database – CIATData

- Transfer Pricing Database – CIATData

- Transfer Pricing in Latin America and the Caribbean : A General Overview based on CIATData Transfer Pricing Information updated to November 2019

- Cocktail of measures for the control of harmful transfer pricing manipulation, focused within the context of low income and developing countries

3,938 total views, 8 views today