Keynote Speech Issued by the Delegate from the Inter-American Center of Tax Administrations (CIAT)

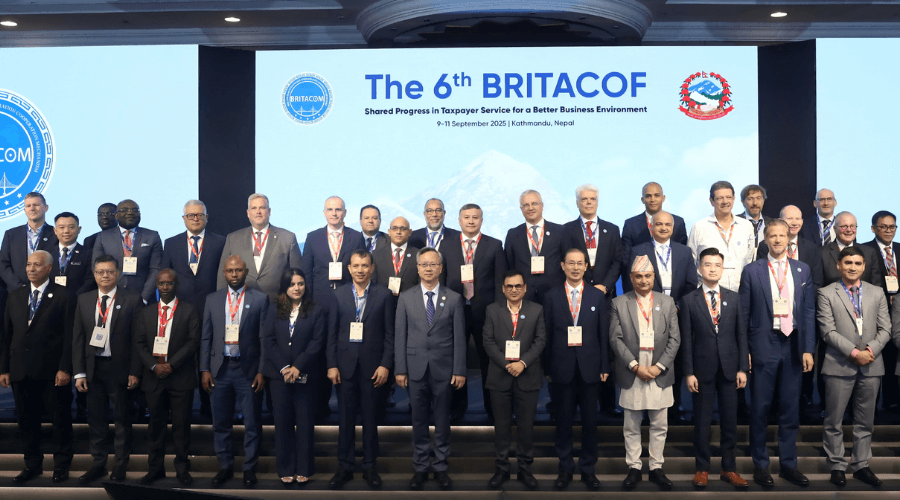

From September 9th to 11th, 2025, the 6th Belt and Road Initiative Tax Administration Cooperation Forum (BRITACOF) was held in Kathmandu, Nepal. It has attracted commissioners of tax authorities from 45 jurisdictions, representatives from 13 international organizations, and nearly 50 multinational enterprises.

With the theme of Shared Progress in Taxpayer Service for a Better Business Environment, the forum conducted in-depth discussions on topics including Tax Administration Product Portfolio, Taxpayer Service Product Portfolio, Tax Rule of Law Governance, Tax Administration Transparency, Tax and Fee Payment Service, and Digital Technology Application.

On the session of discussion on Topic 6: Digital Technology Application, Mr. Márcio F. Verdi, the Executive Secretary of Inter-American Center of Tax Administrations (CIAT), has made a statement online: “Fully leveraging technology can significantly enhance the efficiency of tax administration. Sharing technological resources is essential to accelerate the development of tax systems across countries; otherwise, the gap in tax administration capabilities among nations will continue to widen.” Additionally, he entrusted a professor who served in the University of Taxes, to attend the forum on-site as delegate.

During his speech at the event, Professor Santiago pointed out that leveraging digital technology to enhance tax administration has always been a goal of CIAT, and this object has now been achieved. By integrating data, services, analysis, and control, the efficiency of tax management can be significantly improved. Latin America has been a pioneer in this regard, and the core work of CIAT involves conducting research, providing training, and offering technical assistance in the areas of tax administration and technology.

Professor Santiago delivered a speech focusing on CIAT’s research on tax administration and digital technologies, CIAT’s Advanced Analytics Center, and CIAT’s technical assistance, demonstrating CIAT’s practical achievements and application effects in the field of digital technologies and tax administration.

First, he presented CIAT’s research achievements in the field of tax administration and digital technology through diagrams and data, including multiple journals integrating tax administration and technology, indicators for multi-dimensional phenomena, trends in Latin America and the Caribbean, and global trends. Then, he demonstrated the interfaces and functions of DEC (Digital Economy Compliance Software), Electronic Invoicing Anomaly Detector, and Electronic Fiscal Documents Reception System, highlighting the strong capabilities of CIAT’s Advanced Analytics Center. Finally, he listed CIAT’s technical assistance for projects in regions and cities such as Maranhão State, Alagoas State, Belize, and Honduras, demonstrating CIAT’s ability to apply technology in tax administration.

Delegates attending the conference noted that the research achievements of the Inter-American Center of Tax Administrations (CIAT) in the field of tax administration and digital technology will greatly improve the efficiency, accuracy and security of tax administration, and provide reference as well as learning value for the modernization of tax systems in various countries.

Additional information: BRITACOM Events

1,433 total views, 2 views today