How to tax digital activities at the subnational level? Overview of subnational taxation on the digital sector in Latin America

The accelerated growth of the digital economy makes it necessary to modernize countries tax systems, both national and subnational, and adapt them to tax more appropriately intangible goods and digital services, in order to avoid the erosion of tax bases through tax avoidance mechanisms and to expand the revenues to finance essential public services that must be provided by all levels of government.

This is especially relevant in more decentralized countries, where intermediate or local governments have important tax assignments, to the extent that both tax systems and the foundations for their assignment between levels of government have been designed for another era and other circumstances.

In this context, we have recently prepared a study Jiménez and Podestá (2022) in order to analyze the challenges of indirect taxation on digital activity in those countries where indirect taxation is responsibility of more than one level of government, as in the case of Argentina, Brazil and Colombia, deepening the previous analysis on taxation on the digital economy at the level of central governments, conducted by Jiménez and Podestá (2021).

Subnational governments can modify existing tax regimes to include the different sectors of the digital economy or they can create new taxes that more appropriately tax digital services, specifically those that extract and monetize user data through online advertising.

In the case of the most decentralized countries in Latin America, much of the taxation by indirect taxes depends on subnational governments, such as the ICMS in Brazil, the gross income tax (impuesto sobre los ingresos brutos) in Argentina or the industry and commerce tax (ICA) in Colombia.

Indirect taxes related to consumption and economic activity imply greater risks for tax coordination, to the extent that differences between the rates applied in neighboring regions of the same country can induce taxpayers to “export” consumption, production or marketing decisions to areas of lower relative tax burden within the same country. The many activities and sectors that are part of the digital economy make proper taxation even more difficult to define because there is often no clear answer as to which jurisdiction can impose taxes, on which sectors or activities and to what extent.

The most widely used approach in the region to tax digital activity is through the already existing general consumption taxes, given that it is easier because tax jurisdictions simply expand their tax regimes to include all services, in particular digital goods, content streaming services and other services provided electronically. However, for the purpose of an adequate taxation of the digital sector, it is necessary to take a comprehensive look at the tax instruments applicable to this sector, both indirect taxes and income taxes.

The implementation of subnational indirect taxes on digital activity has not been uniform or homogeneous and in some cases has led to intergovernmental conflicts, such as between municipalities and states of Brazil regarding the collection of municipal services tax (ISS) and the state ICMS for software downloads or legal disputes such as claims to the courts regarding the possible unconstitutionality of the application of the gross income tax in Argentina.

As of 2018, most Argentine provinces have been expanding the scope of the gross income tax in order to include digital economy activities in the taxable base. Thus, this tax is levied on the commercialization of digital services conducted by companies domiciled, based or incorporated abroad, such as digital platforms that commercialize online subscription services for access to audiovisual entertainment, and those that offer intermediation services in the provision of services and gambling activities that are developed through any digital media. Depending on the province, other activities in the digital sector are also explicitly included.

The general gross income tax rate on digital services is an average of 3.5%, although the rates vary between the Argentine provinces and, in some cases, according to the type of digital good or service and the status of registered taxpayer. To determine the taxation of the gross income tax on digital services, Argentine jurisdictions have defined two criteria: the significant digital presence and/or the domicile of the user of digital services.

On December 27, 2021, the Argentine provinces and the national Executive signed a new Fiscal Consensus that includes provisions on subnational taxation of the digital economy. In the new consensus, the concept of jurisdictional nexus is introduced to replace that of territorial sustenance or physical presence for the marketing activities of digital goods and services. For these transactions, the jurisdictional nexus is present when there is digital presence of the seller, provider and/or lessor or when the domicile of the acquirer is located in the provincial territory. In addition, it is established that the gross income tax is levied on the electronic commerce of digital services, including online subscription services for access to entertainment (music, videos, audiovisual transmissions in general, games, etc.), intermediation in the provision of services of all kinds through digital platforms (hotel, tourism, financial, etc.), and gambling activities that are developed or exploited through any digital media. It also sets maximum rates of this tax according to the sector of economic activity, which in the case of trade is 5% and communications 5.5%.

On the other hand, in Brazil, as of April 2018, states can charge the ICMS (state VAT) on transactions with digital goods and merchandise, such as software, programs, electronic games, applications, electronic files and the like, which are standardized. Only transactions destined for the final consumer are taxed and the tax is paid in the state where the download or transmission is taking place and where the buying consumer is located, that is, where the acquirer has his domicile or establishment. The effective rate of the ICMS for digital operations cannot exceed 5% of the transaction value.

However, there are interjurisdictional conflicts between Brazilian states and municipalities. In February 2021, the Brazilian Supreme Court determined that software licenses can only be taxed with the municipal services tax (ISS) which, since the end of 2016, explicitly includes digital services in its taxable base.

The law establishes a minimum rate of 2% and a maximum rate of 5% for ISS on digital services that is determined by each municipality and prohibits the granting of exemptions, incentives or tax or financial benefits, including the reduction of the tax base, tax credits or others that result in a lower tax burden than that arising from the application of the minimum rate.

On the other hand, in the case of Colombia, the tax that is paid on the income generated in a municipality by industrial, commercial and service activities, has been extended to activities conducted through information and communication technologies (ICT) in the city of Medellín since 2017, applying a rate of three per thousand. Then, in Bogotá, it was arranged that the ordering, purchase, distribution and delivery services of products through platforms or applications will be taxed with the ICA from 2022, with an aliquot that will increase progressively until reaching 1.104% in 2024.

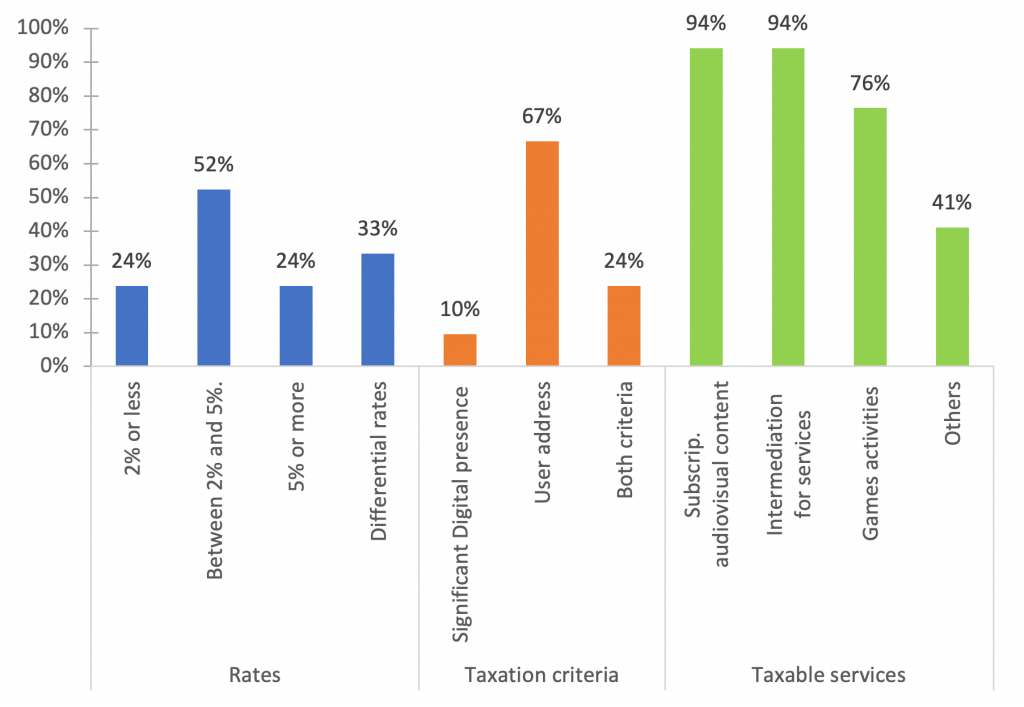

The review of subnational taxation on the digital economy in these three countries shows that more than half of the subnational governments analyzed have established tax rates ranging between 2% and 5%, although there is some variability in the rates among the different jurisdictions and, in some cases, within the same jurisdiction, depending on the type of digital good or service.

In addition, in order to determine the indirect taxation of digital services in a given jurisdiction, the subnational governments of Brazil, Colombia and most Argentine provinces use one or more indicators to identify whether the address of the service user or digital asset is located in their territory, although some Argentine provinces apply the concept of significant digital presence.

Regarding the scope of these taxes, almost all of the subnational governments examined levy indirect taxes on the marketing of online subscription services for access to audiovisual content and intermediation services. In addition, most jurisdictions include gambling activities in the taxable base, and some also tax other digital services or goods, such as data processing and storage services, online advertising, databases, remote system administration, online technical support, etc. (Figure 1).

Figure 1. Latin America (selected countries):

Summary of the main characteristics of subnational indirect taxes on the digital economy

As a percentage of total jurisdictions

As a percentage of total jurisdictions

Source: Own elaboration based on official legislation.

At the subnational levels of government of the Latin American countries, there is room to advance in the modernization of tax regimes, clearly assigning tax responsibilities between levels of government and broadening the tax bases to tax all digital services. This redesign would make it possible to address the transition more adequately to an economy increasingly based on digital services.

It is also important that countries accompany the international debate on how to tax income from the sector, in order to explore and analyze in greater depth the possibility of creating new taxes, both national and subnational. In particular, those instruments that impose taxes on the extraction and mining of user data obtained by companies, in order to tax the value derived from the extraction and monetization of these data, although it is clear that the determination of the value of this information can be complex. The advantage of a data mining tax is that it has a more direct connection to the value that companies obtain from the collection of their users’ data, unlike a tax that taxes digital advertising, as a proxy for the value of the extracted data.

Finally, it is essential that the different jurisdictions in the same country make greater efforts to move towards harmonization, both in relation to the types of digital goods and services reached by the tax as the effective rates applied, so as to reduce the possibility of distortion in the allocation of resources and tax competition between different subnational governments.

2,572 total views, 3 views today