Mutual agreement procedures as a mechanism for resolving transfer pricing disputes in Latin America

As a consequence of a (primary) transfer pricing adjustment, economic double taxation may occur. However, in the treaties for the avoidance of double taxation (DTT) there is the figure of the correlative adjustment, which consists of the transfer pricing adjustment that should be made in the tax base of the counterparty to avoid that the same income is taxed by the two Contracting States of the DTT to the two taxpayers involved in the transaction. When the taxpayers involved in the transaction are residents of the Contracting States of a DTT, they can use the provisions referring to the Mutual Agreement Procedure (MAP) contained in the DTT in order to apply the correlative adjustment. In this sense, Article 25 of the OECD model in its first paragraph establishes that:

“When a person considers that the actions of one or both of the Contracting States result or will result for him in taxation not in accordance with the provisions of this Convention, he may, irrespectively of the remedies provided by the domestic law of those States, present his case to the competent authority of either Contracting State. The case must be presented within the three years following the first notification of the action resulting in taxation not in accordance with the provisions of the Convention.”

In this way, taxpayers may submit their case, duly substantiated, to the Competent Authority of any of the Contracting States of the DTT (if the DTT is consistent with the OECD 2017 model and/or the recommendations of action 14 of the BEPS action plan). Said competent authorities must do everything possible to agree on the resolution of the case, in order to relief double taxation, as mentioned in paragraph 2 of the same article of the OECD Model that establishes that:

“The competent authority shall endeavour, if the objection appears to it to be justified and if it is not itself able to arrive at a satisfactory solution, to resolve the case by mutual agreement with the competent authority of the other Contracting State, with the view to the avoidance of taxation which is not in accordance with the Convention. Any agreement reached shall be implemented notwithstanding any time limits in the domestic law of the Contracting States.”

It is important to mention that jurisdictions should seek to resolve MAP cases within an average period of 24 months, although it should be noted that it is precisely the transfer pricing cases that usually take the longest to resolve and where agreements are more difficult to reach, mainly due to their complexity.

An interesting reference to have a clearer understanding of this process in practice, although it is always essential to review domestic regulations, would be the MAP Statistics Reporting Framework developed and published by the OECD as a guide to the competent authorities to report their cases, for statistical purposes. This reporting framework develops the typical process of a MAP case, which could be summarized as follows:

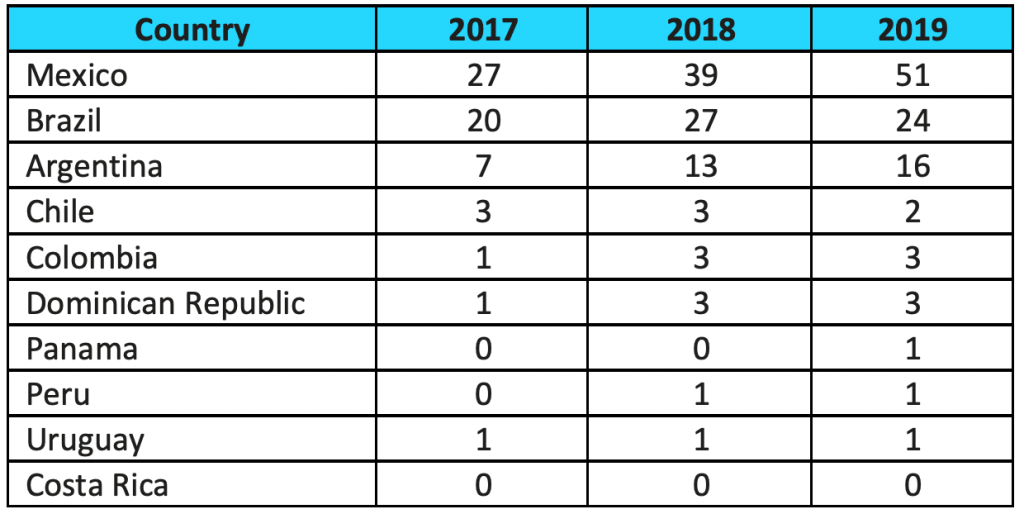

According to what is observed in the statistics (MAP Statistics) provided by the member countries of the inclusive framework based on the aforementioned reporting framework and compiled by the OECD as a result of what is established in action 14 of the BEPS Action Plan, although this type of figure has not been in common use in Latin America, there has been an increase in its use, not only in transfer pricing cases, with the largest number of such cases being concentrated in Mexico, Brazil, and Argentina. The following table shows a detail of the data reported by country:

Table 1 – MAP cases by jurisdiction:

Source: Own elaboration with OECD data.

Source: Own elaboration with OECD data.

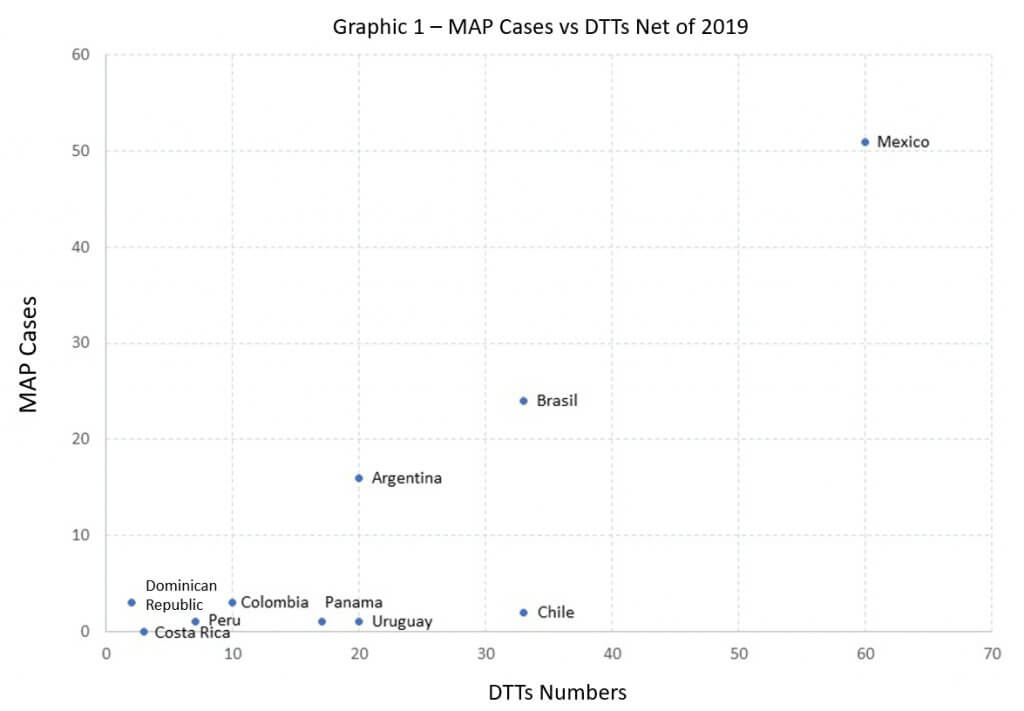

The importance of using this mechanism for the resolution of disputes in Latin American countries must also be seen from the perspective of the treaty network of the different countries, observing that, in general terms, the countries with the highest number of cases tend to be those with the highest number of DTTs signed. The following graph reflects this importance considering the OECD statistics (MAP cases) and the CIAT database (CIATData) (number of DTTs per jurisdiction) for 2019:

Source: Own elaboration with OECD data and CIAT.

With the recent developments in the international tax system and the COVID-19 pandemic, an increase in disputes between taxpayers and tax administrations can be expected, so MAPs offer an interesting alternative to taxpayers to avoid double taxation, especially for the resolution of transfer pricing disputes.

8,608 total views, 4 views today