- 18

- Jul

- 2025

- Written by: Andre Dumoulin

- /

- Comments Leave a reply

Can we expect a boom in environmental taxation by 2025? Countries, especially those in the global South, face interconnected crises involving climate change and consequently; biodiversity loss and water, health and food threats. These crises are becoming more frequent. In the current context, characterized by rising debt, declining investment, reduced…

4,372 total views, 2 views today

- 21

- Jun

- 2025

- Written by: Fernando Peláez Longinotti

- /

- Comments Leave a reply

Tax expenditures are a key component -although often not very visible- of tax policies in Latin America. They are incentives, exemptions and preferential treatments established in tax legislation, which reduce the tax burden of certain taxpayers to achieve specific economic or social goals. Their magnitude is relevant and, in many…

5,381 total views, 1 views today

- 18

- Jun

- 2025

- Written by: Andre Dumoulin

- /

- Comments Leave a reply

As the world prepares for COP30 in Belém, Brazil, developing countries are taking significant steps in environmental taxation and climate financing. These efforts aim to balance economic growth, social equity, and environmental sustainability—while also asserting some leadership in global climate governance. 1. The Growing Threat of the Climate Crisis The…

7,501 total views, 2 views today

- 14

- Jun

- 2025

- Written by: Pablo Porporatto

- /

- Comments Leave a reply

In the present era of digital transformation, tax administrations (TAs) are at an innovative crossroads. Artificial Intelligence (AI) has emerged as a disruptive and empowering force, promising to revolutionize the way taxes are managed, interact with taxpayers and combat fraud. In this context, Artificial Intelligence Agents are emerging as the…

9,244 total views, 4 views today

- 10

- Jun

- 2025

- Written by: Cecilia Ruz

- /

- Comments Leave a reply

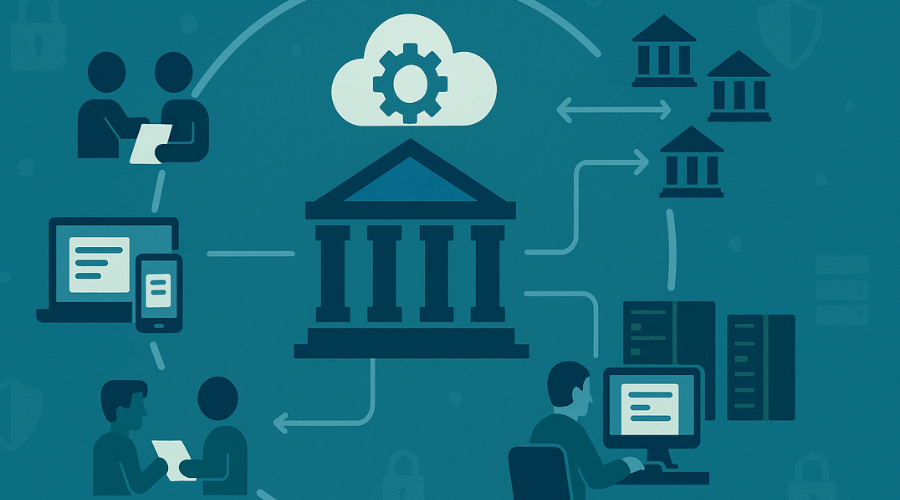

The massive incorporation of IT systems in different sectors and the need to simplify administrative processes pose a challenge for Tax Administrations: to redefine the way in which they interact with their digital environment. In the report Tax Administration 3.0: The Digital Transformation of Tax Administration [1], the Organization for…

- 7

- Jun

- 2025

- Written by: Mario Pires

- /

- Comments Leave a reply

1) Introduction When talking about tax code models for Latin America and the Caribbean (LAC), the technical and doctrinal debate revolves around two fundamental references that have marked different stages of the regional regulatory development. The first of these is the 1967 Model Tax Code for Latin America, promoted by…

4,328 total views, 1 views today

Ronnie Nielsen en What future does artificial intelligence have in Tax Administrations? "Thanks, Alfredo, for this as always very informative blog! Your tireless comment..."

스카이슬롯 en “Final Beneficiary” or “Effective Beneficiary”? "It is really a nice and helpful piece of information. I am glad that you shared ..."

the walking dead season 9 ซับไทย en “Final Beneficiary” or “Effective Beneficiary”? "Thanks for the tips you have contributed here. Something important I would like ..."

Roxanne Mazzillo en Against corruption, more cooperation "Your blog site is like a breath of fresh air...."

Val en If only it were a game "Great blog...."