Tax revenues in Latin America and the Caribbean fell in 2023 as commodity prices weakened

Tax revenues in Latin America and the Caribbean (LAC) decreased as a share of GDP in 2023 amid a slowdown in economic activity in the region and a decline in global commodity prices, according to a new report.

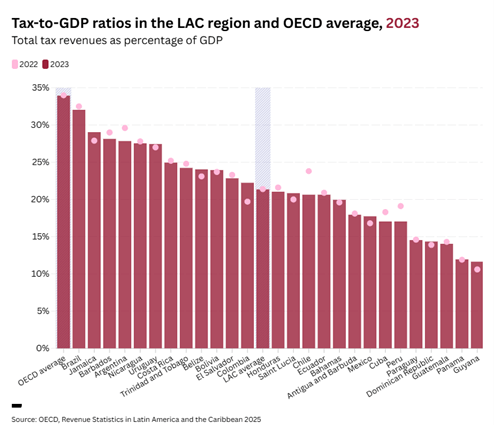

Revenue Statistics in Latin America and the Caribbean 2025, released today at the UN-ECLAC 37th Regional Fiscal Seminar in Santiago, Chile, shows that the average tax-to-GDP ratio in the LAC region was 21.3% in 2023. This was 0.2 percentage points (p.p.) below the level in 2022 and slightly below the level prior to the COVID-19 pandemic (21.4% in 2019). Tax-to-GDP ratios in the LAC region ranged from 11.6% in Guyana to 32.0% in Brazil in 2023. By comparison, the average tax-to-GDP ratio in OECD countries was 33.9% in 2023.

Between 2022 and 2023, the tax-to-GDP ratio fell in 14 of the 26 LAC countries included in the report. Chile and Peru observed the largest declines (of 3.2 p.p. and 2.1 p.p. respectively). In both cases, this was primarily due to lower income tax revenues, which resulted from the impact of lower commodity prices on the economy and high tax refunds and credits in 2023.

According to the new report, the overall decline in tax revenues as a share of GDP in the LAC region was due to a fall in revenues from income taxes, notably among some of the main hydrocarbon and mineral producers. Income tax revenues declined by 0.1% of GDP on average from a peak of 6.3% in 2022. Social security contributions increased by 0.1 p.p. in 2023 while revenues from taxes on goods and services remained unchanged as a share of GDP.

A decline in commodity prices in 2023 dragged down the LAC region’s revenues from non-renewable natural resources. Hydrocarbon-related revenues among the region’s ten biggest oil producers declined to 3.9% of GDP on average in 2023 (from 4.4% of GDP in 2022) while mining revenues declined to 0.59% of GDP (from 0.74% of GDP in 2022). The report estimates that revenues from hydrocarbons and mining decreased further in 2024, to 3.2% of GDP and 0.5% of GDP, respectively.

For the first time, the 2025 edition of Revenue Statistics in Latin America and the Caribbean presents harmonised data on non-tax revenues, such as rents and royalties, interest and dividends received by the government, and public sales of goods and services.

The report shows that non-tax revenues at the central government level for 22 LAC countries averaged 3.1% of GDP in 2023, ranging from 0.4% in Peru to 11.6% of GDP in Cuba. Between 2019 and 2023, non-tax revenues declined by 0.4 p.p. on average across the LAC region, albeit with strong year-on-year variations over this period, including a decline of 0.7 p.p. between 2022 and 2023.

Revenue Statistics in Latin America and the Caribbean 2025 is a joint publication by the Inter-American Center of Tax Administrations (CIAT), the Inter-American Development Bank (IDB), the United Nations Economic Commission for Latin America and the Caribbean (UN-ECLAC), and the Organisation for Economic Co-operation and Development (OECD) Centre for Tax Policy and Administration and Development Centre.

To access the report, data, overview, country notes and infographics go to http://oe.cd/revstatslac25-en.

Press contacts

- CIAT: Publication and Communication Manager, Elizabeth Rodríguez (erodriguez@ciat.org; T: +507 307 2428)

- ECLAC: Public Information Unit (prensa@cepal.org; T:+56 2 2210 2040)

- IDB: Communications Division, Romina Nicaretta (rominan@iadb.org; T: +1 202 623 1555)

- OECD: Media Office (news.contact@oecd.org ; T: +33 1 45 24 97 00)