Equity, Technology, and the Future: The Strategic Role of the DEC (Digital Economy Compliance) System

The digitalization of the economy has brought immense benefits, but it has also created a critical distortion in domestic markets. While local businesses and workers punctually fulfill their tax obligations—sustaining public infrastructure—large foreign digital providers have historically operated in a “gray zone,” often exempt from indirect taxation due to a lack of physical presence.

This asymmetry is not merely a collection issue; it is a matter of economic justice.

Defending the Local Business Fabric

The fundamental purpose of DEC (Digital Economy Compliance) transcends software. Its mission is to create a Level Playing Field.

Consider a local entrepreneur or an established service company in our country. They pay income taxes, social security contributions, rent, and municipal fees. Their employees pay taxes on their wages. If a foreign competitor can offer similar digital services without the burden of VAT (or its equivalent), they gain an unfair competitive advantage of 15% to 25% simply by not being domiciled locally.

Implementing DEC is an act of defending the national economy. By facilitating tax compliance for foreign providers, we ensure that competition is based on quality and innovation rather than tax evasion or regulatory arbitrage. In doing so, we protect local employment and the sustainability of our businesses.

Law First, Technology Second

It is imperative to emphasize that technology does not legislate. For DEC to function, legislative adjustment is a sine qua non condition.

The system is designed to operate on a solid legal foundation where the law:

- • Clearly defines the taxable event for digital services.

- • Establishes mandatory registration for non-residents.

- • Simplifies formal obligations to encourage voluntary compliance.

Without this political and legislative will, any IT tool is sterile. DEC is the engine, but the law is the fuel.

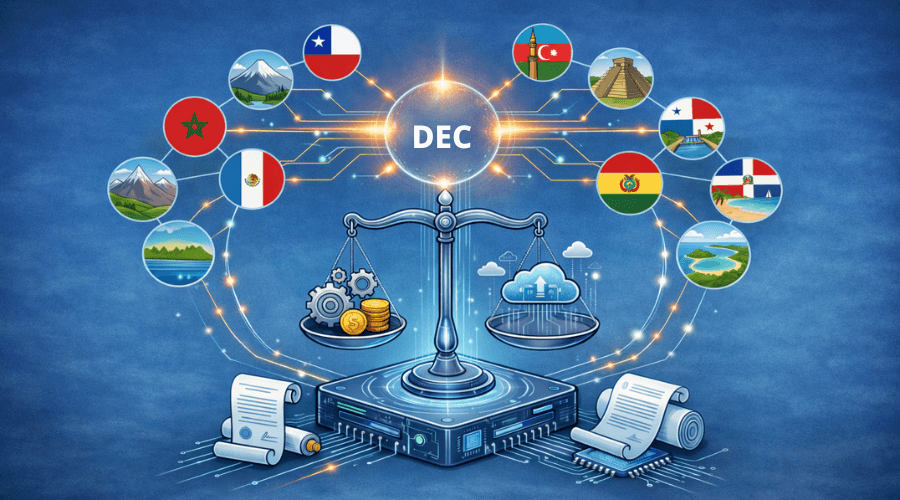

Current Status: A Proven and Expanding Solution

Thanks to international cooperation and the study of success stories—with special thanks to the Tax Administration of Chile, whose model and facilities served as inspiration and a case study for the development of our tool—DEC has matured rapidly.

Currently, the system demonstrates its robustness in various scenarios:

- • Fully Operational: Countries such as Morocco and Azerbaijan already manage their daily digital tax collection through DEC.

- • Installation and Deployment Phase: In our region, Guatemala, Panama, Bolivia, and the Dominican Republichave installed the system and are advancing through the regulatory or technical processes for its official launch.

Looking to the Future: DEC Enterprise and Global Cooperation

At CIAT, innovation never stops. We understand that administrative efficiency is the next great challenge. Therefore, we are in the planning and design phase of a new evolution of the system: DEC Enterprise.

This future project seeks to develop a multi-tenant (multi-jurisdictional) architecture so that a single, robust technological installation can serve multiple jurisdictions simultaneously, drastically reducing infrastructure and maintenance costs.

The viability of this ambitious model has been the subject of deep study and high-level strategic collaborations. We highlight the joint work carried out with the Pacific Islands Tax Administrators Association (PITAA) and the Australian Taxation Office (ATO).

During an exceptional week of face-to-face technical discussions held in Fiji, we defined the foundations of how DEC Enterprise will meet the specific needs of the Pacific Islands. The goal is to provide these jurisdictions with a shared, powerful, and secure solution capable of overcoming geographical and resource limitations through technological cooperation.

Conclusion

The digital economy does not wait, and tax administrations must not wait either. With DEC, we offer a decisive response to protect our local taxpayers and secure state resources.

We invite fiscal and technology leaders to explore the technical documentation, manuals, and the sandbox environment available on our new portal: 👉 www.ciat.org/dec