The cooperative compliance program: the tax control strategy in the international experience

The collaborative relationship strategy designated by the OECD[1] as a reference framework for tax agencies to improve tax compliance comprises different modalities[2], among which can be distinguished: 1) ”cooperative relationship” proper: it consists of a whole range of services provided by the tax administration through interaction with taxpayers aimed at facilitating compliance with tax obligations, and the 2) “cooperative compliance”: the parties mutually assume obligations in an operating framework based on transparency and justified trust, with a high incidence on tax control by the tax administration.

The control strategies

In the “cooperative compliance” in turn, two classes stand out: 1) Vertical control “ex post”: applies the audit to previous tax periods and 2) “ex ante”: horizontal control: it applies the audit or horizontal monitoring prior to the tax return.

In the so-called “ex post” control, risk management is applied by categorizing the taxpayer according to their tax trustworthiness in phases and based on this, the tax agency applies a different control both in intensity and in assiduity. For example, Australia applies this model in the Top 100 (Justified Trust Program) and Top 1000 (Combined Assurance Program) programs[3].

As for the “ex ante” horizontal control or monitoring of the filing of returns, based on a reciprocal collaboration, it is applied among others by the following countries: 1) IRS of the USA (CAP), 2) Belastingdienst of the Netherlands (HTM) and 3) ATO of Australia (ACA).

This category of cooperative compliance, which is based on voluntary adherence, the objective was the control of large multinational companies with complex operations and the benefits to be obtained, by both subjects of the tax obligation were clear: 1) for the TA, to obtain in a transparent framework suitable information to improve control and 2) for companies: a) achieve a decrease in administrative cost, b) obtain legal certainty of the tax settlements made c) the expeditious resolution of queries through a team with a high technical level and d) improve the tax image by being admitted among the most reliable taxpayers.

Apart from its ACA cooperative compliance program, Australia also applies the PCR (Pre-lodging Compliance Review), which is an annual compliance review program prior to the filing of returns, although it had originally been exclusively applied to large taxpayers, it has now been extended to the others, in situations in which the TA considers that a timely compliance guarantee is necessary. Its result does not entail legal certainty for the taxpayer as the ACA is, except in the subject that a resolution is requested[4].

USA: CAP (“Compliance assurance process”)

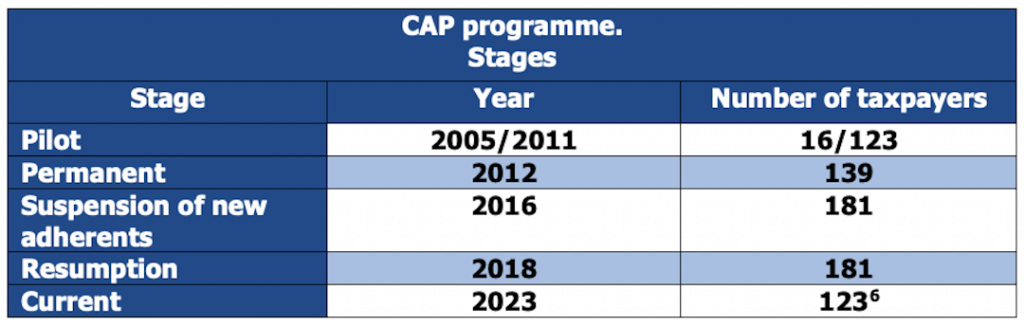

The application of this program[5] started in 2005 as a pilot test and from 2011 it was permanently incorporated into the management of the Internal Revenue Service (IRS).

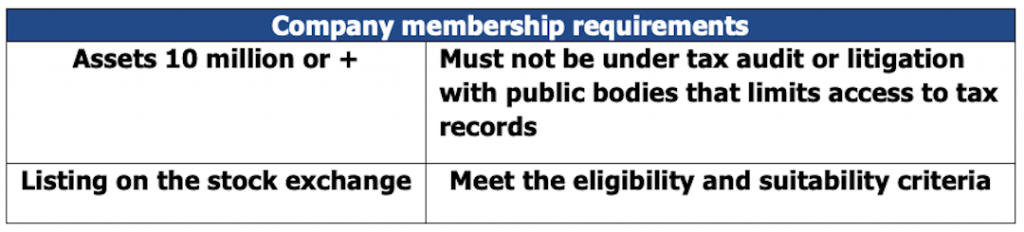

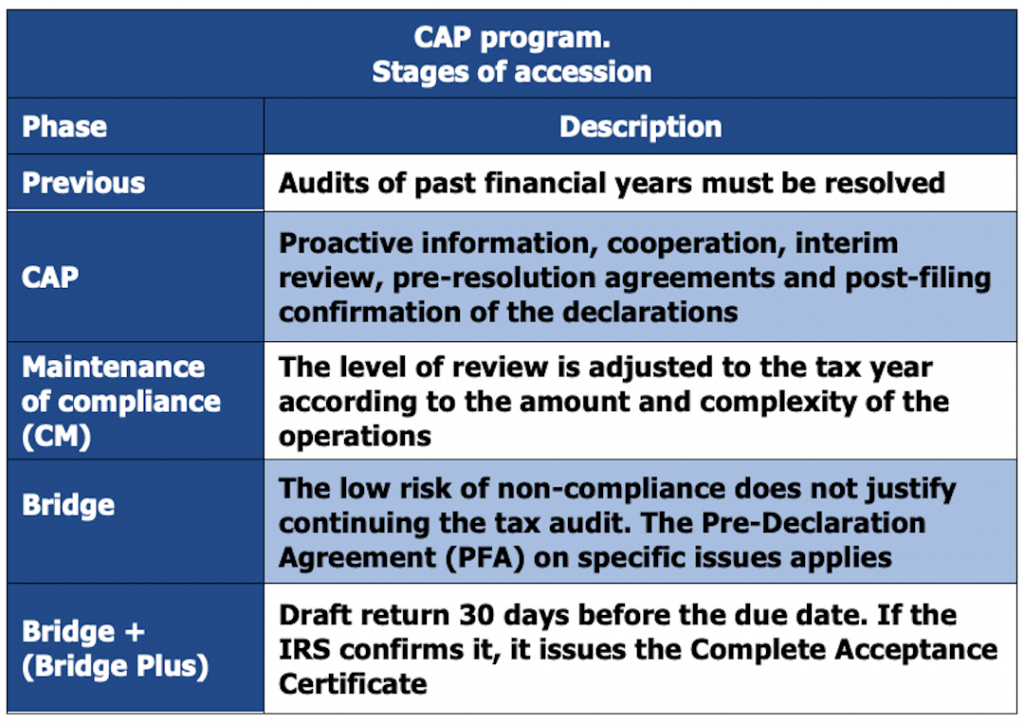

The following is a description of the stages since its creation, the requirements to join and the phases of adhesion to it:

Netherlands: HTM (Horizontal Tax Monitoring)

This program[7] began to be applied in 2005 to large companies with complex operations, but in view of its initial success it was extended in 2008 to medium and small companies. In 2017 before a critical evaluation report of the Belastingdienst[8], a complete review of the program was initiated.

As a result, after 15 years of application in 2020, the HTM was redesigned with application from 2023, by which it expired for the 100 largest companies and with the most complex operations in the country, which instead were included in individual and personalized control plans, reinforcing for this the human resources assigned with the highest qualification.

Large companies (not included in the first 100) can still adhere to the HTM, but the Tax Administration increased monitoring actions by imposing stricter requirements on internal control measures and conducting more frequent verifications.

Small and medium-sized enterprises will not be able to join the HTM and all agreements concluded were terminated.

Australia: ACA (Annual Compliance Arrangements)

The program[9] was introduced by the Australian Taxation Office (ATO) in 2008. In 2014, only 24 companies were affiliated, of which 18 were private and the rest were government entities. In 2014 the Australian National Audit Office (ANAO) claimed that the evaluation reports of the program were incomplete[10].

Historically, Annual Compliance Agreements (ACAS) were entered into with a small group of qualified taxpayers and established mutual rights and obligations and consisted of phases based on “justified trust.” Then, the companies considered key to the economy were invited to the program.

From 2023 the ATO decided that the top 100 companies of the ACA with a high level of security will return to the annual compliance review program prior to the PCR (Pre-lodging Compliance Review)[11].

This means that with respect to these taxpayers, the controls are resumed with a comprehensive approach covering the tax results of the total economic activities and the ETB (effective tax borne) analysis.

Conclusions

The following characteristics can be highlighted from the experience of the program in the three countries:

Have been observed among others, as best practices:

[1] OECD (2013): https://read.oecd-ilibrary.org/taxation/la-relacion-cooperativa-un-marco-de-referencia_9789264207547-es#page36

[2] CIAT (2015): https://www.ciat.org/Biblioteca/DocumentosdeTrabajo/2015/2015_DT-2_cumplimiento_cooperativo.pdf

[3] In these cases, obtaining the high security rating is prior to being included in the PCR or ACA programs.

[4] Two years after achieving high security, taxpayers switch to the “Monitoring and Maintenance” program that limits audits to new transactions or when there are significant changes in business activities. Every 3 years there is a comprehensive review to revalidate the “justified trust”.

[5] IRS: https://www.irs.gov/es/businesses/corporations/compliance-assurance-process-cap-frequently-asked-questions-faqs

[6] https://www.irs.gov/pub/irs-pdf/p55b.pdf

[7] CIATBlog: https://www.ciat.org/ciatblog-la-fiscalizacion-de-las-grandes-empresas-la-estrategia-del-gato-y-el-raton-o-el-modelo-de-monitoreo-horizontal-htm/

[8] There were no differences between the results of the tax audits of the companies that joined and those that did not join the program.

[9] ATO: https://www.ato.gov.au/businesses-and-organisations/corporate-tax-measures-and-assurance/large-business/in-detail/compliance-and-governance/annual-compliance-arrangements-what-you-need-to-know

[10]ANAO: https://www.anao.gov.au/work/performance-audit/annual-compliance-arrangements-large-corporate-taxpayers

[11]ATO: https://www.ato.gov.au/businesses-and-organisations/corporate-tax-measures-and-assurance/large-business/top-100-justified-trust-program

[12] As an exception, the Netherlands extended it to medium-sized and small enterprises.

[13] GAO: https://www.gao.gov/assets/gao-13-662.pdf

11,484 total views, 12 views today