Modernization of the Tax Administration for the Domestic Resources Mobilization (DRM)

Introduction

Domestic Resource Mobilization – (DRM) refers to the process by which a country generates, manages and efficiently uses its own financial resources to finance its economic and social development, reducing dependence on external sources such as debt or international aid.

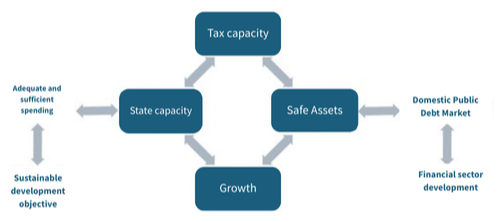

A general outline of the functions associated with the State and DRM capabilities is presented below.

Source: Adapted from (IMF-WB, 2024)

Tax capacity is recognized as a fundamental pillar of State capacity, as well as effectiveness and efficiency in public expenditure management. Together with the development of the financial sector, especially to serve the domestic public debt market, these capacities allow governments to mobilize sufficient revenues and use them to meet their growth and development priorities.

However, although these efforts lay an important foundation, they are not enough on their own to promote sustained economic growth; for this, the dynamism of the private sector, especially through productive investment and job creation, is crucial.

Several international organizations recognize the importance of DRM initiatives as fundamental to the common pursuit of sustainable development [1].

An effective DRM management strategy is one that exploits these functions and their links, while considering the particularities of each country, such as the political economy of reforms and the level of development (IMF-WB, 2024).

Requirements and sources of funding

Developing countries face the need to mobilize significant additional resources to meet their development goals. Recent estimates indicate that the equivalent of 3.4% of projected global GDP will be required by 2030 to achieve the Sustainable Development Goals (SDGs) linked to health, education, water and sanitation, access to electricity and road infrastructure. If the costs of climate change mitigation and adaptation are included, the need for financing amounts to 3.8% of global GDP on an annualized basis. These figures, along with their respective sources, are detailed in (IMF–WB, 2024).

Three public sources are highlighted to finance these spending priorities: (a) public revenues as the primary source, tax revenues being their main component; (b) efficiency gains derived from public spending on physical and social infrastructure; and (c) government borrowing in domestic public debt markets.

Key pillar for DRM: tax revenues

It can be seen from the graphic diagram above that tax revenues are fundamental in the context of Domestic Resource Mobilization. Thus, it is important to have a strategy to advance the objectives of improving the fairness of the tax system, as well as to strengthen justice in its administration. This strategy should provide a conceptual framework to address the main shortcomings of resource mobilization systems, especially in low- and middle-income countries.

Its purpose should be to facilitate the increase of tax collection, in order to provide countries with a stable and predictable fiscal environment that favors growth, equity and development (Junquera-Varela et al., 2017). To achieve this objective, it is necessary to implement tax systems that are comprehensive, simple, equitable and that facilitate voluntary compliance by taxpayers.

The principles for structuring a tax system according to a DRM strategy can be found in (Junquera-Varela and Lucas-Mas, 2024).

Basic strategies for the tax capacity pillar in the DRM

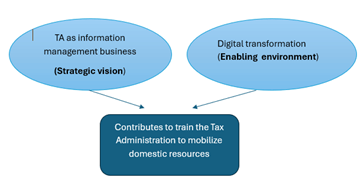

In order for the DRM tax capacity pillar to achieve its objectives two strategies are proposed:

Tax administration is focused as an information management business. The business concept of information management maintains that information is a critical asset and that a fundamental mission of the tax administration is the collection, treatment, protection, analysis and strategic use of information. Conceiving the tax administration as a “data business” allows us to define more clearly which aspects should be transformed, why it is necessary to do so and towards which strategic objectives its digitalization should be oriented.

Digital transformation: refers to adopting digital technologies to redesign processes, services and structures in the tax administration, promote automatization, digital platforms, data interoperability, artificial intelligence, big data and online services. It is the vehicle that allows to radically improve how information is handled.

Source: Prepared by the author.

Without a clear focus on tax administration as an information management business, digital transformation continues to be important, but it can become chaotic or technologically driven without a clear strategic purpose.

The approach of the tax administration as an information management business – the centrality of information

The implementation of modern tax policies linked to coherent tax administrations is key to advance in the Mobilization of Domestic Resources (DRM). Milka Casanegra pointed out that, in developing countries, “the tax administration is the tax policy”, underlining its advisory role in tax design to avoid taxes that are difficult to apply or vulnerable to evasion (IMF, 1992).

A Modern tax code must incorporate technologies of the digital economy and facilitate the digital transformation of the administration. In this regard, the cases of Tajikistan and Uzbekistan [2] illustrate recent reforms (Junquera-Varela and Lucas-Mas, 2024).

To conceive the tax administration as an information management business implies a strategic change that improves its efficiency, effectiveness and legitimacy. It goes from being a reactive collector to a key information manager for the State. At the heart of this transformation is data: without accurate information about income, sales, assets or financial flows, taxation cannot be calculated or controlled.

All critical functions – registration, declarations, payments, audit – are information management processes. From data collection and verification to cross-checking and validation, every stage depends on reliable data. Fraud detection requires data analysis and risk profiling; audits involve forensic analysis.

Tax risk management is also based on large volumes of data, such as customs, financial and banking records. Without mastery in information management, it is not possible to apply intelligent controls, which are now standard in many administrations.

Likewise, compliance management is based on the strategic use of information. Promoting voluntary compliance requires communicating clear and timely data, using behavioral analysis (nudging) and adapting services to different taxpayer profiles.

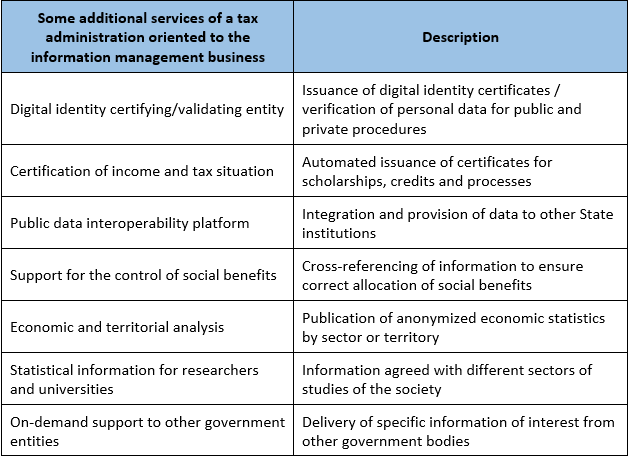

In addition, thanks to the large volume of information they manage, tax administrations would be in a position to offer the government and society a variety of services that go beyond their strict tax functions. The following are some representative examples:

Source: Prepared by the author.

Finally, all this requires solid data governance, a fundamental aspect in administrations that are conceived as information businesses.

Digital transformation of the tax capacity

Digital transformation is considered as an enabler of Internal Resource Mobilization (DRM), by integrating digital technologies with trained personnel, redesigned processes, reliable data and continuous coordination (IMF-WB, 2024). It is an essential driver for low- and middle-income countries to reduce their dependence on foreign aid and modernize their tax administrations (CIAT, 2020).

Its impact is greater when it is integrated into a strategy that conceives the tax administration as an information management business.

Among the benefits, the expansion of the tax base stands out, by allowing more taxpayers to be registered, including informal sectors, through big data and information crossings. It also improves voluntary compliance, by simplifying procedures and using personalized digital communications, reducing the need for coercive measures.

Digitalization increases efficiency by automating processes and applying analytics to segment risks and better selecting audits. In addition, tools such as electronic invoicing, real-time controls and predictive analytics strengthen the fight against tax evasion and avoidance.

Another important effect is the strengthening of transparency and citizen trust, thanks to digital services and public information portals that reinforce the social contract.

The digital transformation also prepares administrations for the challenges of the digital economy, such as cryptocurrencies and global platforms, ensuring long-term fiscal sustainability.

Finally, Artificial Intelligence offers unique opportunities to optimize decision-making, strengthen operational efficiency and renew the relationship with citizens.

Final comments – digital transformation in other pillars of DRM

In addition to revenue, other essential capabilities in Internal Resource Mobilization (DRM) initiatives are also strengthened by digital transformation. In particular, public spending — the other side of the fiscal equation — benefits from the increasing digitalization of the financial sector.

The integrated financial management systems (IFAS), already operational or under development in several Latin American and Caribbean countries, automate the stages of expenditure (budget, commitment, accrual, payment) and connect with public and private financial systems – such as financial institutions, investment and public procurement, as analyzed by Pimenta & Seco (2021).

Finally, the articulation and exchange of experiences between the different institutional capacities not only enrich mutual learning but are essential to successfully design and implement comprehensive and sustainable Internal Resource Mobilization (DRM) strategies.

Main bibliographic references:

CIAT 2020. ICT as a Strategic Tool to Leapfrog the Efficiency of Tax Administrations CIAT & Bill & Melinda Gates Foundation.

Available at: https://biblioteca.ciat.org/opac/book/5696

IMF 1992. Improving Tax Administration in Developing Countries. Editors: Richard Bird & Milka Casanegra de Jantscher. IMF September.

Available at: https://doi.org/10.5089/9781557753175.071

IMF 2015. Current Challenges in Revenue Mobilization: Improving Tax Compliance. Staff Report. IMF

Available at: https://bit.ly/4jCA1vk

IMF 2023. Transforming Public Finance Through GovTech.

IMF Available at: https://www.imf.org/-/media/Files/Publications/SDN/2023/English/SDNEA2023004.ashx

IMF & WB. 2024. Stepping Up Domestic Resource Mobilization: A New Joint Initiative from the IMF and WB. IMF & WB. June.

Available at: https://www.imf.org/-/media/Files/Research/imf-and-g20/2024/domestic-resource-mobilization.ashx

Junquera-Varela et al. 2017. Strengthening Domestic Resource Mobilization. WB. Available at: http://dx.doi.org/10.1596/978-1-4648-1073-2

Junquera-Varela, R F, Lucas-Mas, C O. 2024. Revenue Administration Handbook. IMF & WB.

Available at: https://hdl.handle.net/10986/41090

OECD. 2020. Tax Administration 3.0: The Digital Transformation of Tax Administration. OECD Publishing.

Available at: https://doi.org/10.1787/ca274cc5-en

Pepper, C., Dry, A. 2021. Financial Management Information Systems (FMIS): Project Guide. IDB

Available at: https://doi.org/10.18235/0003342

[1] Example: United Nation’s 2030 Agenda for Sustainable Development Goals.

[2] The tax code of the Republic of Uzbekistan is available in English at: https://cis-legislation.com/document.fwx?rgn=20583

5,652 total views, 6 views today