Urgencies and particularities of the green tax agenda in Latin America

Introduction

Climate change is a public “bad” with global causes and consequences, but with obvious local expressions such as extreme weather events, sea level rise or loss of biodiversity and that shows some relevant specificities from the perspective of the countries of Latin America and the Caribbean.

At the same time, it is a development problem that has significant negative effects on economic activities, social welfare and the environment, so it requires urgent and extensive structural transformations to reach carbon-neutral economies.

The countries of Latin America and the Caribbean are particularly vulnerable to the effects of climate change, which is attributable to different economic and social geographical characteristics. These vulnerabilities, together with the particular level and structure of greenhouse gas emissions with respect to developed countries, are features that should be taken into particular account.

Incorporating these regional specificities into the map of climate risks, the modality of adaptation to these risks and the agenda of tax reforms related to the environment is essential to build a regional strategy to address the energy transition and face climate change.

The objective of the Policy Brief recently published by the Project Extractivism.de it is to justify and underline the urgency and relevance of prioritizing the use of tax instruments related to the environment in Latin American fiscal and tax reforms.

Considering that the ecological transition will introduce relevant socio-economic costs and the high inequality that pre-exists in Latin American countries, particular attention should be paid to the distributive impacts, both personal and regional and also intergenerational, linked to the introduction of environmental taxes and the establishment of mechanisms that mitigate these effects on certain social groups and economic sectors.

Specificities of the region for the design of an environmental tax agenda

For the proper design of an environmental tax policy, some of the specificities of the region should be considered, which are especially relevant for a systemic approach to environmental fiscal reforms.

• Persistent concentration of income and wealth, inequality and poverty: The incidence of poverty is significant, and it is a region with strong disparities in the distribution of wealth and income, both at the personal and regional levels. Due to this, it is necessary to pay special attention to the possible distributional effects of the implementation of a green tax reform, considering that the available evidence shows that the lowest income groups and the poorest regions in LAC are more vulnerable to climate change and natural disasters.

• The importance of extractive industries: Natural resources have a greater relative weight in the region, and this has influenced and will continue to influence the tax instruments used and the characteristics of the tax space available.

• Weak states: The State shows a reduced capacity to provide basic public goods and to obtain sources of financing. In addition, the existence of a large mass of subsidies for energy products, mostly on fuel consumption, poses a great challenge in terms of environmental policy. These subsidies have expanded in quantity and amount in recent years, with the additional objective of compensating for the international increases in oil prices and their impact on inflation, generating opposite effects to those originally sought, undermining environmental objectives.

• Lower historical level and different carbon emission structure: The emissions generated by the region that contribute to creating the greenhouse effect are a smaller proportion of global emissions and, in addition, the mix of activities that originate emissions is also different, with a clear predominance of activities that are intensive in natural resource. This indicates that the mitigation agenda in LAC is not limited to energy and also covers other sectors and activities.

Components of the ETR (environmental tax reform)

The concept of environmental tax reform (ETR) emerged towards the end of the eighties and was consolidated in the nineties within the framework of reforms mostly conducted in Europe. The basic idea that drove the reforms was to use the price mechanism, due to its ability to provide information and influence incentives, to correct the distortions that deteriorate the environment and prevent a rational use of natural capital.

A green tax is defined as a tax whose taxable base is a physical unit (or a substitute for it) that has a specific proven negative impact on the environment.

To do this, it is necessary that the tax base of the environmental tax is related to the problem under consideration (the environmental damage of certain emissions or the use of products intricately linked to said damage) and that the structure of tax rates contributes to the environmental damage or to the achievement of pre-set environmental objectives.

This broad definition allows the incorporation of taxes that, originally, were introduced for purely collection purposes (for example, the taxation of hydrocarbons or on automobiles) but that undoubtedly have associated environmental effects.

The taxes related to the environment can be classified according to their taxable base, be it Energy (generation, distribution and use in its different forms); Motor vehicles and transport; Others (pollution and natural resources).

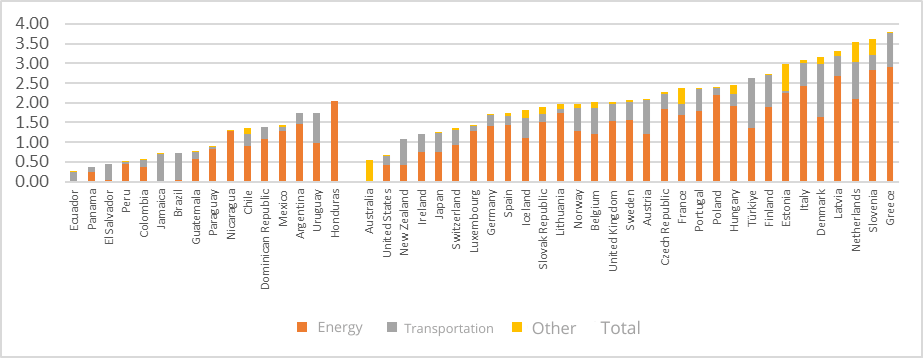

As can be seen in Figure 1, taxes related to the environment in the region are significantly, although heterogeneous, lower and focused on energy, in terms of GDP, than those applied in OECD countries.

Graph 1: Tax revenues derived from environmental taxes in OECD and selected Latin American countries, 2020. (% GDP)

Source: OECD.Stat. Environmentally related tax revenue. Data extracted on 22 Dec 2022

In addition to the problems related to the quantitative relevance or the low “quantity” of environmental taxation, the low “quality” in the design of many tax figures is worrisome. Among these qualitative factors stand out, the non-coverage by the taxation of numerous environmental problems, polluting sectors or activities; the persistence of tax rates that do not adequately reflect environmental impacts, frustrating the extra-fiscal objectives of environmental and health protection; the label as environmental taxes of taxes that do not address environmental pollution as a way to generate environmental reputation (“greenwashing”).

Taxes on the extractive industry: an imperfect but potentially significant form of environmental taxation

Taxes levied on exploitation and extractive production are not usually considered environmental taxes.

According to the EU, taxes on mineral and oil extraction “do not influence prices in the way that other environmental taxes, i.e., taxes on products, do”, so they are not included in the nomenclators usually used by international organizations (OECD, EU) to classify environmental taxes.

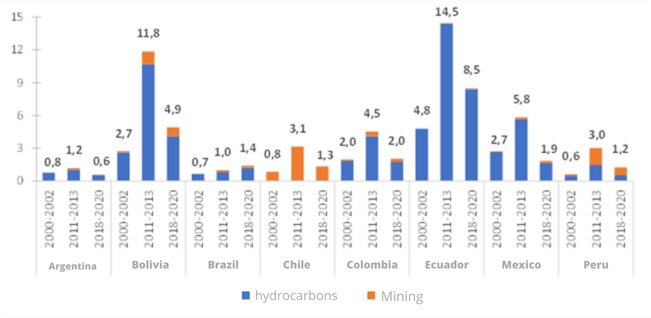

Although the dominant objective of taxation on production and exploitation is the appropriation of extractive income and the collection of tax revenues, many of them, such as income from royalties, have a significant environmental impact in fact and often unwanted, through the reduction of production. Therefore, although they are not considered environmental taxes, their high environmental impact on extractive industries, as well as their tax importance (Jiménez and Podestá, 2023), mean that they can potentially be a powerful tool in the design of environmental tax reform.

Graph 2: Tax revenues derived from the exploitation of non-renewable natural resources. Selected Latin American countries, 2000-2020 (% GDP)

Source: Jiménez and Podestá (2023) based on CEPALstat

Distributive impact and the compensations designs

The growing social concern about the effects of the ecological transition requires paying special attention to the distributive impacts, both personal and regional, as well as intergenerational, of environmental taxes and compensatory alternatives to mitigate these effects.

It should be noted that the evidence available in the region confirms that low-income groups contribute a smaller proportion of greenhouse gas emissions, but at the same time they are the most vulnerable to the effects of climate change.

At the same time, the application of tax instruments to encourage a sustainable environment and energy transition have a significant distributive impact, among families, sectors and regions, so it is impossible to think about an environmental tax reform and the political economy of its implementation without the appropriate design of a compensation system, through different instruments (subsidy, transfers, tax expenditure).

International and intergovernmental coordination

There is a broad academic and empirical consensus that the coordination of these instruments at the international level produces additional economic and environmental benefits, derived from the global nature of the impact of climate change.

That is why, to implement these structural transformations, countries have made a global commitment to meet the goals of the Sustainable Development Goals (SDGs) and the Nationally Determined Contributions (NDCs).

In addition to the above, and considering the regional and local impacts, the causes that determine the establishment of an environmental tax exceed the territorial limits of the national or subnational entity that has implemented it. This makes the necessary adaptation of the spatial scope of taxes a priority at the internal level of each country, through the relevant coordination systems or the application of a common policy.

At the intergovernmental level, within the same country, the allocation of environmental management powers between levels of government is central. According to academic literature, it should be considered that the existence of environmental problems of a marked territorial and local character justifies the tax role of sub-national administrations in this field.

This is especially important in a region like LAC, given a high degree of decentralization. Both for the design and establishment of appropriate instruments, as well as for their practical application and monitoring, the most appropriate allocation of responsibilities between different levels of government may vary depending on the magnitude and scope of environmental externality.

Recommendations and future challenges

Over the course of the next few years, the countries of the region will have to implement fundamental structural transformations to their current style of development in order to meet the configuration of a low-carbon, inclusive and resilient economy to climate change.

In order to implement these important structural transformations, it is essential to align the tax policies by orienting them to modify the behaviors of the economic agents that are at the base of the climate change.

The LAC countries are very vulnerable to climate change and have particularities that require a different analysis framework than the traditional environmental tax reform applied in developed countries. The design of the environmental tax strategy in the region should pay special attention to the interactions between the global, regional and local environmental impact of the exploitation of natural resources, while actions should be introduced aimed at mitigating possible undesired distributive impacts through appropriate compensation mechanisms to assist the affected sectors.

This path must be followed, considering that there is a limited room for maneuver and that it will become even narrower in the course of the next few years, due to the accelerated deterioration of environmental quality levels and the existence of important irreversible changes associated with the acceleration of climate change.

To be politically feasible, an environmental tax strategy must be aligned with the fulfillment of a set of development objectives related to the reduction of poverty and a progressive improvement in income distribution. Therefore, a comprehensive and transversal vision of the tax system’s performance in the face of multiple environmental challenges is necessary.

The political commitment of the economic authorities (Ministries of Economy, Treasury and Finance together with the Tax Administrations) is considered indispensable for the effective implementation of a new environmental tax strategy. The more active participation of economic leaders in addressing the challenges of climate change, both at the national and sub-national levels, should be considered as a key ingredient for the deployment of a tax and financing (green) strategy, consistent with the magnitude of the transformations required to adopt consumption patterns and production forms compatible with carbon neutrality in the horizon 2050-2070.

To ensure the success of a new environmental tax strategy in the region, particular attention should be paid to the particular and complex political economy dimensions posed by the response to climate change. Until now, environmental problems and the sustainable development agenda in LAC have not had the political priority they deserve. In fact, there is no broad social consensus in the region regarding the need to move towards a new fiscal pact that contributes to achieving the SDGs and to take on the challenges of climate change.

The necessary process of transformation of the development strategy will have to be faced in a context characterized by a historical resistance to the implementation of tax reforms, which has certainly been accentuated during recent years. The response to climate change requires combining the responsible and sustainable use of natural resources with the need that exists in the region to improve levels of economic efficiency and to achieve a fairer income distribution.

It is, therefore, a matter of promoting a broad debate in which the multiple dimensions involved in the construction of a new development strategy can be combined. It is within the framework of this urgent and essential debate that the recently published “policy brief” seeks to provide inputs for the discussion.

[1] Artículo basado en el Policy Brief “La reforma fiscal ambiental en América Latina: urgencias y particularidades de la agenda fiscal verde en países altamente desiguales y especializados en extracción de recursos naturales” publicado por el Proyecto Extractivism.de https://extractivism.de/en/publications/extractivism-policy-briefs-en/environmental-tax-reform-in-latin-america-2/

9,481 total views, 1 views today