Evolution of Human Resources in the Tax Administrations of Central America, the Dominican Republic, and Panama

Considering the following publications of the Inter-American Center of Tax Administrations (CIAT): “State of the Tax Administration in Latin America: 2006-2010” by CIAT-IDB and “Overview of Tax Administrations: Structure; Income, Resources and Personnel; Operation and Digitalization ISORA (International Survey on Revenue Administration)” by Dr. Santiago Díaz de Sarralde Miguez, CIAT Director of Tax Studies and Research; We can contemplate the evolution of Human Resources in the Tax Administrations (TAs) of Central America (Guatemala, Honduras, El Salvador, Nicaragua and Costa Rica), the Dominican Republic and Panama.

In this panorama, we will consider the years 2010 to 2017, which allows building a regional comparison of the evolution of human talent in these tax administrations in four lines: total number of employees, percentage of employees by gender, ages of these and time within the organization.

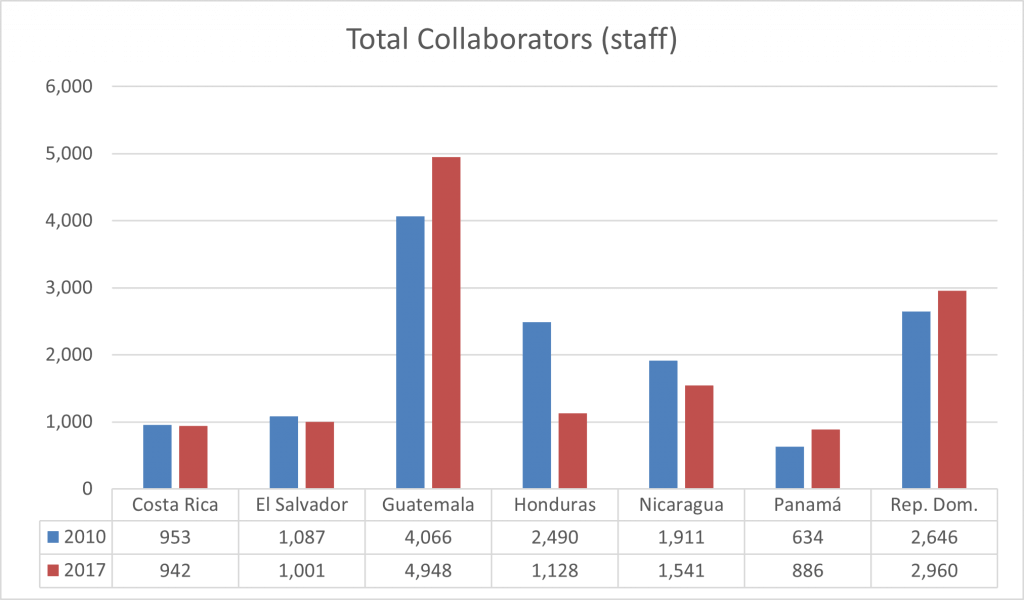

First, we analyze the total number of agents in these TAs from 2010 to 2017. Graph # 1 reveals a significant increase in personnel in Guatemala (22%) as well as a drastic decrease in personnel in Honduras (-55%) [in this particular case of Honduras, we must not forget that the tax administration changed from be the Executive Directorate of Revenue (DEI), which was in charge of internal taxes and customs, to the Revenue Administration Service (SAR), which only deals with internal taxes]. The other administrations present moderate changes in the number of their personnel, offsetting the increase in workload derived from the increase in population with technological advances.

Graph #1

Own elaboration, based on cited documents.

Own elaboration, based on cited documents.

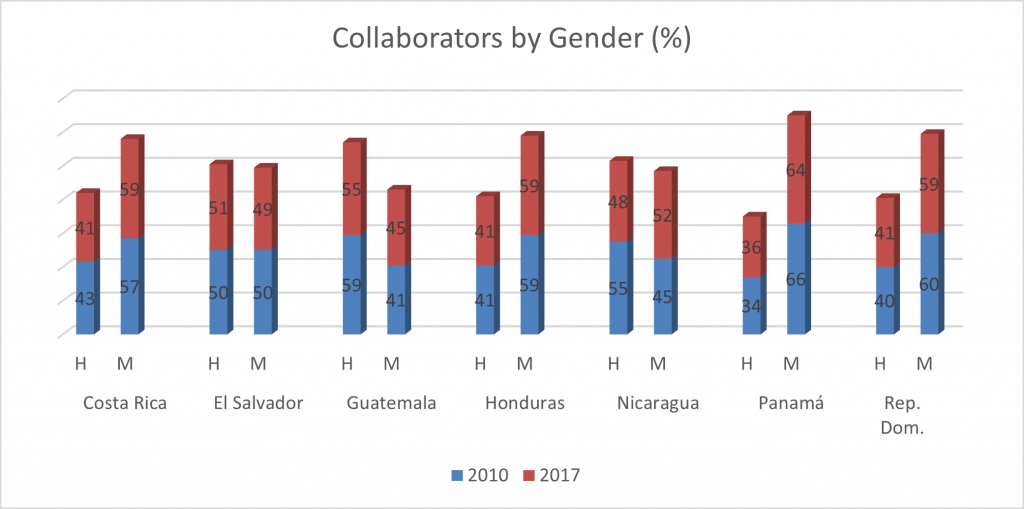

Secondly, we are going to analyze what concerns human resources from a gender perspective, an aspect becoming more and more relevant every day. In this sense, we will see the participation in the Tax Administrations according to sex: (H) men and (W) women. Graph # 2 shows how the percentage of participation of women has increased in the period between 2010 and 2017, mainly in Nicaragua (from 45% in 2010 to 52% in 2017), Guatemala (from 41% in 2010 to 45% in 2017) and Costa Rica (57% in 2010 to 59% in 2017) where the main increases occur; in the other countries there is a slight decrease in the participation of women.

Graph #2

Own elaboration based on cited documents

Own elaboration based on cited documents

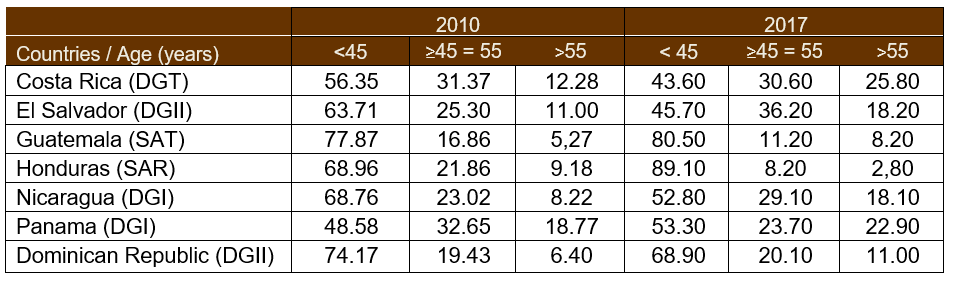

In relation to the age of the collaborators of the Tax Administrations in Central America, the Dominican Republic and Panama, between 2010 and 2017, several changes have to be highlighted: the countries with the greatest number of personnel over 55 years of age are still Costa Rica (26%) and Panama (23%); Guatemala continues to have a percentage of more than 75% of its employees with ages below 45 years and it is also worth highlighting an important percentage change in the personnel aged 46 to 55 in Honduras (from 22% in 2010 to 8% in the 2017) probably the result of the extinction of the previous DEI and creation of the new SAR.

Table 1

Staff Age (%)

Own elaboration based on cited documents

Own elaboration based on cited documents

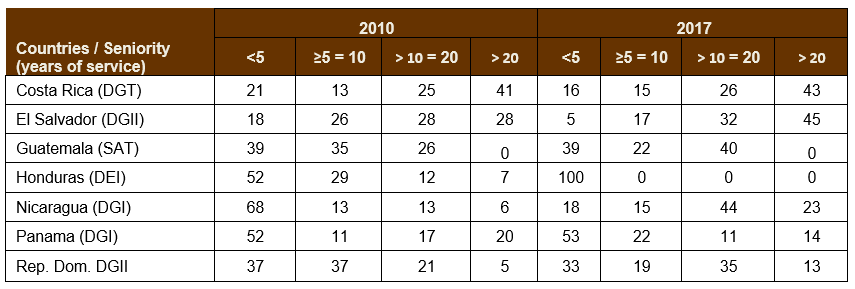

Finally, we have the evolution based on the seniority (years of service) of the human talent that works in the tax administrations of Costa Rica (General Directorate of Taxation), El Salvador (General Directorate of Internal Taxes), Guatemala (Superintendency of Tax Administration), Honduras (Revenue Administration Service), Nicaragua (General Directorate of Income), Panama (General Directorate of Income) and the Dominican Republic (General Directorate of Internal Taxes).

It is to note that Costa Rica (which remains above 40%) and El Salvador (28% in 2010 and has increased to 45% in 2017) and Nicaragua (which has increased considerably from 6% in 2010 to 23% in 2017) stand out with a staff that has more than 20 years of seniority.

The case of Honduras draws attention due to its restructuring, going from 52% of personnel with less than 5 years of seniority in 2010 to 100% in 2017.

Table 2

Staff Seniority (%)

Own elaboration based on cited documents

Own elaboration based on cited documents

In conclusion, this brief overview verifies that the region continues to evolve in terms of the number, age, gender, and length of service of its workers, aspects that should continue to be analyzed, to increase the efficiency and effectiveness of tax administrations

2,835 total views, 2 views today