The Tax Administration facing the challenges of participatory taxation. Epistemic notes

I. By way of exordium.

Citizen participation in the exercise of political power has been one of the central themes of the theory of the State and of law. With the development of the administration sciences, the vertex of analysis has fallen on the role of citizen participation in public management. The latter is the tangible result of the exercise of public political power and therefore of the performance of public administrations. However, the dominant perspective on the subject has been to analyze it from the citizenship perspective, a transcendent matter from the viewpoint of public freedoms and the guarantee of rights; however, public administrations and their perspective is transcendental in the sense proposed by Fried Van Hoof and Asbjørn Eide [1] since the participatory phenomenon implies for the State and its Public Administrations, obligations to respect, due to the freedom content of the right, the participation of citizens in its various manifestations and to promote participatory mechanisms as a material guarantee to the exercise of the right. These elements are important for the approach of a vision of participatory taxation and the challenges it poses for tax administrations, given the specialty of these in the face of the institutional legal frameworks that regulate the general administration and the sensitivity of the tax phenomenon for the State and citizens. Hence, the main objective of this work consists in substantiating the epistemic challenges faced by tax administrations in the face of the notion of participatory taxation, this conception being limited in its strictly tax implications.

II. Tax administrations facing the challenges of participatory taxation

The term “participatory taxation “was coined by the Portuguese sociologist Boaventura de Souza Santos, for whom its essential core responds to a situation in which” the State is responsible for performing, with respect to welfare, coordination functions rather than direct production, the control of the relationship between resources obtained and their use”. Participatory taxation is not, in our conception[2], from the strictly epistemological point of view, a univocal category, but a complex state of relations whose common denominator is the effective empowerment of citizens in financial matters, based on their qualification in the legal system. It is a desirable manifestation of public finance management, which is based on democratic legitimacy and aims to satisfy the demands for participation in public management, especially financial management. For its verification, four minimum configuring elements have been postulated, which make up its content and from whose verification stems the verification of the categorical existence. Its conformation responds to the analysis of public and financial management conducted above. Legitimacy as the basis of citizen participation in public financial management requires the qualification of citizens from the legal system and material guarantees that make participation in management effective. This, from the perspective of participatory taxation, would be expressed in the elements of normative qualification and democratic governance as elements that respond to the above. For its part, information transparency is a transcendent element in participation in management, hence it is included in participatory taxation. Financial efficiency is the theoretical result of citizen participation in financial management; therefore, it constitutes the last of the configurating elements identified. It is not an exclusive plexus; in fact, other elements could be incorporated. However, they gather the necessary breadth to analyze a multiplicity of situations related to the legal, economic, sociological, anthropological and semiotic development of each society.

At the strictly taxation level, this notion implies not circumscribing only the object of exercising the right to participate in public financial management to the mere obtaining of public revenues and the realization of public expenditures, since, in our opinion, it ignores the peculiarities and complex interrelationships of public finances in modern societies and is, in fact, affiliated to the strict conception of public finances. As CAZORLA PRIETO has stated, “the financial activity of public authorities forms a fundamental part of global economic activity. Every measure concerning public revenues and expenditures affects, albeit with varying intensity, the economic life of a collectivity. Hence, financial activity is object of knowledge of economic science, under the denomination of science of Public Finance” [3]. With this, the financial social relations that would support the effect of the subjective right that we expose are even more varied than the conventional scenario public revenues-public expenditures.

Democratic legitimacy is the foundation of citizen participation in public financial management and consequently of the right of participation in the management of public finances. This foundation is reflected in the two types of legitimacy that we will address. The majority rule channels citizen participation through political representation in the financial decision-making process and the mechanisms of democratic financial governance. In the case of representation, it is expressed in decision-making on tax figures, the budget, public credits, public debt, the very management of public finances mediated by the figure of representatives, mostly representative bodies linked by their competencies to the aforementioned categories. Legitimacy in this case is manifested through the expression of electoral processes in which representation emerges.

In relation to the mechanisms of democratic governance, financial management includes aspects such as participatory budgets, public hearings on capital expenditure decisions, binding consultations for the establishment of tax figures, double budget readings, plebiscites on public spending, obtaining public revenues or movement of tax quotas, workers’ approvals and workers’ control in relation to public revenues obtained as part of public enterprises, citizen consultations on tax figures, public spending, public debt and public credit, the social comptroller in the control of management itself of public finance and participatory lending. There is a visible variety of concrete expressions, as we have outlined, of the legitimization mechanism via majority, but as a common denominator they follow the decision-making process of the majority expression of citizens.

In the case of the rational-legal mechanism as a source of legitimation, in the matter of citizen participation in the management of public finances, it manifests itself in a duality of scenarios. First, as translating the higher values of the legal system that endorse the mechanisms of citizen participation in management, such as those we have related above, and the formal expression of the right to citizen participation in the management of public finances. In the second of the scenarios, it allows the formal recognition of citizen participation in management as part of the validating mechanisms that the State establishes for the recognition of the Law. That is, the clearest manifestation of the incorporation of the notion of participation into the legal rules governing financial management. Such a mechanism is a powerful way of legitimizing the rules themselves based on the strength of the participatory idea.

Democratization in the process of design, decision-making and control in public financial management becomes the concrete expression of the notion of participation. This is a sensitive area of state functioning – including, of course, the Public Administration, its tangible expression in attributions and scope – since it constitutes the support of the rest of the functions by possessing a fundamentally medial or instrumental teleology.

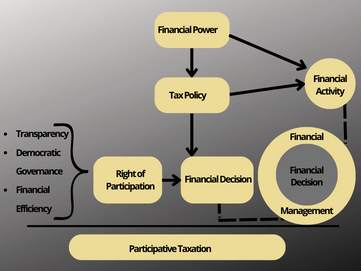

Once this clarification has been made, at the tax level, the main manifestations of participatory taxation transform the very notion of tax administration, giving it a priori a coordinating role and involving citizens in the adoption of tax policies or decisions in the process of tax collection, or the affectation of tax revenues from non-binding mechanisms that guide the directions of public administrations in the matter, graphically it would be expressed as follows:

The graph describes the interactions within the public tax administrations by illustrating the weight of the right of participation [4]. Increasing the details, it brings the administrations closer to the plane of good tax administration [5]. The latter is not only about structural transformations, which are important to guarantee the new patterns of functioning and guarantee to the (managed) citizens – taxpayers or not – but also of organizational, semiotic and behavioral innovations in agents and officials. In this, we agree with Tardivo when he argues that “a good public administration is one that fulfills the functions proper to democracy. In other words, a public administration that objectively serves the citizenry, which conducts its work rationally, justifying its actions and that is continuously oriented to the general interest” [6]. At the level of tax administrations, in principle, it could be understood as the objective democratization of the tax collection process, guaranteeing rational citizen participation in the different decision-making phases of the process. In extenso we have addressed above how this leads to the legitimization of the administration and the State itself. However, what has been proposed poses at least three clear challenges for tax administrations, a structural one that implies – in fact it has been happening in the last decade – an organizational design more directed towards the wishes and wills of citizens, multiple consultations on the destinations of VAT, direct taxation, certain tax benefits has involved modifications in the agents and administrative officials at least their temporary functional transformation. This requires greater receptivity: to have the sensitivity to grasp the concerns and interests of society as a whole, diverse and opposed, in the individuals and collectivities that comprise it. It is not simply a reservoir of global assessments, studies or scientific conclusions. The change must lie in the way of understanding citizen participation as something real and necessary for the construction of administrative decisions. Vocation of citizen participation in the service provided. On the other hand, the modification of the internal organizational rules of the administrations so that there is resonance between the participatory tax legal system and its administrative correlate. And the last direction has to do with the expansion of the notion of patrimonial responsibility of the tax administrations from the perspective of participatory taxation. Of course, by constituting three general challenges, they result from a multiplicity of situations that in themselves imply challenges for administrations. However, for purely expository reasons, we will focus on those raised trying to illustrate in a holistic way the various possible situations.

When we talk about an organizational design in tune with the postulates of good administration and participatory taxation, we run the risk, given the examples presented above, of including it only in manifestations of democratic governance that transport the superior values of the legal system and the rule of law to the tax collection process and, of course this generates institutional or organizational demands. But there is an even more typical element and that is the principle of transparency, present both in participatory taxation as a desirable manifestation of public finance management, and in good administration as a fundamental right and guiding principle. Formulated from a conception more inclined to formalism, the fact that it implies higher management costs for the administrations would be overlooked, since a greater amount of material and human resources must be dedicated to these processes, which constitute the support and material guarantee of real participation. Even this principle transcends to redefine the understanding of the situational framework in which a certain legally valid administrative decision was adopted but subject to the control of citizenship.

In relation to the internal norms, we could specify that their teleology has to be anchored in the methodology of understanding because “…when people are the reference of the political, economic and social system, a new framework appears, in which the dialoguing mentality, attention to the context, reflective thinking, the continuous search for points of confluence, and the ability to reconcile and synthesize, replace dogmatic and simplifying bipolar viewpoints, and highlight a style that, as can be easily appreciated, seeks, above all, to improve “people’s lives” [7]; this would have a significant impact on the regulatory regime and initiate, ipso facto, a major transformation in the very epistemology of these instruments in the administrative order of tax administrations. This is not a one-size-fits-all process, it has iridescences to justice and administrative litigation. It is a principle that has to be operationalized there, even in a conflictive way, although it is internalized and implemented in the administrative venue.

Finally, the patrimonial responsibility must include the costs of non-participation, that is, the responsibility of the administrations that, rationally being able to listen to the dialogue with the citizenry, opt for the old paradigm so that it operates under the canons of a negative selective incentive. It is not a mere extension of a sensitive institution, it is, at the tax office, a precautionary principle for the behavior of administrations, their agents and officials in the adoption of functional standards closer to the rule of law and democracy.

III. Concluding Remarks.

The challenges posed by the notion of participatory taxation for tax administrations, as we have explained, are consistent with the teleological and epistemic requirements of the rule of law for public administrations in general and represent in a categorical duality, demands to strengthen citizen empowerment in taxation. This is not a perspective that ignores the challenges posed to the administrations in different areas, especially those arising from the different economic-social scenarios of the different legal-tax systems, but it undoubtedly broadens and guarantees the catalog of citizens’ rights, democracy and places the higher values of the legal system in harmony with the taxation process, ignoring the teleological coherence and support of other rights and freedoms, which is, in fact, the most common analysis aspect of the subject.

Bibliographic References

Abramovich, V. and C. Courtis (2003). “Apuntes sobre la exigibilidad judicial de los derechos sociales.” La protección judicial de los derechos sociales 3: 3-31.

Limonta Montero, R. (2021). “La fiscalidad participativa y la economía social y solidaria.” revista de Derecho Fiscal (19).

Limonta, R. (2019). “La decisión financiera pública y el dimensionamiento del derecho de participación en ella: apuntes para un debate.” La decisión financiera pública y el dimensionamiento del derecho de participación en ella: apuntes para un debate: 323-347.

Prieto, L. M. C. (2021). Derecho financiero y tributario: parte general, ARANZADI/CIVITAS.

Tardivo, P. S. (2021). “El principio de transparencia de la gestión pública en el marco de la teoría del buen gobierno y la buena administración.” Revista de la Facultad de Derecho y Ciencias Sociales y Políticas 10(19): 123-149.

[1] Abramovich, V. and C. Courtis (2003). “Apuntes sobre la exigibilidad judicial de los derechos sociales.” La protección judicial de los derechos sociales 3: 3-31.

[2] Limonta Montero, R. (2021). “La fiscalidad participativa y la economía social y solidaria.” revista de Derecho Fiscal (19).

[3] Prieto, L. M. C. (2021). Derecho financiero y tributario: parte general, ARANZADI/CIVITAS.

[4] Limonta, R. (2019). “La decisión financiera pública y el dimensionamiento del derecho de participación en ella: apuntes para un debate.” La decisión financiera pública y el dimensionamiento del derecho de participación en ella: apuntes para un debate: 323-347.

[5] Tardivo, P. S. (2021). “El principio de transparencia de la gestión pública en el marco de la teoría del buen gobierno y la buena administración.” Revista de la Facultad de Derecho y Ciencias Sociales y Políticas 10(19): 123-149.

[6] Ibid.

[7] Ibid.

4,711 total views, 1 views today