How Companies’ Data Can ¨Talk¨ to Each Other: The Legal Entity Identifier (LEI)

• 1. Introduction

Tax compliance officers handle vast amounts of data from multiple sources within their jurisdictions. However, as business becomes increasingly global, corporate structures stretch across borders, adding another layer of complexity. The challenge isn’t just collecting data—it’s ensuring different systems can ‘talk’ to each other. Tax officers need standardized data from international sources to integrate into their own compliance system seamlessly. To bring order to this international maze, tax authorities require tools that enable cross-border data standardization and interoperability

This is where the Legal Entity Identifier (LEI) becomes invaluable — it is a key to ensuring transparency and efficiency in global transactions.

• 2. What is the LEI?

To understand the origins of the LEI, we must look back at the 2008 global financial crisis, triggered by the collapse of Lehman Brothers. The crisis exposed significant gaps in regulators’ ability to identify counterparties in complex financial transactions, making risk assessments and crisis response efforts more challenging.

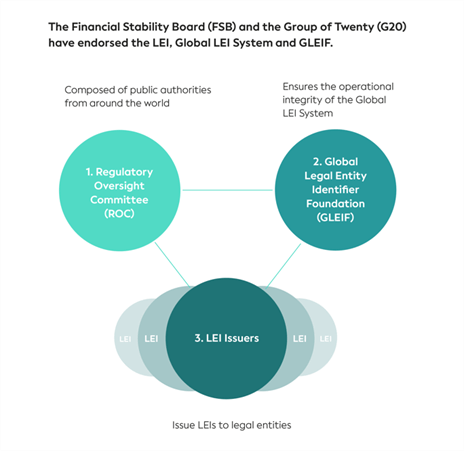

In response, the G20 and the Financial Stability Board (FSB) mandated the development of a global entity identification system. This led to the establishment of the Global Legal Entity Identifier Foundation (GLEIF) in 2014, a not-for-profit organization to develop and maintain the Legal Entity Identifier (LEI) as a broad public good for the benefit of the users of the public and the private sector.

GLEIF ensures that the LEI remains a widely accessible and trusted system under the supervision of the Regulatory Oversight Committee (ROC)—a group of international public authorities dedicated to ensuring its neutrality and alignment with public interest objectives.

The Global LEI System is the infrastructure that enables LEIs to be issued to legal entities globally. It provides a robust framework for uniquely identifying legal entities participating in financial transactions.

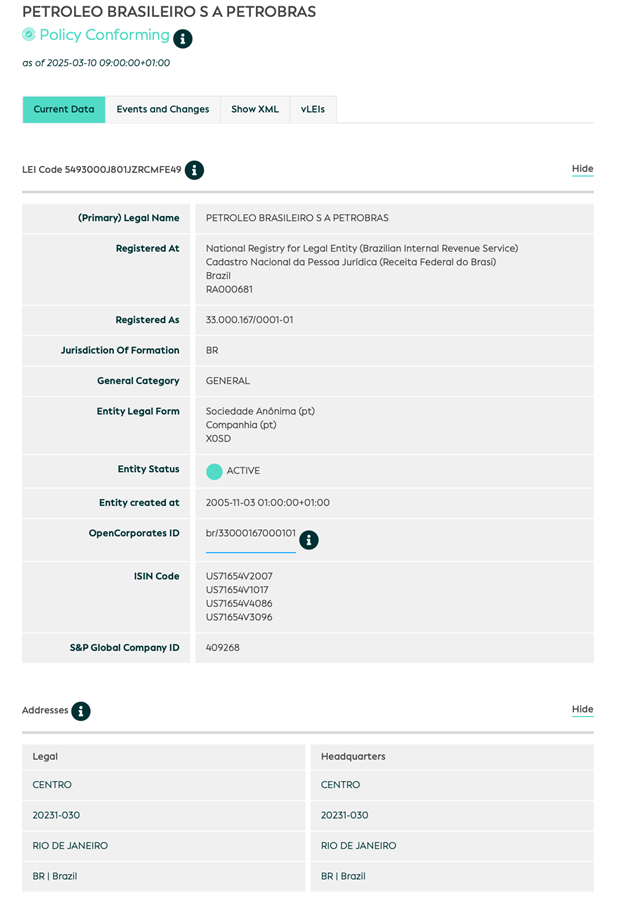

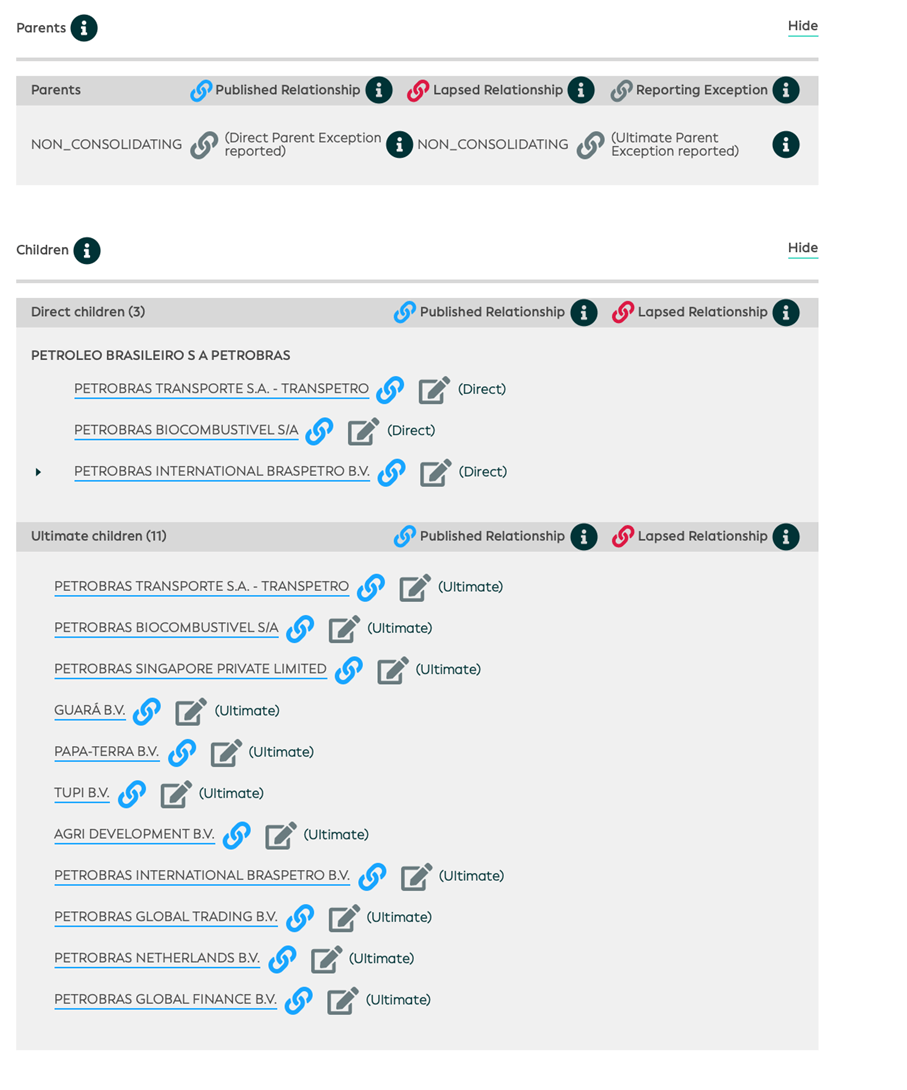

The LEI is a unique, 20-character alphanumeric code assigned to legal entities worldwide. It links to standardized, publicly available reference data, ensuring that each registered entity is uniquely identifiable. With the LEI, we can not only ensure that the company exists and get access to its basic reference data such as name and address but also its ownership information. The reference data associated with an individual LEI, i.e. publicly available information on a legal entity, is constantly validated against public third-party sources. Every LEI links to a verified company identity record held in the Global LEI Index[1], a data pool that anyone, anywhere can access free of charge.

The LEI is referenced in the Organization for Economic Cooperation and Development (OECD) Common Reporting Standard as an accepted identifier to identify crypto-asset service providers. The European Union mirrored this LEI recognition in its Directive on Administrative Cooperation (DAC8O), introducing rules for the exchange of tax information on crypto assets amoung national tax authorities[2].

Here an example of a the company Petrobras with LEI 5493000J801JZRCMFE49 (https://search.gleif.org/#/record/5493000J801JZRCMFE49):

- • 3. How the LEI Eliminates Confusion in Entity Identification?

Relying on name matching to identify companies often leads to errors, such as false positives or misidentifying the wrong entity or subsidiary. Many organizations share similar or identical names, making manual or unstructured searches unreliable.

For example, searching for “CIAT” could return CIAT S.R.L., a company based in Italy (LEI: 8945007H4SZ832S1O561), which has no connection to the Centro Interamericano de Administraciones Tributarias (CIAT) (https://www.ciat.org/quienes-somos/). This issue becomes even more critical when dealing with complex corporate structures, subsidiaries, or multinational enterprises.

Additionally, companies need machine-readable data to automate processes and minimize human error. The LEI provides a standardized, structured format that ensures accurate entity identification, enabling seamless data integration across various financial and regulatory systems. By adopting the LEI, organizations, regualtors, researchers and other users can significantly improve data accuracy, operational efficiency, and risk management while reducing the likelihood of misidentification. They can further enhance the results of AI algorithms applied to large datasets by removing fuzzy matching and providing AI models with validated structured entity data.

- • 4. Why Standardization Matters

Two key characteristics make the LEI highly effective:

- • Uniqueness: Each legal entity is assigned only one LEI, which remains associated with it throughout its existence.

- • Standardization: LEI reference data is validated against local authoritative sources and integrated into the LEI Index. This ensures that, regardless of whether a legal name is written in Chinese characters or an address follows different formatting conventions, the data is standardized and consolidated uniformly across all jurisdictions.

The LEI Index is publicly available free of charge, with no login requirements or GDPR restrictions.

By ensuring transparency, reducing financial crime risks, and strengthening regulatory compliance, the LEI serves as a critical global identifier.

- • 5. LEI Adoption and Regulatory Integration

Since its introduction in 2014, the LEI has been progressively incorporated into national and international regulations. In the United States, the Dodd-Frank Act, along with regulations from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), requires LEIs for specific reporting frameworks. In the European Union, the LEI is mandated under major financial regulations such as EMIR (European Market Infrastructure Regulation), MiFID II/MiFIR (Markets in Financial Instruments Directive/Regulation), and SFTR (Securities Financing Transactions Regulation). Across the Asia-Pacific region, India has taken a leading role in enforcing LEI adoption in financial transactions, while Australia and New Zealand have also introduced regulatory requirements. Today, over 200 regulations worldwide either mandate or recommend the use of the LEI, reinforcing its role as a key tool for financial transparency and compliance.

- • 6. How Can a Company Obtain an LEI?

Obtaining an LEI is a straightforward process that typically takes less than 48 hours:

- A company representative applies for an LEI through an accredited LEI Issuer (also known as a Local Operating Unit (LOU)). A list of LEI Issuers is available on the GLEIF website.

- The LEI Issuer verifies the submitted data against public sources, listed in GLEIF’s Registration Authorities (RAs) Index. In some jurisdictions, tax administrations also serve as Registration Authorities. Here two examples of two cases where CIAT has also two of its members, Chile and India:

- • Chile: The Directorate General of Taxation (Ministry of Finance).

- • India: The Income Tax Portal.

- Once validated, the LEI Issuer assigns an LEI to the entity and publishes it in the GLEIF LEI Index.

- LEIs must be renewed annually to ensure data accuracy.

- • 7. The role of the LEI and vLEI in fighting fraud

One of the biggest challenges businesses and regulators face today is the rising prevalence of identity-related fraud. Fraudsters exploit weaknesses in entity identification systems to commit financial crimes, including money laundering, tax evasion, and trade fraud.

The LEI provides a globally recognized identifier that reduces fraud risk by offering verified, standardized, and publicly accessible legal entity data.

A significant advancement in fraud prevention is the Verifiable LEI (vLEI)—a digitally verifiable version of the LEI that provides cryptographically secure proof of an entity’s identity and its authorized representatives. vLEIs can be particularly valuable for financial institutions, tax authorities, and corporate compliance officers as they ensure that only legitimate representatives can act on behalf of a company. By integrating vLEIs into digital identity verification, businesses can mitigate fraud risks and strengthen trust in digital transactions.

- • 8. Why should tax administrations be interested in the LEI?

Tax authorities are constantly seeking ways to enhance tax compliance, transparency, and data accuracy. Here are some cases in which the LEI provides several key benefits:

- • Accurate identification of corporate taxpayers: Helps tax authorities precisely identify legal entities, reducing errors in tax records and mitigating identity fraud.

- • Digital-first approach: Instant digital retrieval of business profile that has been validated and verified following global due diligence standards. Create alerts for changes to business profiles such as ownership structure, operating status or address change (see Appendix).

- • Cross-border tax compliance: As international tax cooperation expands, LEIs provide a standardized mechanism to match financial records across jurisdictions, improving data consistency.

- • Enhanced monitoring of multinational enterprises (MNEs): LEIs facilitate the tracking of related-party transactions, supporting fair transfer pricing assessments and strengthening tax enforcement mechanisms.

By integrating LEIs into tax reporting systems, tax authorities can enhance compliance rates, reduce administrative burdens, and improve fraud detection efforts.

- • 9. Conclusion

The Legal Entity Identifier (LEI) has evolved from a G20-driven financial stability initiative into a critical tool for global transparency. With its growing adoption, the LEI is poised to play a significant role in strengthening compliance, preventing fraud, and fostering trust in international financial and trade ecosystems.

For businesses, financial institutions, and tax authorities, adopting the LEI is not just a regulatory requirement—it is a strategic step toward a more transparent, efficient, and secure global economy.

Appendix

Sample configuration for automated alerts via GLEIF API

Configure:

- • LEIs of interest

- • CDF Fields of interest to track for changes in LEI records

- • Email Recipients to receive notifications

- • Utilize the GLEIF API field modification endpoint (/api/v1/lei-records/{LEI}/field-modifications) to monitor changes to CDF fields for the LEIs of interest, e.g.,https://api.gleif.org/api/v1/lei-records/6SHGI4ZSSLCXXQSBB395/field-modificationsfilter[field]=/lei:LEIData/lei:LEIRecords/lei:LEIRecord/lei:Entity/lei:LegalName&sort=-date&page[size]=1

- • Filter on LEI and CDF Field

- • Sort by date descending

- • Retrieve one result

- • Modifications are detected by tracking the field modifications retrieved from the API over time

- • Snapshots of the field modifications are stored in a database.

- • The LEI, CDF Field and date are the combined unique identifier of a modification that can be used to track if a field modification from the API was already tracked in the database.

- • Before tracking and notifying about changes, an initial snapshot of all latest field modifications is taken as baseline.

- • Be aware of the GLEIF API of around 60 requests/minute when tracking the field modifications.

[1] https://search.gleif.org/#/search/

[2] https://www.gleif.org/en/newsroom/blog/9-in-the-lei-lightbulb-blog-series-the-value-of-the-lei-in-crypto-asset-regulation

12,714 total views, 31 views today