Global climate finance, and policy design linking the multiple crises

Trends in Climate Action, no more isolated solutions.

As you may know, 2024 has been the warmest year on record since measurements began. Temperatures exceeded 1.5°C compared to data from 1850-1900 and climate disruptions are manifesting themselves everywhere [1]. Public climate mitigation policies may be held back by a number of factors, even in the countries that are promoting them most vigorously. The impacts of climate and environmental crises continue to grow and accelerate, and the applicable technological solutions continue to improve, so the situation offers both serious threats and many opportunities.

Over the past three years, there has been a notable increase in global commitments to climate action. 131 countries adopted net zero emission commitments; this reflects a growing recognition of the urgency of addressing climate change despite political and economic challenges. As global temperatures rise due to the burning of fossil fuels, researchers and policymakers have proposed solutions such as installing renewable energy, replacing gasoline cars with electric ones, and developing technology to suck carbon out of the air. A new report published by the United Nations expert group on biodiversity advocates an approach based on addressing the “nexus” between two or more of the five essential thematic areas: climate change, biodiversity, food, human health and water. This approach is not only more likely to help the world meet the UN’s biodiversity, sustainable development and climate change mitigation goals, it is also more cost-effective [2].

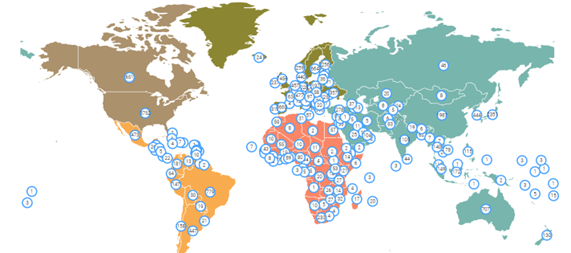

The U.N. global climate action portal (NAZCA: Non-State Actor Zone for Climate Action) [3] that gathers the commitments and actions of non-state actors, including regions, cities, companies, and organizations involved. At this time, it identifies no less than 43,136 actors engaged in climate action (such as the net zero commitment): these include 194 countries, 14,439 cities, 304 regiones, 5,900 organizations, and 20,511 companies. From the interactive map displayed, it is possible to identify in one click what are, in each country, the actors engaged in climate action, as well as the last update to the nationally determined contributions. This is an impressive demonstration of what we can do with data and how to apply data governance.

The portal features an intuitive interactive map that allows users to easily visualize global climate actions (see map here under). This design enhances user engagement and facilitates access to information on climate commitments in different regions and sectors. The ability to filter data by actor type (e.g., cities, companies) increases its usability. This project represents a superb example of the application of user-oriented data science. It collects commitments from thousands of entities, allowing users to analyze trends, compare actions between different actors and identify gaps in climate commitments.

To be included on the Global Climate Action map, an organization needs to register their climate action commitments through the United Nations Framework Convention on Climate Change (UNFCCC) platform, essentially providing details about their climate initiatives, targets, and progress on the dedicated portal, which allows them to be showcased on the interactive map as a participating non-state actor in the fight against climate change

Global map of the Non-State Actors for Climate Action Zone (Source: UNFCCC), see reference.

This growth shows how the willingness to integrate effective environmental and climate policies continues to mature, as do their tax consequences.

Climate risks at the forefront of financial previsions for 2025 [4]

Data on climate and environmental risks continue to improve as well. According to a first estimate by reinsurer Swiss Re, published on Thursday, December 5, its amounts should increase this year by 6% compared to 2023, amounting to $310 billion (€294 billion) [5]. This trend is expected to continue in 2025. As for damages covered by insurers, they should reach $135 billion, up 17% in one year, says Swiss Re. These trends directly affect global taxation, as every government project and every major company will have to pay more for its insurance, affecting prices and global demand.

Conditional Value at Risk (CVaR), also known as Expected Shortfall, is a tool that quantifies the expected loss of an investment or portfolio in scenarios where losses exceed a certain threshold (the Value at Risk, or VaR). Climate Value at Risk has emerged as a valuable new tool for assessing and managing climate related risks. By assessing the different types of climate risks (acute physical risks, chronic physical risks, political/legal risks, technological risks, market risks and reputational risks), it provides quantitative information that supports informed decision making.

For companies, the report estimates that “215 out of the 500 largest companies in the world could lose about one trillion dollars due to climate change. Most of these risks are reported to materialize from 2024 onwards. But “The transition to low-carbon economy presents an untapped growth potential and will determine which companies emerge as future innovators and take advantage of these opportunities via the successful development or growth of key low-carbon technologies”

The report also evaluates the impact of climate risks for regulators, stating that “their capture by capital frameworks requires a more forward-looking approach than used for many other risks, and scenario analysis and stress testing will play a key role in this.

Financial and tax outcomes from COP 29 in Baku.

Following the international events calendar, the annual Conference of the Parties (COP 29) was held this year in Baku, Azerbaijan, from November 11 to November 11, centered of Climate Finance.

ㅤ

In spite of facing huge obstacles and obstructions, the developed countries agreed to a new goal of at least 300 billion annually by 2023 to support climate action in developing countries. This is triple the previous commitment of $100 billion per year. The overall financing target including both public and private contributions is set to reach at least $ 1.3 trillion per year by 2035 [6].

The financial commitments of developed countries may lead to increased scrutiny and possible reforms of their tax systems. Binding agreements on environmental taxation are called for. Proposals for new taxes, such as wealth taxes on billionaires and windfall taxes on the profits of fossil fuel companies, could generate substantial revenues. Taxes are considered to be the most potent vehicle for climate finance.

For example, a 2% global wealth tax could raise between $200 billion and $250 billion annually, while a 90% windfall profits tax on energy companies could generate an estimated $941 billion [7]. “There is a pressing need to improve tax cooperation between developed and developing nations to ensure an equitable distribution of climate finance resources”. [8] This includes addressing disparities in the way carbon taxes are applied globally, particularly with mechanisms such as the EU’s Carbon Border Adjustment Mechanism (CBAM) [9], which can affect developing countries.

ㅤ

Energy transition: At COP28, countries committed to phasing out fossil fuels and significantly increasing renewable energy capacity, aiming to triple renewables and double energy efficiency by 2030. Although this goal remains at risk, the world is on track to reach only 66% of this target. [10] Reports indicate that while renewable energy investments have surged, especially in solar energy, clean energy investments have reportedly doubled compared to fossil fuels—but fossil fuel subsidies remain at an all-time high, hindering overall progress.

If policies of some governments proclaim that they will be keeping or even increasing their fossil fuel subsidies in thee coming years, this can slow down the energy transition, but not prevent it, because the environmental pressure of extreme temperatures and climate events, keep growing, while clean technologies are increasingly the least expensive technologies.

Current projections suggest that emissions may peak before 2025 if existing policies are effectively implemented. However, these reductions are not sufficient to meet the goals set by the Paris Agreement, which requires a 43% reduction in emissions by 2030[11]

Challenges in Local Implementation: Analysis shows that many national climate plans lack strong urban initiatives, with only 27% containing robust urban strategies. Furthermore, only a small percentage of G20 cities have aligned their targets with global warming limits of 1.5 degrees Celsius. As countries prepare their next round of Nationally Determined Contributions (NDCs) for 2025, there is an urgent need for collaboration between national and subnational governments to enhance ambition and ensure effective implementation of climate actions[12]

The next global climate meeting, COP 30, is scheduled to be held in Belém, Brazil, in 2025, although the exact dates have not yet been specified, and countries are expected to update their national commitments (NDCs) in this coming year.

ㅤㅤ

Connecting the link between global commitments and regional needs: New CIAT courses on environmental taxation.

CIAT’s Human Talent Directorate will offer two courses on green environmental taxation for tax administration officials in 2025. An introductory course on environmental taxation in general and a more advanced course focused on initiatives in Latin American and Caribbean countries, covering carbon taxation, national and local action levels, environmental services initiatives, and interagency coordination.

The CIAT Human Talent Directorate will offer in 2025 two green taxation courses directed at tax administrations officials. One introductory course on environmental taxation in general and one more advanced, focusing on about initiatives in Latin American and Caribbean Countries, covering carbon emissions taxation, national and local levels of action, environmental services initiatives and coordination between agencies.

The commitment of developed countries to mobilize $300 billion annually for climate action highlights the importance of financial resources in the fight against climate change. This funding can serve as a catalyst for Latin American countries to implement their own environmental taxes, creating a sustainable revenue stream that aligns with global efforts while addressing local challenges. [13]

Latin America is particularly vulnerable to the effects of climate change, such as extreme weather events and biodiversity loss. This requires tailored environmental fiscal policies that consider the unique economic and social contexts of the region. The course will explore how these policies can be designed to mitigate local effects while contributing to global climate goals.

Recent developments, such as Mexico’s introduction of new environmental taxes (e.g., Waste Tax, Water Tax, and Atmospheric Emissions Tax), illustrate a growing trend to integrate environmental considerations into tax systems. These local initiatives can draw inspiration from the global discussions at COP29, which emphasized the need for sound environmental fiscal frameworks that support sustainable development. ECLAC organized a regional tax cooperation platform this year, also representing an opportunity to cooperate on best practices in environmental taxation issues. [14]

These courses present how practitioners can participate in these reforms, towards more carbon-neutral economies, in the design and implementation of effective environmental fiscal policies that fit both regional needs and international commitments.

So, we can conclude 2024 on a serious, but hopeful, note that the trends slowing progress toward a more sustainable world will remain a real, but not definite, obstacle, and wish our readers a happy 2025.

ㅤ

[1] https://www.theguardian.com/environment/2024/dec/27/climate-crisis-dangerous-heat-2024

[2] https://www.carbonbrief.org/ipbes-nexus-report-five-takeaways-for-biodiversity-food-water-health-and-climate/

[3] https://climateaction.unfccc.int/

[4] https://www.finextra.com/blogposting/27342/climate-change-impact-unraveling-financial-consequences-and-identifying-opportunities-using-c-var

[5] https://globalgreen.news/natural-disasters-caused-310-billion-in-economic-losses-worldwide-in-2024-estimates-swiss-re/#:~:text=The%20economic%20losses%20caused%20by,dollars%20(294%20billion%20euros).

[6] https://www.cesr.org/will-the-finance-cop-live-up-to-the-expectations-a-critical-analysis-of-the-stakes-at-cop29/

[7] https://www.slaughterandmay.com/insights/horizon-scanning/cop29-did-the-finance-cop-find-its-feet-and-what-progress-was-made-on-carbon-markets/

[8] https://africanclimatewire.org/2024/10/tax-cooperation-and-climate-finance-kicking-the-can-down-the-road-to-cop29/

[9] https://www.anthesisgroup.com/insights/cbam-reporting-4-key-takeaways-from-2024/

[10] https://www.climatechangenews.com/2024/10/11/despite-solar-surge-world-off-track-for-cop28-renewable-energy-target/

[11] https://unfccc.int/documents/642847

[12] https://www.wri.org/insights/climate-commitment-tracker

[13] https://www.ciat.org/ciatblog-urgencias-y-particularidades-de-la-agenda-fiscal-verde-en-america-latina/?lang=en

[14] https://www.cepal.org/en/notes/regional-tax-cooperation-platform-latin-america-and-caribbean-ready

4,829 total views, 3 views today