- 2

- Sep

- 2025

- Written by: Antonio Seco

- /

- Comments Leave a reply

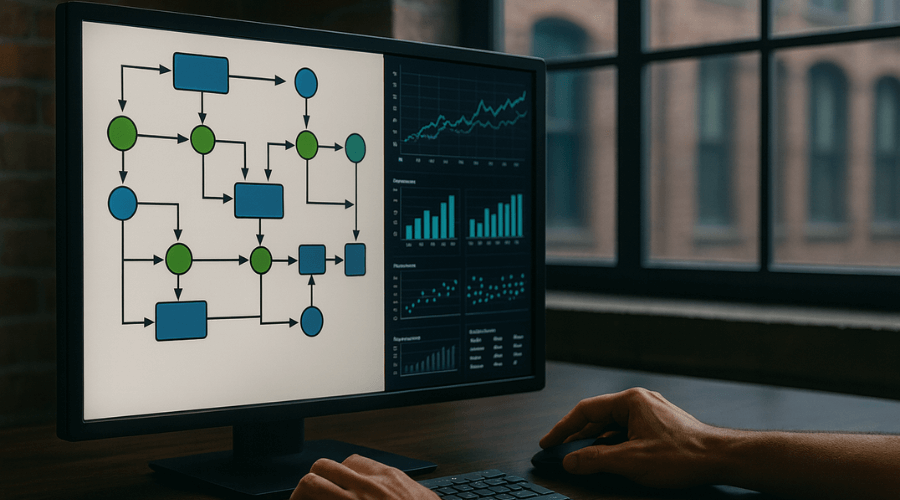

Process mining consists of the application of specialized algorithms to the event logs generated by information systems, to identify trends, patterns, and details about how processes are executed. In this sense, it constitutes a tool that combines data science and process analysis to discover, validate and optimize workflows. By integrating…

3,877 total views, 2 views today

- 26

- Aug

- 2025

- Written by: Andre Dumoulin

- /

- Comments Leave a reply

Plastic pollution is one of the most pressing environmental challenges of the 21st century. Plastic waste is a social justice and human rights issue that, in addition to being an environmental and ecological problem, threatens food security, human health, and economic development. Countries in the Global South are disproportionately affected…

10,969 total views, 10 views today

- 23

- Aug

- 2025

- Written by: Mario Pires

- /

- Comments Leave a reply

For the heads of Tax Administrations (TAs) in Latin America and the Caribbean (LAC), knowing the starting point and the trajectory of their peers in the field of digitization and digital transformation at a global level is a priority. A global inventory of technology initiatives in the tax or fiscal…

8,943 total views, 8 views today

- 12

- Aug

- 2025

- Written by: Alfredo Collosa

- /

- Comments Leave a reply

The recent publication Overview of Tax Administrations in CIAT Countries[1] is based on data from the latest version of the International Survey on Tax Administration (ISORA), compiled during 2023 and referring to the situation of the administrations in 2022, in which the tax administrations (TAs) of 179 countries participated. The publication gathers…

4,347 total views, 5 views today

- 9

- Aug

- 2025

- Written by: Alfredo Collosa

- /

- Comments Leave a reply

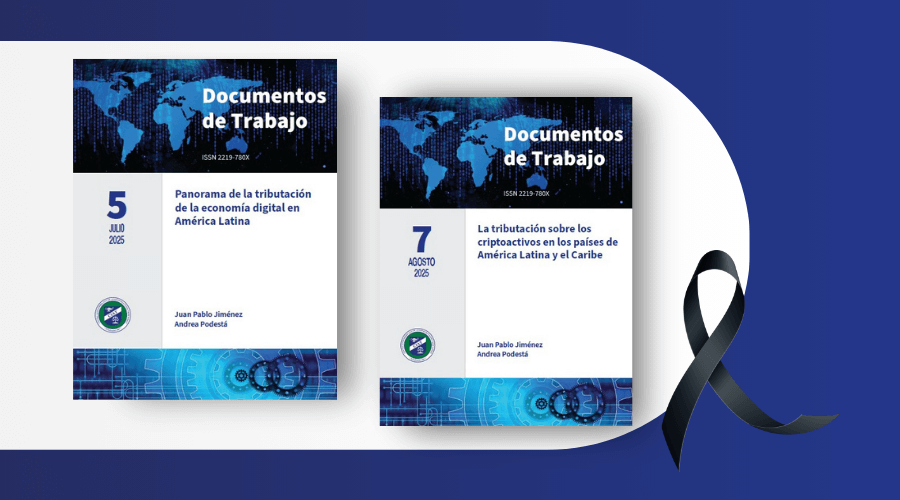

The remarkable progress of crypto-assets and the tokenization of the economy since the emergence of Bitcoin, back in 2008, has led to different regulations being issued around the world. They seek to provide transparency, protect consumers, and combat tax fraud and crimes such as money laundering and terrorist financing, as…

34,007 total views, 16 views today

- 30

- Jul

- 2025

- Written by: Andrea Podestá, Santiago Diaz de Sarralde and Raul Zambrano

- /

- Comments Leave a reply

We recently published the working paper “Overview of the taxation of the digital economy in Latin America“ by Juan Pablo Jiménez and Andrea Podestá, and shortly we will publish another of their studies: “Taxation of crypto assets in Latin American and Caribbean countries”. Usually, we would now be reading a blog…

3,557 total views, 1 views today

Ronnie Nielsen en What future does artificial intelligence have in Tax Administrations? "Thanks, Alfredo, for this as always very informative blog! Your tireless comment..."

스카이슬롯 en “Final Beneficiary” or “Effective Beneficiary”? "It is really a nice and helpful piece of information. I am glad that you shared ..."

the walking dead season 9 ซับไทย en “Final Beneficiary” or “Effective Beneficiary”? "Thanks for the tips you have contributed here. Something important I would like ..."

Roxanne Mazzillo en Against corruption, more cooperation "Your blog site is like a breath of fresh air...."

Val en If only it were a game "Great blog...."