Sometimes Sofia does not know. And that is good.

In 2016, when Alexa, Cortana, Google Assistant and Siri were vying to be the digital assistant of choice for consumers and were able to respond in natural language about the weather, route directions to a destination, and other such things. in the opening talk of our Technology Meetup, I was encouraged to point out that we would soon see digital assistants supporting the work of tax administration officials. And I was not referring then to the use of machine learning models and neural networks to facilitate classification or regressions, but to assistants that directly support the work of officials, and that although none of them had seen the light, I was also encouraged to baptize as Digital Tax Assistant – Astrid.

Initiatives arose, mainly in the space of assisting taxpayers with frequently asked questions, and their programmed answers, through virtual conversational assistants (chatbots) [1] in several administrations, generally available to serve taxpayers directly, enhanced even by the mobility restrictions that we lived in the pandemic [2].

Today, as the wave of Artificial Intelligence floods with energy the various beaches of the world, including those of the tax administration, we can find predictions (prophecies, even) and projects underway, but also questions and alerts, in the process of incorporating generative artificial intelligence, particularly large language models – LLM – to support the work of the tax administration, perhaps directly serving taxpayers, or supporting the work of officials. And this way, Sofia was born.

The Municipal Secretariat of Fazenda of the Prefecture of São Paulo manages municipal taxes, which means that it must deal with a large number of requests for information and queries that are managed by officials in the area through various channels. As can be imagined, the sources of information supporting the answers are scattered in many documents, ranging from laws to internal rules, to manuals and guides to jurisprudence. Major challenges include standardization of responses, quality management and, of course, training of new employees.

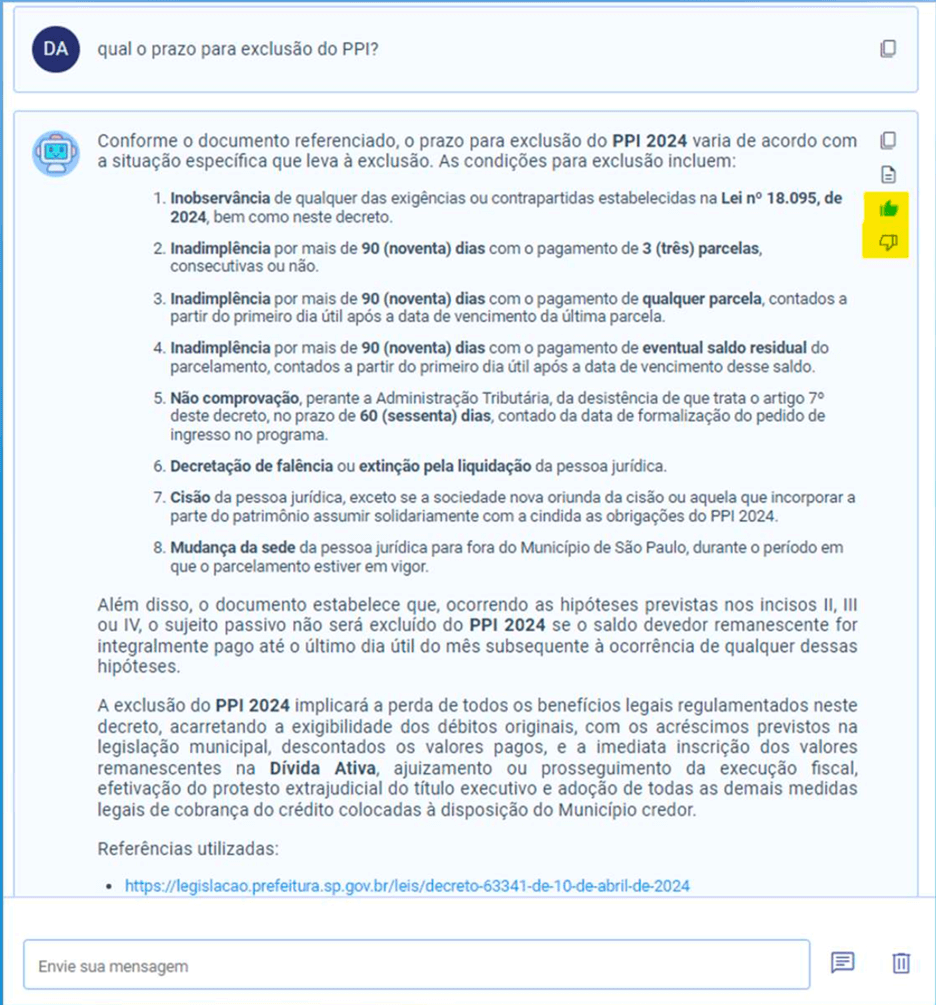

So, they decided to develop Sofia, a GPT-based assistant, exclusively for Secretariat staff, to provide quick and intuitive access to the Secretariat’s documentation, arranged in Secretariat sites and documents. Below is a screenshot of a question asked to Sofia and her answer.

(Translator’s note: The question in Portuguese refers to the deadline for the PPI 2024, which is the “Incentive Installment Program” established in São Paulo to regulate the payment of tax and non-tax debts. It aims to facilitate the installment of debts. The program includes provisions introduced through Decree No. 63,341/2024, which outlines the specific benefits and deal terms.)

You probably noticed that at the bottom of the screen the references used in the generation of the answers are identified, with links to access the sources, if necessary. Also, icons are available to give positive and negative feedback. Beyond this, the feedback function implemented for Sofia in the Secretariat has a curation team to apply and manage the necessary adjustments. Negative feedback allows users to identify if it is correct, incorrect or if the content is improper.

Of course, when I was in front of Sofia I could not resist asking her some questions about IPTU [3] exemptions and expirations, first in Spanish, then in English, and then getting correct answers in Portuguese. And then came the real test, asking Sofia something she should not know. Things like, “What team does Vinicius Junior play on?” or if she “can write in Spanish lyrics for “Piano man”; requests that were correctly answered by ChatGPT 4. and Gemini; but to which Sofia responded with elaborate “I don’t know”, by saying I have no information to answer this, but basically “I don’t know.”

The use of Sofia for taxpayer assistance officers is widely used. Errors in responses by officials went from 10.80% before Sofia to 4.36% after Sofia. In September 2023, 41% of the questions had no answers; in March 2024, only 6% of the questions had no answers. The internal use of Sofia has effectively contributed not only to the standardization of answers but also to shortening the training time for new employees, who can access the tool from a page on the Intranet, the Teams platform, or WhatsApp.

But speaking of the introduction of transformational models based on LLMs, one more thing….

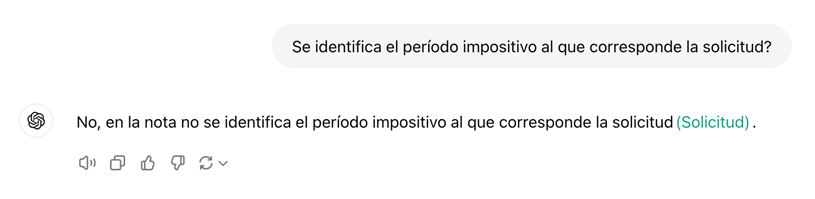

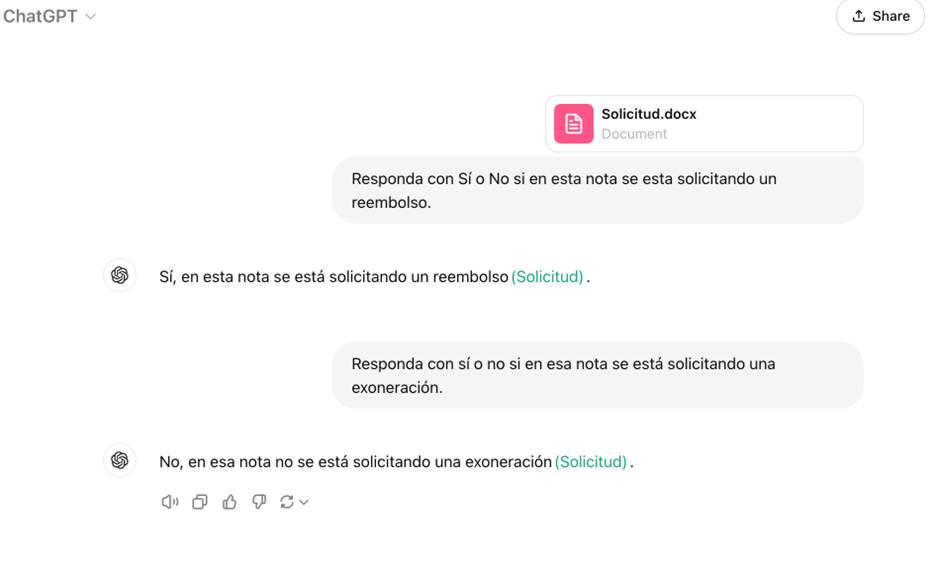

Another LLM application that the Secretariat has developed goes by the name of ‘Optimus Project’, which stands for Optimization of Municipal Tax Processes. Using the available documentation, and the elaboration of a set of about 60 “Yes” or “No” questions on the content of the requests submitted by the taxpayers, it can identify and determine the most appropriate processing and response to be given to the document in an extremely efficient manner.

An illustrative example. A taxpayer sends a request as follows:

“I hereby request a refund of the overpayment of the real estate tax that has already been paid twice.”

And you interact with the model (in my case, with ChatGPT 4.o) with some pre-elaborated questions.

( Translator’s note: to confirm that the request is for a refund, which it does, and if it identifies the tax period to which this request would apply, which it does not.)

Therefore, the application can decide the flow that the process should follow, including a detailing of the taxpayer’s request and possibly a recommendation of what to answer, developed based on the knowledge of the people in the business area. The 60 questions are run 10 consecutive times, and the majority answer to each question is used to determine the answers. It is easy if to question 1, all 10 times they say yes, but it may be 7 out of 10 when the text itself written by the taxpayer is not so clear. In addition, LLM tools themselves do not always present the same answers to the same questions, having a natural variability of the tool. The process has introduced levels of efficiency in the Secretariat, and has not, or at least not so far, replaced any human being in their work. How about it?

Greetings and good luck.

[1] Seco, A., Muñoz, A. IADB, Asistentes conversacionales virtuales en las administraciones tributarias: Principios, modelos y recomendaciones. 2019 https://publications.iadb.org/es/asistentes-conversacionales-virtuales-en-las-administraciones-tributarias-principios-modelos-y

[2] https://www.ciat.org/asistentes-conversacionales-virtuales-en-las-administraciones-tributarias-el-futuro-es-hoy/

[3] Urban property tax in Brazil.

6,358 total views, 1 views today