Decentralized finance (DeFI) Offshore accounts evolution? Part II

In the first part of the blog, we described the basic functioning of decentralized finance protocols called DeFi, and the fiscal and money laundering risks that arise from their anonymity.

However, the action of governments and tax administrations to prevent and act on the financial crimes that could be involved in the use of these protocols will require implementing specific regulations.

IS IT POSSIBLE TO REGULATE THE DEFI?

The World Economic Forum document called “Decentralized Finance (DeFi) Policy-Maker Toolkit”[1], provides a toolkit designed as a starting point for policymakers seeking to understand the risks and opportunities offered by DeFis and devise the best regulatory policies.

It mentions that the activity of DeFis covers multiple domains of financial regulation, including securities, derivatives, exchanges, investment management, banking supervision, financial crimes, consumer finance, insurance, risk management and macro-prudential supervision. That is why a coherent overall strategy is important and could be delegated to a cross-disciplinary working group or similar body.

Various DeFi activity patterns will clearly match the established legal categories; others will not.

They therefore suggest the adoption of specific policies for defis, which include:

In addition, an effective regulatory framework involves a combination of existing regulations, modernized regulations and new specific regulations.

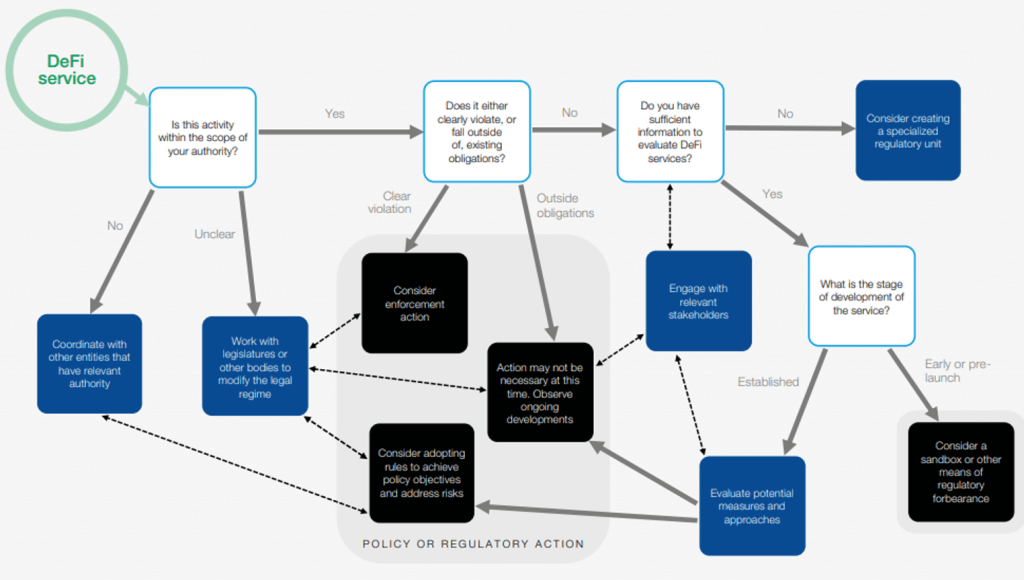

The following table[2], illustrates the proposed toolkit for identifying and designing policies on DeFi.

Finally, the document highlights that specific legislative bodies for digital assets are emerging, including the comprehensive Markets in Crypto Asset (MiCA[3]) proposal of the European Union. However, most jurisdictions have not yet adopted frameworks tailored to these needs.

THE ROAD TO REGULATION IN THE UNITED STATES OF AMERICA

The SEC (Securities and Exchange Commission) has evidenced its intentions to regulate the ecosystem of decentralized finance (DeFi) and cryptocurrencies in general, with the purpose of protecting investors against fraud.

Gary Gensler, president of the regulatory body, has said that the rapid growth of the decentralized financial ecosystem can carry high risks for investors.

Before the European Parliament’s Committee on Economic and Monetary Affairs, he stated that “Unlike traditional exchanges, such as the Frankfurt Stock Exchange, crypto platforms provide direct access to millions of investors. There is no intermediary between the public and the platform, therefore, in absence of clear investor protection obligations on these platforms, the investing public is vulnerable. Unfortunately, this type of assets has been plagued by frauds and scams.”[4]

Along this path, the SEC plans to acquire artificial intelligence tools to monitor transactions occurring within the DeFi industry. According to a news article published in May by “Forbes” magazine[5], the SEC has signed a contract with a private company that will provide the U.S. regulator with the technology needed to analyze and track smart contracts.

Artificial Intelligence and Machine Learning tools are valid for identifying unknown addresses and potentially suspicious transactions. In addition, they are able to identify and monitor known crypto addresses linked to illicit actors.

CONCLUSIONS

Much progress has been made in the fight against the lack of transparency in the anonymous use of offshore accounts of companies incorporated in so-called “tax havens”, especially with regard to the cloak of anonymity that covers the final beneficiary, fertile ground for the commission of financial crimes that usually come out in investigations for data leaks by “repentants” (Luxembourg Papers 2014, Swissleaks 2015, Panama Papers 2016, Pandora Papers 2021, etc.).

Automatic exchanges of information such as CRS[6], or the FATCA[7] in the US, they have undoubtedly been effective tools for achieving more financial transparency, since they allow TAs to discourage the perceived risk and to develop audit policies based on timely and accurate data.

The substantive conduct of exchanges is possible due to the existence of institutions obliged to provide information and the fact that they will be punished for non-compliance by their respective countries adhering to the agreements.

To draw a parallel with the universe of DeFi, a distinction must be made between the decentralized exchange and the company that develops the graphical interface that allows users to interact with the smart contracts developed on the protocol to exchange cryptocurrencies. The first is the platform itself, where users buy and sell their assets, and the second is the organization where programmers build the foundation for exchanges.

Therefore, these companies could themselves ensure the correct use of the platforms and implement protocols within the framework of the global financial rules, which would imply at least the knowledge of their customers who operate, from a certain threshold.

In tax terms, as has happened with offshore accounts, the DeFi per se they are not synonymous with evasion, but the lack of a clear identification of the beneficiaries of financial transactions of a certain amount can turn them into a channel for tax evasion and money laundering.

In principle, although in the DeFi there is no possibility of having “repentants” since the contracts are made between unidentified addresses that prevent knowing immediately who they belong to, it must be borne in mind that traceability tools are also evolving by leaps and bounds, so it is expected that in the near future the new “leaks” come from the tracking and identification they provide.

However, the great challenge will be to achieve the so-called balance between privacy and adherence to tax rules, in order to enjoy the benefits of the fast-evolving technology, but with the primacy of the Law as a pillar of a true rule of law.

[1] https://www3.weforum.org/docs/WEF_DeFi_Policy_Maker_Toolkit_2021.pdf

[2] Only available in English

[3] The MICA proposal can be seen in the following link: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020PC0593

[4] https://www.sec.gov/news/speech/gensler-remarks-european-parliament-090121

[5] https://www.forbes.com/sites/stevenehrlich/2021/08/27/sec-signs-deal-to-investigate-defi-transactions/?sh=4c402819787c

[6] The Common Reporting Standard (CRS), developed in response to the G20 request and approved by the OECD Council on 15 July 2014, requires jurisdictions to obtain information from their financial institutions and automatically exchange that information with other jurisdictions, annually. It establishes the financial account information to be exchanged, the financial institutions required to report, the different types of accounts and the taxpayers covered, as well as the common due diligence procedures to be followed by financial institutions. https://www.oecd.org/tax/automatic-exchange/common-reporting-standard/

[7] Foreign Account Tax Compliance Act https://www.irs.gov/businesses/corporations/foreign-account-tax-compliance-act-fatca

3,516 total views, 7 views today

1 comment

Wow! this is great. Thank you for sharing.