The Future of Tax Administrations Lies in the Intelligence Generated by Big Data

Digital transformation, professionalization of the public administration, and greater international tax cooperation are driving the creation of a second mission within tax administrations beyond traditional tax control: the data agency.

This new stage of institutional evolution of the TA is the topic we address in the study Quo vadis, administración tributaria?, which we published in collaboration with the Inter-American Center of Tax Administrations (CIAT). In this blog, we will discuss some of the main conclusions.

Data Agency Transformation Factos

There are three key factors that are driving this transformation. Firstly, greater budgetary and management autonomy, which promoted professionalization of human resources and improvement of infrastructure, as well as technical independence of the organization.

Secondly, information technology and telecommunication have been massively incorporated and developed, facilitating not only compliance and control of obligations, but also the incorporation of non-tax services, such as e-invoices. The latter has made it possible to process large amounts of data on economic transactions, which can now be used to provide more transparency about the prices of goods and services, and even a more precise measurement of economic activity.

Finally, in compliance with the international transparency commitments (of the Global Forum), there has been progress in lifting bank secrecy, allowing the exchange of information and knowledge of the ultimate beneficiary owners of property, achieving broad access to financial accounts and asset data of taxpayers at a global scale. This allows TAs to also be key agents in the fight against fraud and money laundering.

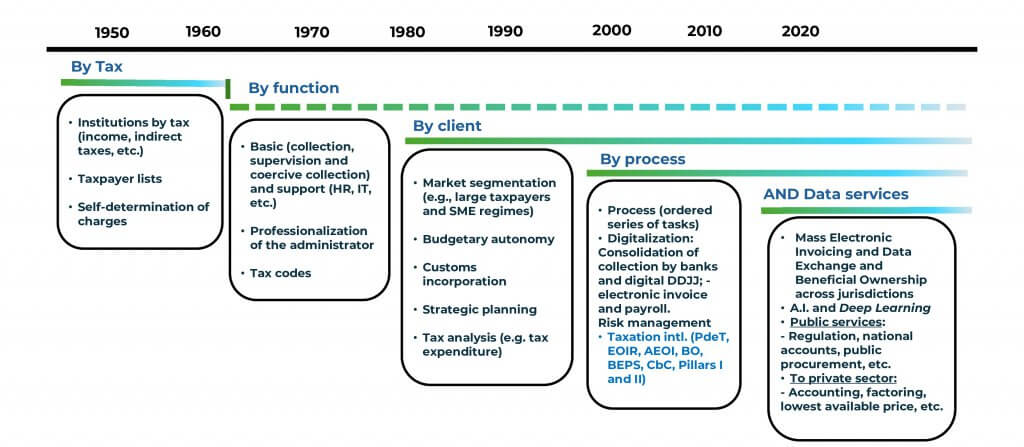

This enormous accumulation of information on taxpayers is bringing administrations closer to data centers and economic intelligence, expanding the business lines developed over decades and, therefore, generating changes in the institutional arrangements to fulfill these functions (Figure 1).

Figure 1. Stages of Tax Administration, Key Components, and Milestones

Source: Barreix and Zambrano (2018)

The Potential of a Data Agency within the Tax Administration

The creation of a data agency will allow tax administrations to deepen tax control.

New data science tools and important computational advances make it possible to exploit available big data and, therefore, transform auditing based on risk and make draft returns a reality. Furthermore, the digitalization of traditional functions (registration, recovery, inspection, etc.) will significantly improve tax control.

On the other hand, voluntary compliance should be strongly promoted, taking advantage of prior availability of information on taxpayers’ operations. This prior availability makes it possible to apply a prospective approach, based on predictive analysis of taxpayer behavior, complementary to the traditional “forensic” review control based on audits of earlier periods.

Digital Service Provider

The data agency will also allow the tax administration to position itself as a provider of digital services in its economic activity and to the taxpayer themself. Some examples of these new functions are, among others:

- • Promoting equity through fiscal policy. In Ecuador, for instance, e-invoice data is used to provide VAT refunds to poor or disabled taxpayers.

- • Expanding credit to smaller companies by “factoring” through sales to third parties of their validated e-invoices, as occurs in Chile.

- • Boosting market transparency. The use of information on the prices of products and services in e-invoices helps find the lowest price of mass consumption goods for consumers, as occurs in the Brazilian state of Rio Grande do Sul, with the Menor Preço mobile app.

Additionally, tax administrations will be able to support the government in key areas such as:

- • Advance economic monitoring for making micro and macroeconomic forecasts, as the transactions of the economy are known in real time, based on economic sector, geographical area, and type of taxpayer.

- • Regulation and defense of competition through e-invoices that can facilitate the identification of abuses of market power by monopolists with economic income, or price collusion by oligopolists that improve efficiency and equity in the market.

Institutional Adjustments of Recovery and Data Management Strategies

The effectiveness of the tax administration as a data agency depends on digital transformation and the transit of information from the following stakeholders:

- Public institutions providing information (cadastres, registries, regulatory agencies, other levels of government, etc.);

- Other recipients of their action (ministries, judiciary branch, police, national security agencies, etc.) and,

- Exchange of information with other jurisdictions.

To be successful in this task, tax administrations must make institutional arrangements to ensure that, on the one hand, quality data is gathered and processed from revenue entities in the public sector and, on the other, these institutions can offer services to streamline private-sector operations.

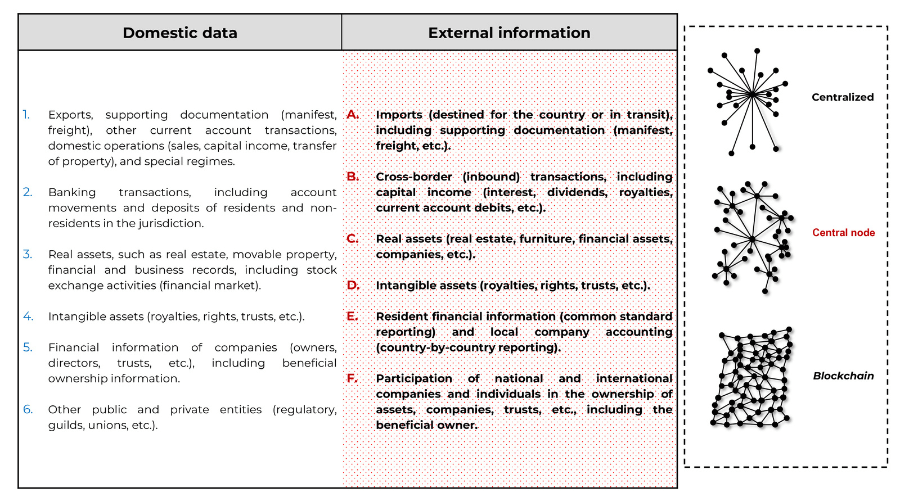

In terms of data from revenue entities, it is recommended to concentrate its management in a single organization, as this would help ensure that the data is gathered massively, systematically, and completely, taking advantage of synergies in processes and systems. This, added to the regulatory restriction of respecting tax secrecy, prescribes the application of a central node information distribution and security model (see Figure 2).

Figure 2. Internal and External Sources of the Tax Administration in the Future, and Network Prototypes to Structure Tax Information

These two arguments would make it possible to safely merge TA data with Customs and contribution revenues, and even assimilate (piggyback) them to subnational Tas, i.e., concentrating data and control in an expanded TA.

However, this tendency to centralize data management should consider operational exceptions for subnational tax administrations, given the local nature of some taxes (property taxes, vehicle taxes, fees etc.) and customs, which must efficiently manage international trade facilitation in the international movement of goods and people. Customs, in general, do not work with predefined elements and cycles, as is the case in the management of internal taxes (preset taxes, deadlines, and processes).

Coordination of unified data management between Customs and the TA should occur in the Customs/internal tax cycle. With imports, VAT, selective taxes, and income tax appear, and this is when a relevant share of revenue is obtained in open economies. In addition, the taxpayer also perceives it as a unique process; in fact, evasion itself is more relevant in VAT, selective tax, and advance income than in the low tariffs, due to commercial opening.

Management of Data Services with Large-Scale Participation of the Private Sector

In terms of services to streamline the TA, it is important to consider outsourced Information management, using tools such as information in the cloud, security programming, or programming support. The acceleration of information technology and data science, such as generative artificial intelligence, will require TA leadership to stay up to date with new business models.

Another key element of management is computer security (cases of breaches relevant in countries of our region), with the consequent damage to tax secrecy and taxpayer privacy.

It is important to recognize that the creation of a data agency within the TAs of Latin America and the Caribbean also depends on the availability of information, which is currently limited.

On a domestic scale, this limitation is caused by the high levels of informality in economic activity. At the labor sphere, it can reach 55% of the region’s workers and is reflected in the high levels of evasion, in social security, and in income taxation, both for companies and individuals, with somewhat lower levels (around 30%) for VAT.

From an international point of view, although there have recently been major advances in international cooperation in the automatic exchange of financial information, in more than 100 complying countries, not all income is reached, and much less property, which limits the effective global direct taxation of taxpayers. For their part, the expected changes in international corporate taxation have stalled.

New Focus on Human Resources and Cultural Values in the Tax Administration

In the traditional TA, the stability and civil service labor framework generates a specialized civil service esprit de corps, based on the integrity, dedication, secrecy, and institutional loyalty of officials.

With the data agency, the ethos of the tax administration will evolve to incorporate characteristics such as a greater innovation initiative to achieve results (almost essential), the preponderance of career flexibility (also necessary), and a modus operandi that allows for a more autonomous work culture and is less dependent on career ladders.

To adapt to this new reality, the new data agency mission imposes changes in the management of TAs, fundamentally in four areas:

First, the personnel profile must change, to rebalance capabilities (further increasing the number of data science experts compared to those specialized in social sciences).

Second, recruiting strategies should focus on those trained in academia and less for law and auditing firms.

Third, the operational approach must be renewed, to shift from the traditional “pyramidal” hierarchical organization to a more “rhomboid” one because the application of modern technology increasingly requires greater specialization and teamwork to effectively manage the processes. Finally, it is necessary to create a new work culture that stimulates innovation and teamwork.

In summary, the TA will require a more open, horizontal, and flexible differential functional relationship to allow “collaborators” to keep pace with the private sector technological advances and generational change. This approach will not only improve the response capability of the TA but will also allow for more proactive management that is adaptable to changing realities.

Change in Governance within Tax Administrations

Another relevant evolution will be the governance of TAs to ensure greater transparency and responsibility in the use of private information.

If the data agency function grows within TAs, these institutions will be able to centralize a prominent level of socioeconomic information about citizens. It is important to have more democratic governance within these institutions, with transparency and accountability mechanisms.

This will be essential to keep the trust of taxpayers, society, and cooperating jurisdictions in the institution and in the consolidation of its function as a data agency.

This would mean different mechanisms to ensure fairness, for instance, having a Board of Directors with broad representation and autonomy, to protect taxpayer rights; enable “Citizen Oversight Offices” (Bogotá Chamber of Commerce, 2003); and create a specialized ombudsman complemented by special legislative controls, such as national security committees.

The management of tax information must also be consistent with other regulations related to the economic, political, and social power exercised by large companies and to privacy and protection of personal data. To ensure rights, the algorithms that will govern public policies, including tax inspection, must be transparent, which ensures that they do not come from discriminatory practices.

Finally, at the state level, it is crucial to prevent taxation, which provides tax revenue, from interfering with regulatory action. In short, that the state does not sacrifice the rights of users or promote discrimination due to its dependence on fiscal resources or the power of multinational mega-companies.

This article was reproduced with the authorization of the authors (Alberto Barreix, Santiago Diaz de Sarralde, Raul Zambrano and Martin Bès), originally published on the IDB blog.

13,197 total views, 3 views today