CIAT participated in the Regional Policy Dialogue “Rethinking Tax Incentives for Investment in the New Global Context”

From November 13 to 14, 2024, the Regional Policy Dialogue “Rethinking Tax Incentives for Investment in the New Global Context,” sponsored by the Inter-American Development Bank (IDB), was held in Panama.

The dialogue took place at a key moment in history when international recommendations and domestic needs are motivating the countries of Latin America and the Caribbean to more vigorously face the challenge of calculating, evaluating, and adjusting tax incentives. Many questions arise in the context of this work, and the regional dialogue is a very timely starting point.

As expressed by the IDB, “These two days were extremely productive, with tax and economic authorities from 15 countries in Latin America and the Caribbean, academic experts, and specialists from the Inter-American Center of Tax Administrations (CIAT).”

CIAT had the opportunity to moderate the panel on the role of tax administrations in improving the business environment, which included a representative from the IDB and authorities from the tax and customs administrations of Suriname, Guatemala, Peru, and El Salvador. In conclusion, the importance of improving communication channels with potential investors and taxpayers was highlighted, adopting technological tools to achieve greater efficiency (e.g., tax refunds, process simplification, reduction of compliance costs, etc.), as well as providing certainty through clear criteria on the interpretation of regulations and preventive approaches to disputes (e.g., cooperative compliance, BEPS Action 12, panels for the application of general anti-abuse rules, advance pricing agreements, joint or simultaneous audits, etc.), effectiveness in dispute resolution (e.g., alternative mechanisms, BEPS Action 14, etc.), among others.

The CIAT Executive Secretariat congratulates the team of the IDB’s Fiscal Management Division for this initiative and thanks them for the opportunity to be part of this dialogue.

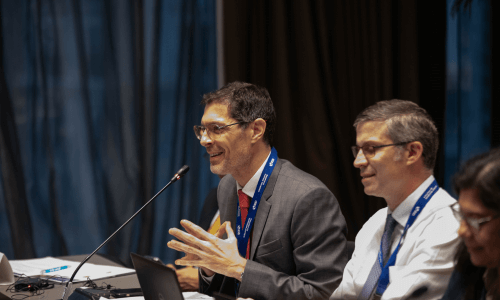

Mr. Isaac Gonzalo Arias Esteban, CIAT Director of International Cooperation and Taxation