The strategy of the economic integration and fiscal harmonization processes: EU vs America

Taxation in the processes of economic integration aims to avoid distortions in the created common economic space, attributable to the will of the political authorities and created to obtain, consciously or not, a special tax advantage to the detriment of the other associated countries, affecting the movements of trade or productive factors

To avoid such distortions, the principle of tax non-discrimination and tax harmonization measures (TH) are applied. While the former is generic, the latter is related to the level of economic integration achieved.

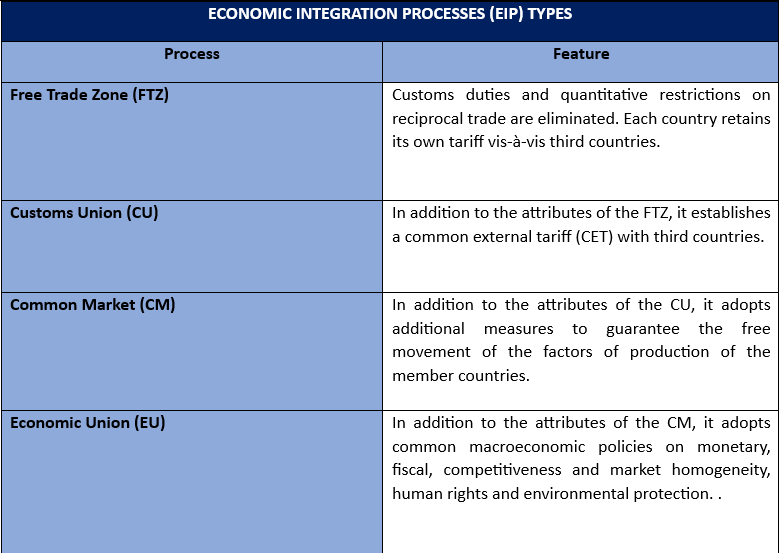

Integration classes

Prior to the development of the topic, it is appropriate to highlight, as established by the economic doctrine, the levels of economic integration processes (EIP) [1], with their main features:

Economic Integration (EI) in the EU

The most successful integrative process at a global level has been in our time that of the European Union (EU) (1993) [2], through which 27 countries [3] have formed an advanced common economic area, at the level of an Economic Union (EU) [4], with an Area of Monetary Union (Eurozone) for certain countries.

Economic Integration (EI) in America

From 1960 to 1990, the creation of subregional processes such as the MCCA (1960), the CAN (1969), CARICOM (1973) and MERCOSUR (1991) originated, which intended to converge once mature, in a single common space such as the EU [5].

This initial subregional multiplicity was followed by more multiplicity, that is, the coexistence of multiple economic partnership areas and FTZs between several countries of the area and also with extra-regional jurisdictions (CPTPP, EU, China, etc.).

Among this proliferation of agreements that have been implemented, one can distinguish bilateral from multilateral ones.

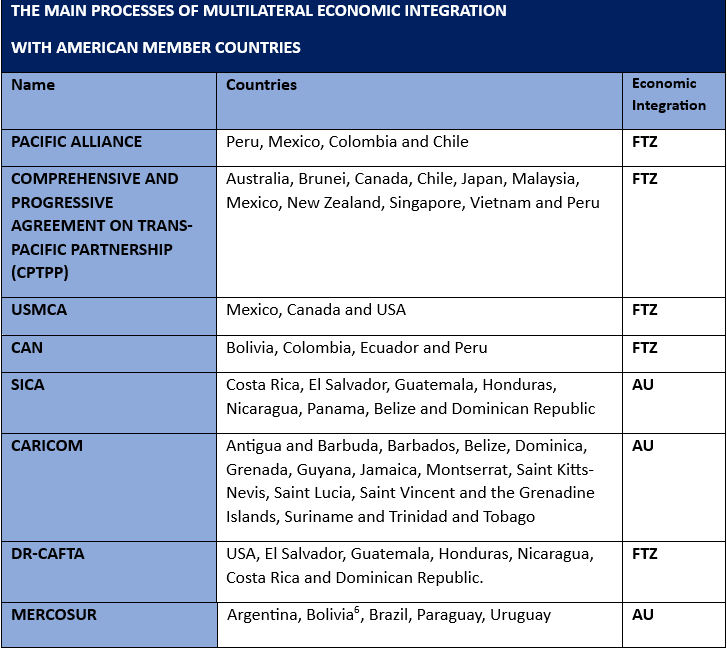

Among the latter, the following EI processes can be highlighted:

Source: Own (2024)

In the current scheme, two dissimilar trade negotiation strategies are visualized: 1) countries such as Chile, Peru, Colombia and Mexico have adopted agreements with different economic spaces unilaterally, while 2) SICA, CARICON and MERCOSUR negotiate the agreements as a bloc.

Tax Harmonization in the EU

Having reached the last stage of EI, it specifically regulated tax harmonization in the field of indirect taxation (general and specific consumption taxes), while in the field of direct taxation, (income tax) although it was not directly regulated in the founding Treaty, several Directives and the case law of the Court of Justice of the European Union (CJEU) have established certain harmonized rules in relation to the taxation of companies and individuals.

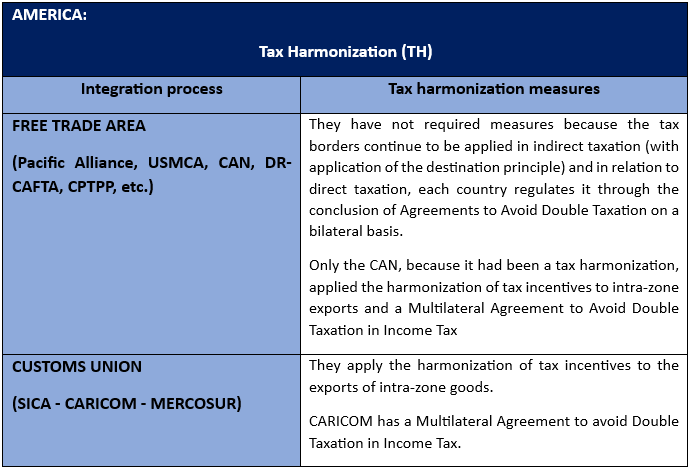

Tax Harmonization (TH) in America

The following is an overview of the TH measures issued in the IE processes of America:

Source: Own (2024)

Conclusion

The economic integration strategy of America and Europe have been opposed, because while multiplicity was the most salient feature of processes in the American countries, in Europe the EU largely predominates.

The other essential difference is the depth of EI: while in Europe the Union has been configured into an Economic Union, that is, it has formed the most advanced stage, in the countries of America the FTZs predominate, that is, the first stages of integration and there are only three blocs constituted in Customs Union (CU) [7].

That is to say, while in the EU the objective was the deepening of EI, in America at present the priority is the expansion through the multiplicity of EI processes.

Regarding the CU, the EU fully applies it with respect to indirect taxation, although it has also regulated certain aspects of Income Tax, with the current objective of making further progress in this field.

On the contrary, when finding, in America the processes , in the initial stages of integration have not required harmonizing their indirect taxes due to the permanence of fiscal borders, limiting themselves to the application of the principle of non-discrimination in taxation and avoiding double taxation in income tax through bilateral agreements made by each country.

The spaces that have been formed as member countries (MC), by having a customs agreement (ACS), have been limited to the fiscal harmonization of intra-zone exports of goods and in two cases to the elaboration of a Multilateral Agreement to Avoid Double Taxation with respect to Income Tax [8].

The limitation of these measures implies the coexistence of fiscal distortions that affect the markets of these economic areas, with respect to incentives for the export of services such as intra-zone investment and foreign direct investment (FDI). Regarding investments, it has led to a “tax war” of incentives between certain countries to attract them, with the inevitable damage to their tax revenues.

There is a tendency of the American countries not to limit their economic and fiscal sovereignty, which prevents not only further progress in integration, but also in being able to solve the problems that tax distortions are currently causing.

Finally, it should be noted as an unintended effect of the current strategy, the weakness in the negotiating power of the American economic spaces [9] in the search for agreements in the international field with the most economically developed jurisdictions.

[1]Exceptions are made to tariff preference regimes, economic partnerships, trade agreements, etc. that do not involve at least one FTZ.

[2]Successor of the EEC (1958).

[3]Despite the departure of the UK, the number has been maintained due to the entry of Croatia.

[4]The EFTA (European Free Trade Agreement) and the UK coexist independently and in a minority.

[5]While the SICA, CARICOM and MERCOSUR are configured as imperfect CU, the CAN retreated to an FTZ.

[6]In the final accession process.

[7]Although imperfect due to the exception regimes they apply.

[8]CAN and CARICOM.

[9] With the obvious exception of the USA.

8,376 total views, 5 views today