Adapting the Tax Systems Evaluation Tools to SDG and Climate Action

As countries prepare for COP30 in Brazil, transforming tax systems into engines for climate action and sustainable development is vital. For the Global South, leveraging taxation aligned with the Sustainable Development Goals (SDGs) is critical to mobilizing domestic resources for mitigation, adaptation, and equity. Several diagnostic tools help governments assess and reform tax systems—yet their integration with climate and SDG priorities varies. This article explores the adaptation of these tools and compares the UNDP’s SDG Taxation Framework with established frameworks like the IMF’s Tax Administration Diagnostic Assessment Tool (TADAT) and the International Survey on Revenue Administration (ISORA).

Why Align Tax Systems with SDGs and Climate?

Taxation serves as both a revenue generator and a behavioral lever to promote sustainability. Ahead of COP30, fiscal systems must be critically reviewed and reformed to phase out fossil fuel subsidies, introduce carbon pricing, and embed equity and resilience within fiscal frameworks. For many Global South countries, diagnostic tools offering SDG and climate lenses provide actionable insights to guide reform.

The UNDP SDG Taxation Framework (STF)

Developed under UNDP’s “Tax for SDGs Initiative,” the SDG Taxation Framework offers a comprehensive lens on aligning tax systems with all 17 SDGs, including climate action (SDG 13) and equity dimensions. STF emphasizes policy coherence, equity, and environmental sustainability, combining qualitative and quantitative data with stakeholder engagement. It operates at a strategic level to evaluate how fiscal policies support development and climate priorities.

In 2025, Angola’s STF assessment identified crucial reform opportunities, including gender-sensitive taxation and revising health-related fiscal policies alongside climate objectives.

The IMF’s Tax Administration Diagnostic Assessment Tool (TADAT)

TADAT evaluates operational performance across nine tax administration functions such as registration, filing, and enforcement through standardized, on-site assessments. While not specifically focused on climate, TADAT builds foundational capacity vital for implementing effective environmental taxes and supporting fiscal reforms tied to sustainability objectives.

The International Survey on Revenue Administration (ISORA)

ISORA provides self-reported annual data on tax administration structures, staffing, and performance from countries worldwide. With strong participation from Latin America and the Caribbean, many CIAT (Inter-American Center of Tax Administrations) member countries contribute valuable data. ISORA offers an important benchmarking and cooperation platform, although direct climate and SDG relevance is limited given its operational focus.

Use of SDG along with TADAT and ISORA

Within Latin America, the CIAT works extensively with member countries’ tax administrations by utilizing performance statistics mainly based on ISORA data, supplemented by TADAT assessments. This approach helps support regional fiscal reforms through evidence-based diagnostics and fosters cross-country comparisons. Presently, CIAT’s engagement does not formally include the SDG Taxation Framework; however, its tools and activities reflect a growing awareness of sustainability issues in tax system strengthening. This subtle distinction invites a constructive reflection on potential complementarities between CIAT’s established methodologies and the broader SDG-aligned framework represented by STF, signaling an opportunity for expanded integration in future initiatives.

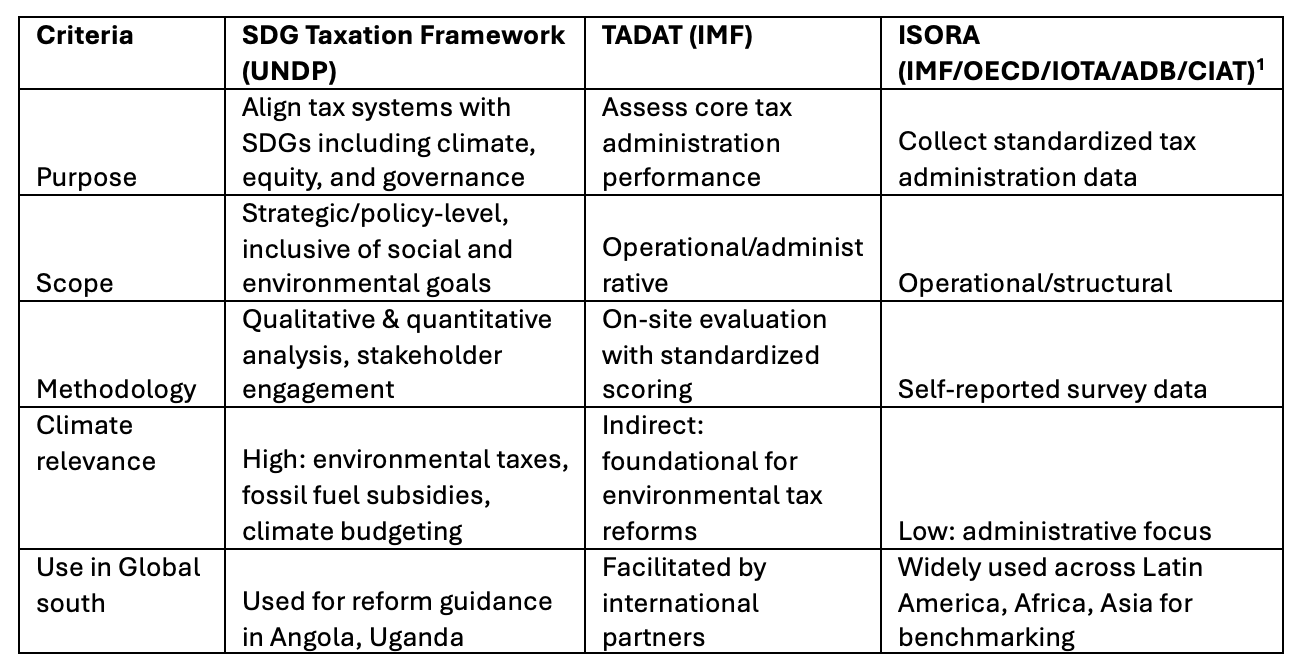

Comparing the Frameworks

Together, these tools form a multi-layered strategy: STF addresses policy goals, TADAT evaluates system effectiveness, and ISORA provides operational benchmarking.

IMF and World Bank Integration with SDG Principles

While not formally adopting the SDG Taxation Framework, the IMF and World Bank embed its principles in reforms and capacity building through complementary instruments such as Medium-Term Revenue Strategies (MTRS) and the Tax Policy Diagnostic Framework (TPAF). Both institutions enhance efforts by integrating ESG criteria and climate risk assessments into lending and advisory processes, reinforcing the domestic revenue mobilization imperative for sustainable development.

Recommendations for COP30 and Beyond

- Adopt climate-aligned tax strategies with strategic diagnostics like STF alongside operational tools like TADAT.

- Enhance regional cooperation for sharing best practices and mobilizing climate finance.

- Embed ESG integration in fiscal governance through budget tagging and transparent reporting.

- Mobilize private finance using tax incentives for green investments.

- Strengthen institutional capacity for effective climate-related fiscal reforms.

Conclusion

With COP30 approaching, adapting tax evaluation tools to meet climate and SDG goals is essential for countries of the Global South. The UNDP’s SDG Taxation Framework offers a strategic, policy-driven perspective, complementing the operational insights from TADAT and ISORA. CIAT’s active use of ISORA and incorporation of TADAT data across Latin America highlights valuable regional tax system benchmarks, while inviting reflection on integrating the SDG-aligned STF approach more fully. Embracing these insights equips governments to align tax systems with global sustainability ambitions, mobilize resources, and drive systemic transformation for a resilient and inclusive future.

References

- SDG Taxation Framework (STF) – UNDP Tax for SDGs Initiative

https://www.taxforsdgs.org/stf

(Official site describing the framework, methodology, and country applications) - UNDP Tax for SDGs Initiative Overview

https://www.taxforsdgs.org/about

(Background on the initiative, strategic goals, and how STF fits into broader SDG finance efforts) - SDG Taxation Framework Diagnostics Launched in Angola

https://www.undp.org/angola/news/sdg-taxation-framework-diagnostics-launched-angola

(Example country application of STF with focus on climate and equity) - Tax for Sustainable Development Goals – UNDP Sustainable Finance Hub

https://sdgfinance.undp.org/our-services/public-finance/tax

(Services and partnerships supporting tax for SDGs) - International Survey on Revenue Administration (ISORA) – OECD

https://www.oecd.org/tax/administration/international-survey-on-revenue-administration.htm

(Details on ISORA’s global data collection and benchmarking) - TADAT – Tax Administration Diagnostic Assessment Tool

https://www.tadat.org/

(Official TADAT website describing diagnostic methodology, use cases, and partners) - CIAT – Inter-American Center of Tax Administrations

https://www.ciat.org/ - Platform for Collaboration on Tax (IMF, World Bank, OECD, UN)

https://www.tax-platform.org/

(Initiative integrating tax policy support aligned with SDGs)

[1] ADB: Asian Development Bank; IOTA: Intra-European Organization of Tax Administrations

2,848 total views, 12 views today