Reconciling a Tax Paradox: The Case for Green Taxation Amidst Fossil Fuel Subsidies.

As the world grapples with the climate crisis, the transition to a more sustainable economy has never been more critical. Products and services that promote environmental responsibility must play a pivotal role in this journey. However, an alarming reality persists many of these beneficial products face higher taxes, unfavorable treatment, or are misclassified as luxury items. How can we genuinely commit to sustainability while our economic systems favor fossil fuel dependency?

This blog explores how current tax systems can inadvertently hinder the shift toward a greener economy and what can be done to rectify this mismatch.

The Financial Burden of Sustainable Choices

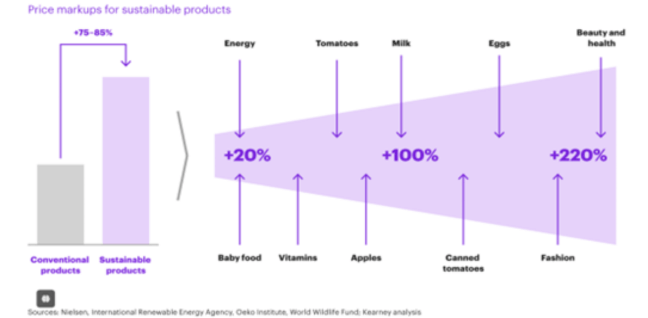

Sustainable products are generally more expensive. We keep hearing that sentence all the time. According to the research conducted by the Dutch consulting company Kearny, “the prices of sustainable products are higher by 75-80% on average. That is quite a markup.[1]” This apply to products sold in supermarkets, organic food, clothing, cleaning or cosmetic products, as indicated on the graph below.

In fact, the sustainability of a product is determined in the manufacturing or production phase, and this is only a fraction of the cost paid by the final consumer. The problem is that when a product cost a little more in the production phase (example: organic food), the price difference is multiplied because the intermediaries will keep increasing the price after the production phase, and an initial difference of 10% in production costs can end up with a difference of more than 50% in the consumer prices. “So how can companies lower the markups for sustainable products to reach a range that more consumers are willing to pay?” According to the study, the ideal way to get these premiums under the 10 percent range, which would make them more competitive on the market, is to adjust the pricing at the end of the value chain, shifting the corporate thinking and accounting logic from a relative margin to a fixed margin. This would enable sustainable production as a fixed-cost markup instead of being multiplied throughout the value chain.”

David and Goliath. Green taxes versus fossil fuel subsidies.

Incentives for Harmful Practices Paradoxically, many traditional products are taxed at lower rates despite their negative environmental impacts. For example, fossil fuels can enjoy huge subsidies, while their greener counterparts face penalties. This incentivizes consumers and businesses to continue using harmful products rather than switching to environmentally friendly options. As highlighted by the CIEP of Mexico, artificially low prices for fossil fuel systems “discourage investments in energy efficiency, renewable technologies, energy infrastructure and increase the vulnerability of countries to international energy price volatility. It is a highly inefficient way of providing support to low-income house holds because high-income households typically capture most subsidies.” [2]

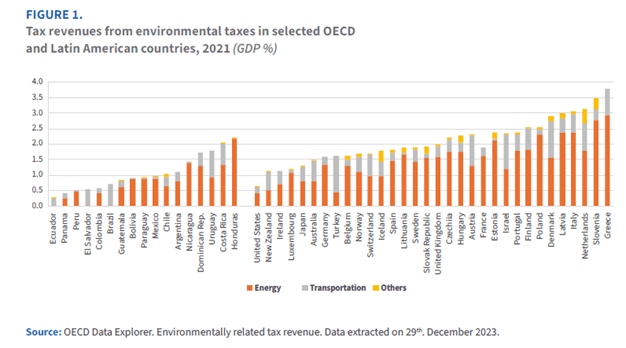

An interactive map of the subsidies to fossil fuels by country can be found on the website fossilfuelsubsidytracker.org [3], the result of a collaboration between the OECD and the International Institute for sustainable development (IISD). In 2022, the world has spent 7 trillion [4] in support of fossil fuels, according to the IMF. This represented approximately 7% of the global GDP and the double of the total amount spent on education. By contrast, the average proportion of global GDP from environmental taxation hovers around approximately 2%, with a generally lower proportion in developing countries.

This can be seen on the graph below, taken from the recent CIAT study on environmental taxation, comparing OECD and LAC countries in terms of their shares of GDP in green taxes on energy, transportation and others.

Source: Toward Green Tax Administrations: Requirements, Capabilities, and Transformations in the Face of Environmental and Climate Challenges / 2024

The CIAT study on Green Tax Administration in LAC countries [5], analyze the realities faced by the tax administrations in the region. The construction of a modern tax system must consider collection, environmental and social criteria in order to comply with decarbonization goals and international climate change commitments. “The study provides an overview of green taxation in the region, reviews experiences of environmental fiscal reforms and analyzes the fiscal space for the implementation of environmental taxes, as well as the role of taxation on extractive activities. It addresses the links between the tax administration and green taxation, emphasizing the information requirements, the essential control mechanisms, the training of human resources and the capacities required to manage compensation mechanisms that help the ecological transition.”

This lack of capacities can lead to situations where public funds are used to subsidize fossil fuels even while private sector investments are aimed at renewable energy. The significant investments in clean energy projects indicate a recognition of the need to transition to a more sustainable energy system. However, the persistent high level of fossil fuel subsidies can undermine these efforts by perpetuating dependence on fossil fuels and slowing the transition to cleaner alternatives.

One good news is that in spite of the massive discrepancy in favor of the fossil fuel industries, the world is progressing towards a greener economy, mostly due to the technological innovations. In 2023, the global economy has invested twice as much on clean energy projects than on fossil fuels projects (2 trillion versus 1 trillion). However, as we can see, the fossil fuel industry is still receiving much more subsidies. There is often a lack of coherence in energy policies, with governments supporting both clean energy initiatives and fossil fuel industries. As a result, the movement towards sustainable economies is much too slow, when we consider the acceleration of the climate disruptions According to measurements, July 2024’s temperature was 1.21°C (2.08°F) above the 20the -century average of 15.8°C, and this was the 14th consecutive month of record-high global temperature [6]

How to reconcile this paradox between the short-term economic goals represented by the fossil fuel subsidies and the sustainable goals registered in the Nationally Determined Contributions of each country? In the first two decades of this millennium, the tax systems of the world have successfully adapted to the technological changes, becoming data-driven electronic administrations.

Perhaps the challenge now is to streamline the opportunities of these technological revolutions to greatly accelerate the movement towards more sustainable and fair economic systems.

[1] EcoSwap. (n.d.). Are sustainable products more expensive? Retrieved from https://ecoswap.uk/are-sustainable-products-more-expensive/

[2] CIEP. (2023). Impact of fossil fuel subsidies in Mexico. Retrieved from https://ciep.mx/ipte-oaxaca/

[3] Fossil Fuel Subsidy Tracker. (n.d.). Interactive map of fossil fuel subsidies worldwide. Retrieved from https://fossilfuelsubsidytracker.org/

[4] IMF. (2023). Fossil fuel subsidies surged to record $7 trillion. Retrieved from https://www.imf.org/en/Blogs/Articles/2023/08/24/fossil-fuel-subsidies-surged-to-record-7-trillion

[5] CIAT. (2024). Hacia administraciones tributarias verdes: requisitos, capacidades y transformaciones ante los retos ambientales y climáticos. Retrieved from https://www.ciat.org/dt-04-2024-hacia-administraciones-tributarias-verdes-requisitos-capacidades-y-transformaciones-ante-los-retos-ambientales-y-climaticos-spanish-only/?lang=en

[6] https://www.ncei.noaa.gov/access/monitoring/monthly-report/global/202407#:~:text=July%202024%20was%20the%20warmest,C%20(60.4%C2%B0F).

8,352 total views, 8 views today