Documents and electronic transactions (vii)

Some novelties

Some time has passed since the last post related to the use of electronic documents; and there are news and statistics that, in my opinion, confirm the Latin America’s leadership in the use of electronic documents for the tax administration.

First, here are some numbers: in Mexico, in 2016, 6142 million electronic tax receipts were issued, 6.2 percent more invoices than in 2015, and an average of 194 invoices issued per second. In Brazil, in operations between consumers _ let’s remind that operations to final consumer use another document _ are currently reaching the total of 16,000 million electronic tax notes, with 1, 322,000 of them issued from taxpayers operating in a business -to-business (B2B) environment. But if someone thinks that the magnitude of these numbers correspond only to very large countries, it is worth visiting the statistical summary of the Internal Revenue Service of Ecuador. It tells us the number of updated documents (not only invoices, other documents are included such as withholding vouchers, Referral guides, credit and debit notes) in the last 5 days and in the last 5 minutes, which at the time of writing reflect a little more than 4 million documents daily in the working days, with an average of about 50 authorized documents per second.

The adoption of national electronic invoice systems, in which the tax administration holds all the documents also increases in the region. On the one hand, Guatemala is significantly improving its current operating model to provide a leading role to the tax administration; On the other hand, in Colombia, the tax reform of late 2016 established the compulsory use of the electronic invoice for all registered taxpayers as from 2019, allowing the administration to incorporate specific sectors to the mandatory change and the taxpayers to join voluntarily; In Panama, the government is working on a project to implement the electronic invoice that will surely enter into the voluntary adhesion phase in 2018.

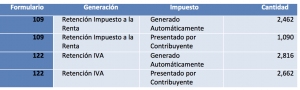

In Paraguay, the introduction of electronic withholding certificates, which are compulsory for about 5,000 withholding agents in 2016, has allowed the SET to pre-fill the fields corresponding to withholdings in the tax returns for the income tax and the VAT. The table below shows the results, generated from more than one million electronic withholding certificates per month, which confirm not only the success achieved by the Paraguayan tax administration in this effort, but also the benefit to the taxpayers using the suggested return. In addition, based on these data, the Paraguayan Tax Administration performs the normalization of the amounts declared by the taxpayers in their VAT statements and income tax returns, impacting these in a unified current tax account, which allows to apply massive and automatic controls on taxpayers.

But the novelties regarding electronic documents are not in their already huge amount, but in their use. In this blog, we have commented their uses for control by the tax administrations in Mexico and Brazil. But there are other applications of electronic invoicing in Latin America that deserve to be highlighted. In the state of Amazon in Brazil, for example, electronic invoicing information is used to investigate reference prices for public procurements of goods, particularly consumption goods. This process has improved the purchasing processes, shortening deadlines, allowing a very accurate budget forecast, automating the inventory process and improving the overall transparency of the process with a public information site.

In Chile, the use of electronic invoices is consolidated as an asset title (factoring) mechanism that, in comparison to paper document, can avoid cumbersome processes of confirmation via notary, or credit validation through phone. The presence of an electronic signature in the invoice gives greater legal certainty and reduces the possibility of falsifications, complementing the online verification at SII.

In Ecuador, since 2015, electronic invoicing applications were integrated with processes such as vehicle registration, tax refunds and the provision of web services for external control entities such as Customs, the Central Bank, or the Centralized Securities Repository.

One of the most interesting uses by Ecuador of the electronic invoicing information is the calculation of the national component, which is usually calculated between local purchases and those imported by a company, but which, thanks to the use of the Information available and technological data processing capabilities, can be extended to determine local and imported purchases from domestic suppliers of the first company; those from their own suppliers; And thus they keep chaining back to determine the true national component, and since the law of public procurement establishes that those suppliers who have a greater national component in the goods and services will have additional scores in the tender process, the SRI performs this validation automatically. This example illustrates how the electronic invoices data, correctly anonymized, can be used for various studies, economic and other, going through processes that would go from the determination of the price index in the basic shopping basket to assessing prices of sales in the different localities instead of conducting surveys and on-site measurements; to the evaluation of consumption habits in specific sectors of society; to a different way of considering some of the important elements in the GDP estimation.

We hope to include some of these experiences in a book that we are promoting with IDB, in collaboration with the administrations of the respective countries. The book will include a chapter on the impact analysis of electronic invoicing on collection, which will be presented by Alberto Barreix on the Friday following the CIAT General Assembly in Asuncion.

Good luck.

1,962 total views, 4 views today